Question: please explain step by step in paper so i can understand IN D B 1 Question 5 (30p) 2 3 Hugo&Charles Property Investment plan to

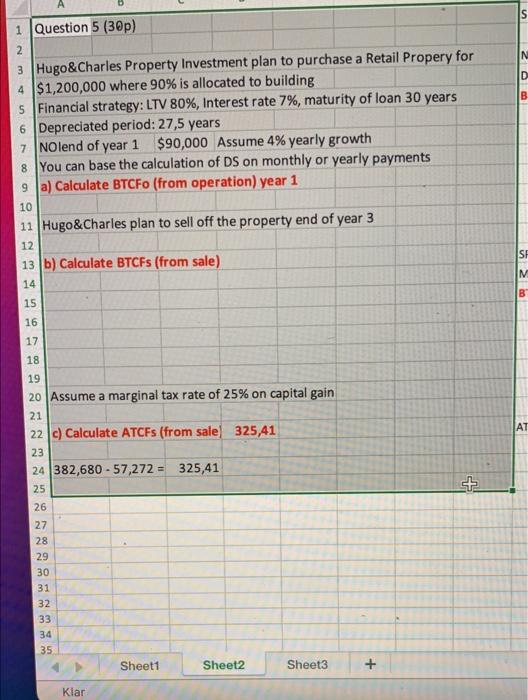

IN D B 1 Question 5 (30p) 2 3 Hugo&Charles Property Investment plan to purchase a Retail Propery for 4 $1,200,000 where 90% is allocated to building 5 Financial strategy: LTV 80%, Interest rate 7%, maturity of loan 30 years 6 Depreciated period: 27,5 years 7 NOlend of year 1 $90,000 Assume 4% yearly growth 8 You can base the calculation of DS on monthly or yearly payments 9 a) Calculate BTCFO (from operation) year 1 10 11 Hugo&Charles plan to sell off the property end of year 3 12 13 b) Calculate BTCFs (from sale) 14 B 15 16 17 18 AT 19 20 Assume a marginal tax rate of 25% on capital gain 21 22 c) Calculate ATCFs (from sale) 325,41 23 24 382,680 - 57,272 = 325,41 25 26 + 27 28 29 30 31 32 33 34 35 Sheet1 Sheet2 Sheet3 + Klar IN D B 1 Question 5 (30p) 2 3 Hugo&Charles Property Investment plan to purchase a Retail Propery for 4 $1,200,000 where 90% is allocated to building 5 Financial strategy: LTV 80%, Interest rate 7%, maturity of loan 30 years 6 Depreciated period: 27,5 years 7 NOlend of year 1 $90,000 Assume 4% yearly growth 8 You can base the calculation of DS on monthly or yearly payments 9 a) Calculate BTCFO (from operation) year 1 10 11 Hugo&Charles plan to sell off the property end of year 3 12 13 b) Calculate BTCFs (from sale) 14 B 15 16 17 18 AT 19 20 Assume a marginal tax rate of 25% on capital gain 21 22 c) Calculate ATCFs (from sale) 325,41 23 24 382,680 - 57,272 = 325,41 25 26 + 27 28 29 30 31 32 33 34 35 Sheet1 Sheet2 Sheet3 + Klar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts