Question: please explain step by step on paper so incan understand the solution lili v tra in FK U ppna terskapade arbetsbcker? Dina senaste ndringar har

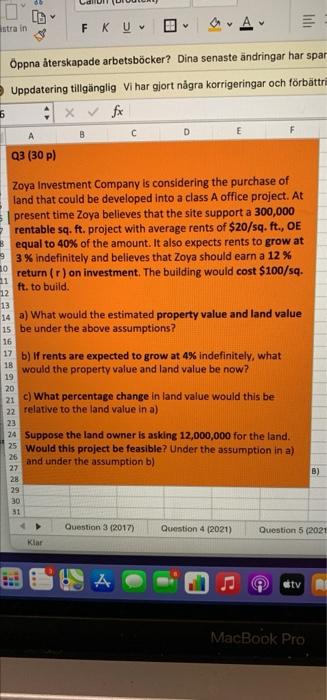

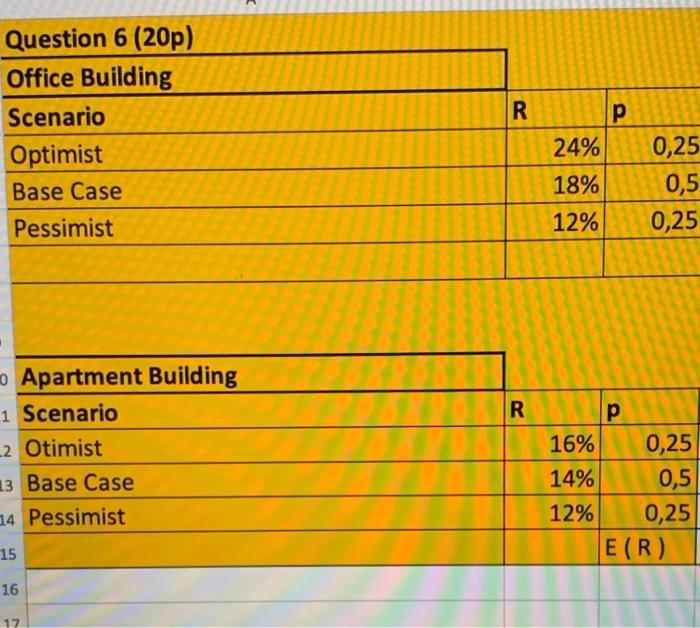

lili v tra in FK U ppna terskapade arbetsbcker? Dina senaste ndringar har spar Uppdatering tillgnglig Vi har gjort ngra korrigeringar och frbttri 5 x fx F B Q3 (30p) Zoya Investment Company is considering the purchase of land that could be developed into a class A office project. At present time Zoya believes that the site support a 300,000 rentable sq. ft. project with average rents of $20/sq.ft., OE equal to 40% of the amount. It also expects rents to grow at 3% indefinitely and believes that Zoya should earn a 12% 10 return (r) on investment. The building would cost $100/sq. 11 ft. to build 12 13 14 a) What would the estimated property value and land value 15 be under the above assumptions? 16 17 b) If rents are expected to grow at 4% indefinitely, what would the property value and land value be now? 18 19 20 21 BON 850 23 c) What percentage change in land value would this be 22 relative to the land value in a) 24 Suppose the land owner is asking 12,000,000 for the land. 25 Would this project be feasible? Under the assumption in a) 26 and under the assumption b) 27 B) 28 29 30 31 Question 3 (2017) Question 4 (2021) Question 5 (2021 Klar tv MacBook Pro R Question 6 (20p) Office Building Scenario Optimist Base Case Pessimist 24% 18% 12% 0,25 0,5 0,25 . R Apartment Building 1 Scenario -2 Otimist 13 Base Case 14 Pessimist 16% 0,25 14% 0,5 12% 0,25 E(R) 15 16 17 lili v tra in FK U ppna terskapade arbetsbcker? Dina senaste ndringar har spar Uppdatering tillgnglig Vi har gjort ngra korrigeringar och frbttri 5 x fx F B Q3 (30p) Zoya Investment Company is considering the purchase of land that could be developed into a class A office project. At present time Zoya believes that the site support a 300,000 rentable sq. ft. project with average rents of $20/sq.ft., OE equal to 40% of the amount. It also expects rents to grow at 3% indefinitely and believes that Zoya should earn a 12% 10 return (r) on investment. The building would cost $100/sq. 11 ft. to build 12 13 14 a) What would the estimated property value and land value 15 be under the above assumptions? 16 17 b) If rents are expected to grow at 4% indefinitely, what would the property value and land value be now? 18 19 20 21 BON 850 23 c) What percentage change in land value would this be 22 relative to the land value in a) 24 Suppose the land owner is asking 12,000,000 for the land. 25 Would this project be feasible? Under the assumption in a) 26 and under the assumption b) 27 B) 28 29 30 31 Question 3 (2017) Question 4 (2021) Question 5 (2021 Klar tv MacBook Pro R Question 6 (20p) Office Building Scenario Optimist Base Case Pessimist 24% 18% 12% 0,25 0,5 0,25 . R Apartment Building 1 Scenario -2 Otimist 13 Base Case 14 Pessimist 16% 0,25 14% 0,5 12% 0,25 E(R) 15 16 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts