Question: (There are 8 things to answer below, but the question will be worth 5 marks in total A trader establishes an option trading strategy as

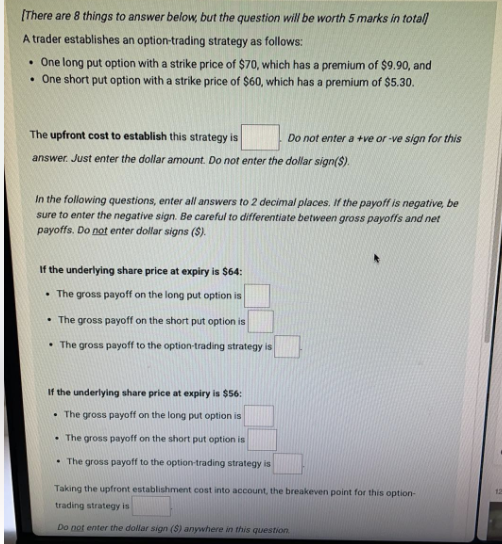

(There are 8 things to answer below, but the question will be worth 5 marks in total A trader establishes an option trading strategy as follows: . One long put option with a strike price of $70, which has a premium of $9.90, and One short put option with a strike price of $60, which has a premium of $5.30. The upfront cost to establish this strategy is Do not enter a +ve or ve sign for this answer. Just enter the dollar amount. Do not enter the dollar sign($). In the following questions, enter all answers to 2 decimal places. If the payoff is negative, be sure to enter the negative sign. Be careful to differentiate between gross payoffs and net payoffs. Do not enter dollar signs ($). If the underlying share price at expiry is $64: The gross payoff on the long put option is The gross payoff on the short put option is . The gross payoff to the option trading strategy is of the underlying share price at expiry is $56: The gross payoff on the long put option is The gross payoff on the short put option is The gross payoff to the option-trading strategy is Taking the upfront establishment cost into account, the breakeven point for this option- trading strategy is Do not enter the dollar sign (S) anywhere in this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts