Question: please explain step by step it should be done with the formula in the bottom QUESTION 1 (6 points) The Smith family just sold their

please explain step by step

it should be done with the formula in the bottom

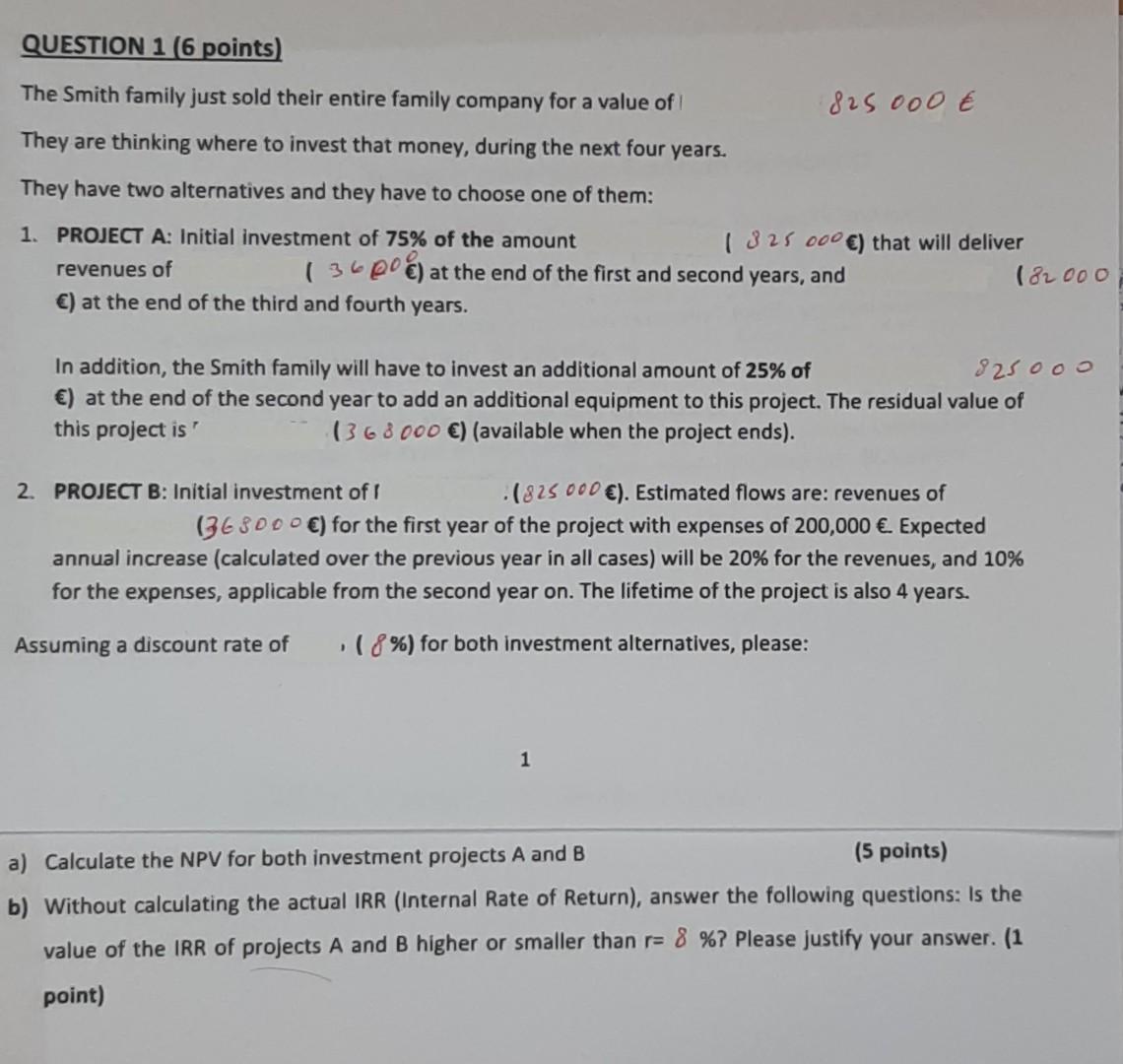

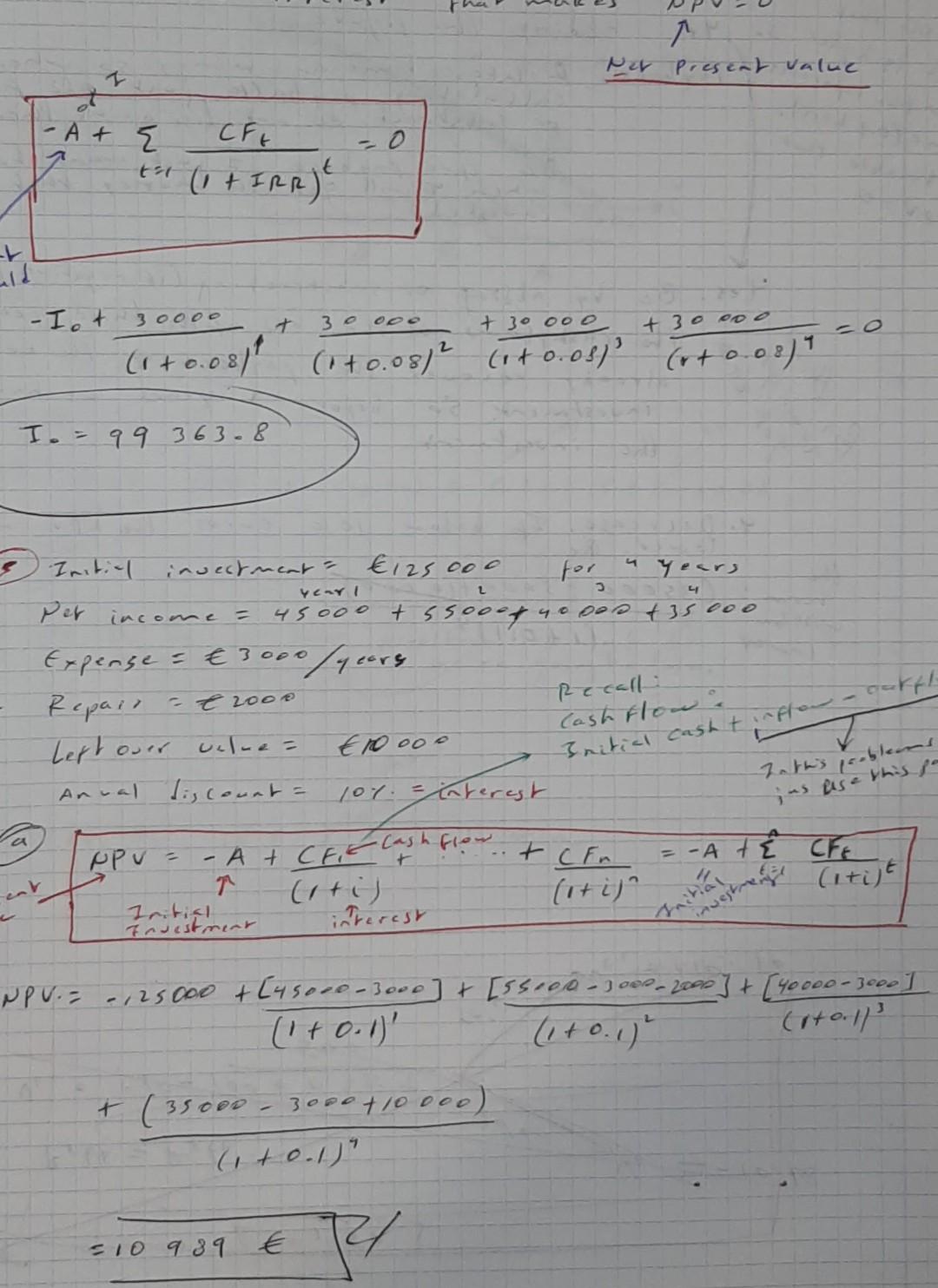

QUESTION 1 (6 points) The Smith family just sold their entire family company for a value of They are thinking where to invest that money, during the next four years. 825 000 They have two alternatives and they have to choose one of them: 1. PROJECT A: Initial investment of 75% of the amount ( 325 000 ) that will deliver revenues of 13600& at the end of the first and second years, and (82000 ) at the end of the third and fourth years. In addition, the Smith family will have to invest an additional amount of 25% of 825 000 ) at the end of the second year to add an additional equipment to this project. The residual value of this project is (3 68000 ) (available when the project ends). 2. PROJECT B: Initial investment of I (825 000 ). Estimated flows are: revenues of (363000 ) for the first year of the project with expenses of 200,000 . Expected annual increase (calculated over the previous year in all cases) will be 20% for the revenues, and 10% for the expenses, applicable from the second year on. The lifetime of the project is also 4 years. Assuming a discount rate of (8%) for both investment alternatives, please: 1 a) Calculate the NPV for both investment projects A and B (5 points) b) Without calculating the actual IRR (Internal Rate of Return), answer the following questions: Is the value of the IRR of projects A and B higher or smaller than r= 8 %? Please justify your answer. (1 point) f per present value - At E CFt o tor (1+IRRE -Iot + 3 + 30 ooo + 30 ooo (" (1 +0.081 (1+0.08)2 (140.06) (ito.os)' (at 0.08) Io = 99 363.8 for year i ssoood Recalli Cash Flow : Initial investmeata 125 000 Years 4 per income = 45000 t 4ooos t35 000 Expenses 3000 (yoore Repair - 2000 Lertour uile = 1oooo Anual Tiscount = 101 - Cnterest r. Ppv= -A + CFR Cash flow. t can = -At CFE q Citil (it in (itit Initial insistrent interest Initial cash t inflow - carti- Zathis problems ins use this po Ininas investment NPV., . , 25000 + [45000-3000] + [sso0o-3a 1000-2000] + [40000 - 3000] (1 + 0.1)' (1+0. 1)' (tooll' + ( 35 000 - 3000 110.000) +0.1) =10 9 89 By

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts