Question: Please explain for part b exactly how you got y which I know is 3.18. I need to know what we're the steps to get

Please explain for part b exactly how you got y which I know is 3.18. I need to know what we're the steps to get it. Thanks

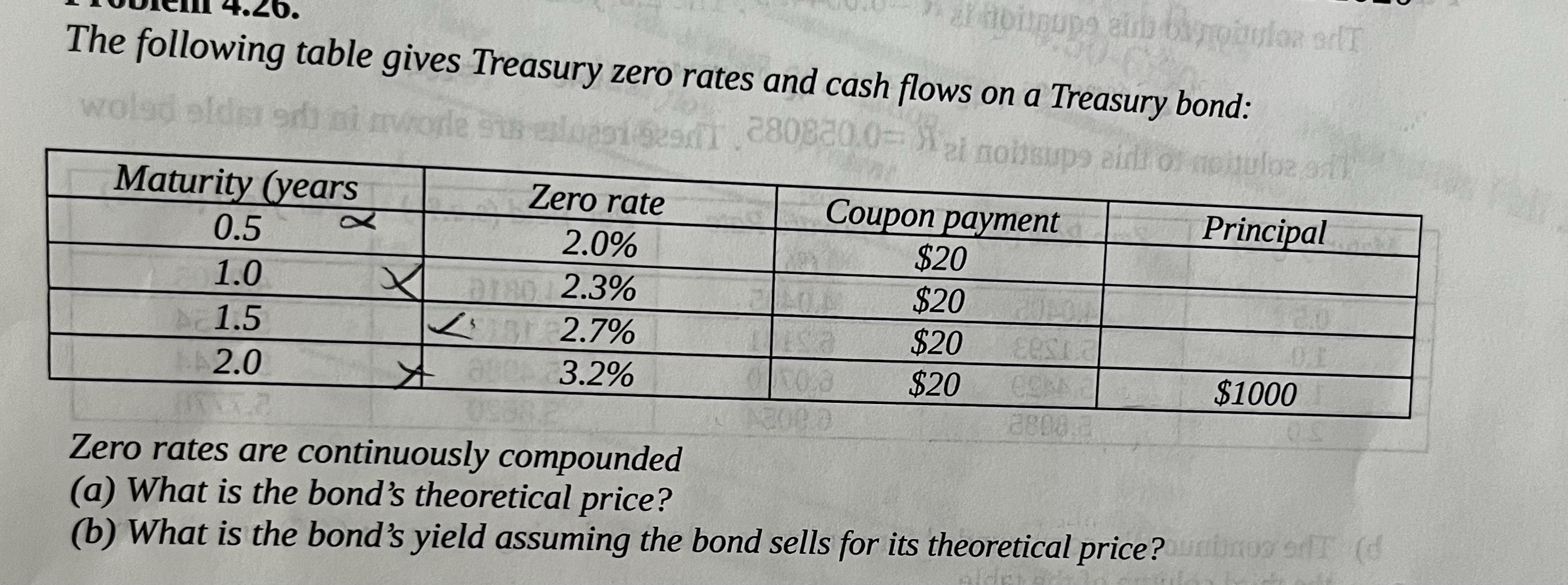

111 4.20. The following table gives Treasury zero rates and cash flows on a Treasury bond: woled elder end ai nworle sin endupsimeon1 280860 2) nousups audio) no tulozell Maturity (years Zero rate Coupon payment Principal 0.5 2.0% $20 1.0 2.3% $20 1.5 2.7% $20 2.0 3.2% $20 $1000 Zero rates are continuously compounded (a) What is the bond's theoretical price? (b) What is the bond's yield assuming the bond sells for its theoretical price? nine of (d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts