Question: please explain how this is done;here is the answer 2017 Dec. 31 Services Revenue 404 44,000 Income Summary 901 44,000 Close the revenue account 31

please explain how this is done;here is the answer

2017

| Dec. 31 | Services Revenue | 404 | 44,000 |

|

|

| Income Summary | 901 |

| 44,000 |

|

| Close the revenue account |

|

|

|

|

|

|

|

|

|

| 31 | Income Summary | 901 | 33,100 |

|

|

| Depreciation ExpenseEquipment | 612 |

| 3,000 |

|

| Salaries Expense | 622 |

| 22,000 |

|

| Insurance Expense | 637 |

| 2,500 |

|

| Rent Expense | 640 |

| 3,400 |

|

| Supplies Expense | 653 |

| 2,200 |

|

| Close the expense accounts |

|

|

|

|

|

|

|

|

|

| 31 | Income Summary | 901 | 10,900 |

|

|

| T. Cruz, Capital | 301 |

| 10,900 |

|

| Close income summary |

|

|

|

|

|

|

|

|

|

| 31 | T. Cruz, Capital | 301 | 7,000 |

|

|

| T. Cruz, Withdrawals | 302 |

| 7,000 |

|

| Close the withdrawals account |

|

|

|

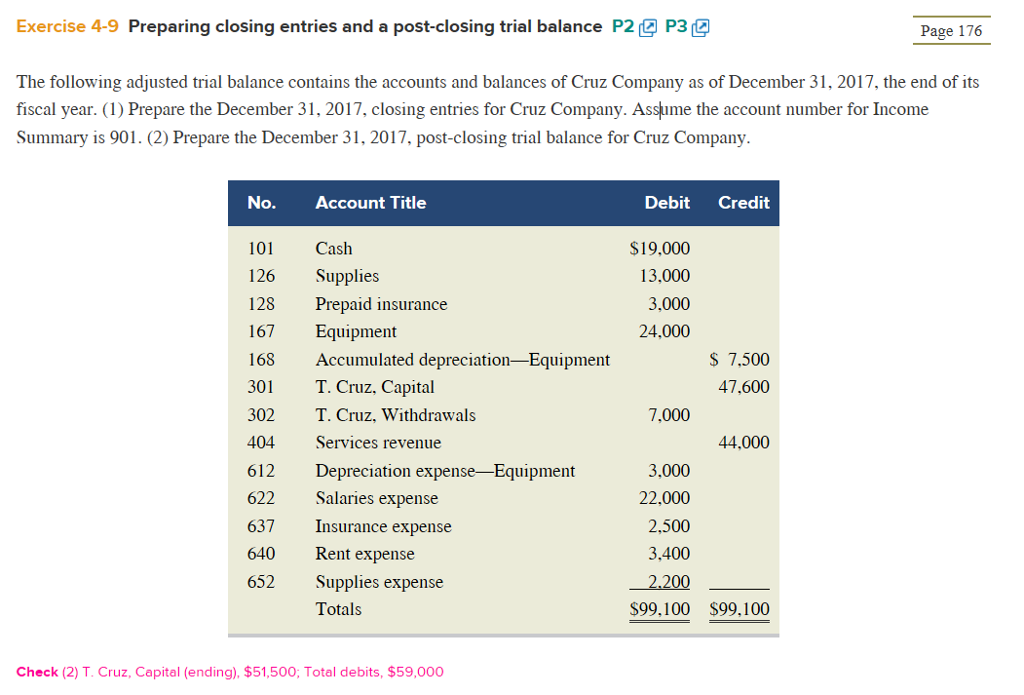

Exercise 4-9 Preparing closing entries and a post-closing trial balance P2 P3 Page 176 The following adjusted trial balance contains the accounts and balances of Cruz Company as of December 31, 2017, the end of its fiscal year. (1) Prepare the December 31, 2017, closing entries for Cruz Company. Assume the account number for Income Summary is 901. (2) Prepare the December 31, 2017, post-closing trial balance for Cruz Company No. Account Title Debit Credit 10 Cash 126 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation-Equipment 301 302 T. Cruz, Withdrawals 404 Services revenue 612D 622 Salaries expense 637 Insurance expense 640 Rent expense 652 Supplies expense $19,000 13,000 3,000 24.000 Supplies S 7,500 47.600 T. Cruz, Capital 7,000 44,000 Depreciation expense-Equipment 3.000 22,000 2,500 3.400 2.200 Totals 99.100 $99,100 Check (2) T. Cruz, Capital (ending), $51,500; Total debits, $59,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts