Question: Please explain! Medical Instruments Cost Allocation Activity Medical Instruments, Inc. manufactures three types of medical instruments in a highly automated production environment. The company tracks

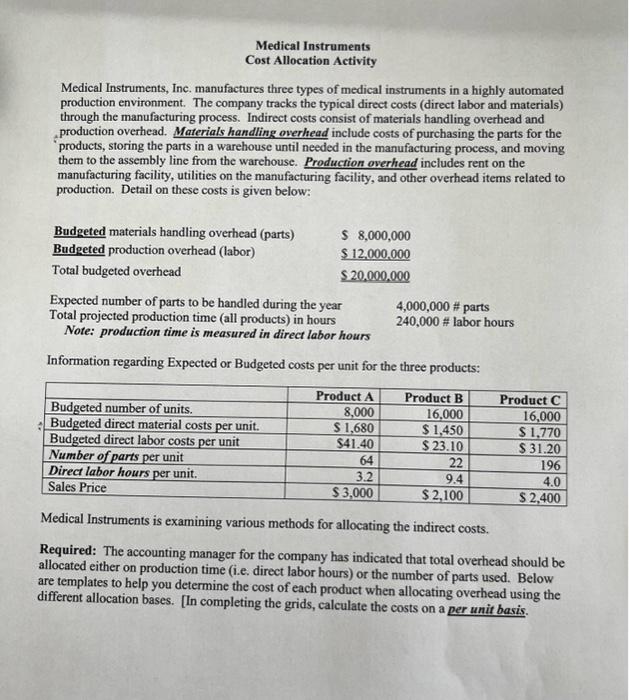

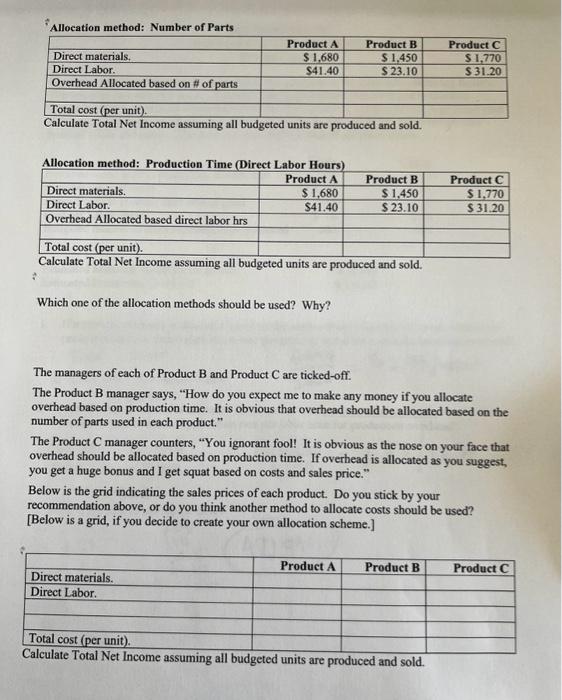

Medical Instruments Cost Allocation Activity Medical Instruments, Inc. manufactures three types of medical instruments in a highly automated production environment. The company tracks the typical direct costs (direct labor and materials) through the manufacturing process. Indirect costs consist of materials handling overhead and production overhead. Materials handling overhead include costs of purchasing the parts for the products, storing the parts in a warehouse until needed in the manufacturing process, and moving them to the assembly line from the warchouse. Production overhead includes rent on the manufacturing facility, utilities on the manufacturing facility, and other overhead items related to production. Detail on these costs is given below: Expected number of parts to be handled during the year 4,000,000 \# parts Note: production time is measured in direct labor hours Information regarding Expected or Budgeted costs per unit for the three products: Medical Instruments is examining various methods for allocating the indirect costs. Required: The accounting manager for the company has indicated that total overhead should be allocated either on production time (i.e. direct labor hours) or the number of parts used. Below are templates to help you determine the cost of each product when allocating overhead using the different allocation bases. [In completing the grids, calculate the costs on a per unit basis. Allocation method: Number of Parts Allocation method: Praduction Time mirant I ahar Lounce) Caiculate lotal Net income assuming all budgeted units are produced and sold. Which one of the allocation methods should be used? Why? The managers of each of Product B and Product C are ticked-off. The Product B manager says, "How do you expect me to make any money if you allocate overhead based on production time. It is obvious that overhead should be allocated based on the number of parts used in each product." The Product C manager counters, "You ignorant fool! It is obvious as the nose on your face that overhead should be allocated based on production time. If overhead is allocated as you suggest, you get a huge bonus and I get squat based on costs and sales price." Below is the grid indicating the sales prices of each product. Do you stick by your recommendation above, or do you think another method to allocate costs should be used? [Below is a grid, if you decide to create your own allocation scheme.] Varcurate rotai Net income assuming all budgeted units are produced and sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts