Question: please explain During 2021 Carl Spackler, a single taxpayer with no dependents, reported the following information: ADDITIONAL INFORMATION - Carl is an investor in a

please explain

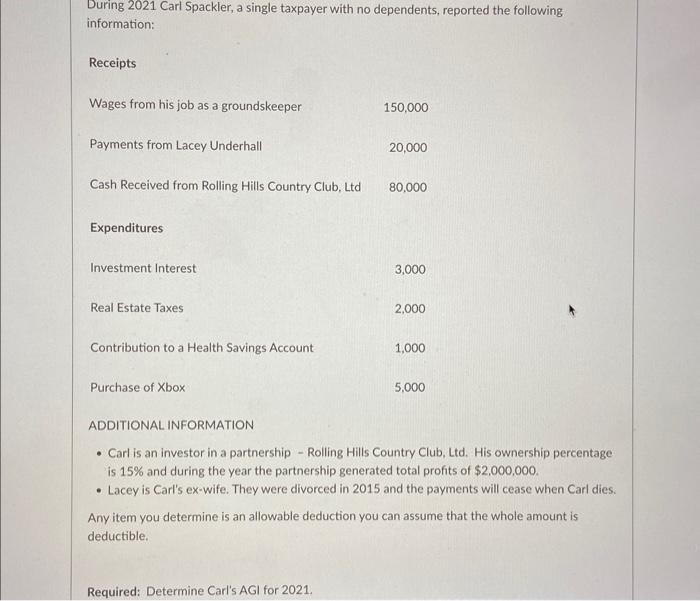

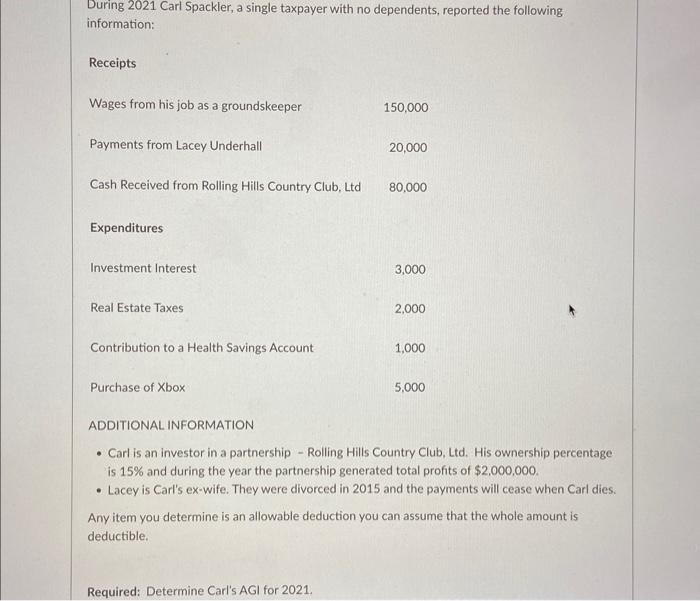

During 2021 Carl Spackler, a single taxpayer with no dependents, reported the following information: ADDITIONAL INFORMATION - Carl is an investor in a partnership - Rolling Hills Country Club, Ltd. His ownership percentage is 15% and during the year the partnership generated total profits of $2,000,000. - Lacey is Carl's ex-wife. They were divorced in 2015 and the payments will cease when Carl dies. Any item you determine is an allowable deduction you can assume that the whole amount is deductible. Required: Determine Carl's AGI for 2021

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock