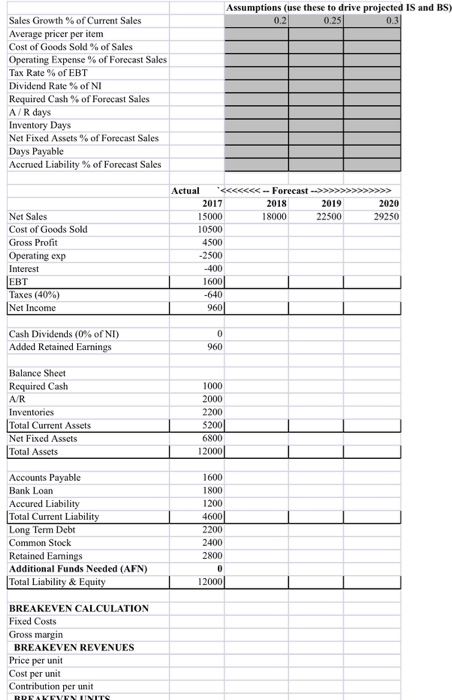

Question: please fill in the spreadsheet attached. complete the forecast for a fictitious company using the attached spreadsheet template. the following assumptions are in the assumption

Assumptions (use these to drive projected IS and BS) 02 0.25 03 Sales Growth % of Current Sales Average pricer per item Cost of Goods Sold % of Sales Operating Expense of Forecast Sales Tax Rate % of EBT Dividend Rate of NI Required Cash % of Forecast Sales A/R days Inventory Days Net Fixed Assets % of Forecast Sales Days Payable Accrued Liability % of Forecast Sales Net Sales Cost of Goods Sold Gross Profit Operating exp Interest Taxes (40%) Net Income Actual '>>>>>>>>>>>> 2017 2018 2019 2020 15000 18000 22500 29250 10500 4500 -2500 -400 1600 -640 960 Cash Dividends (0% of NI) Added Retained Earnings 0 960 1000 2000 Balance Sheet Required Cash A/R Inventories Total Current Assets Net Fixed Assets Total Assets 2200 5200 6800 12000 Accounts Payable Bank Loan Accured Liability Total Current Liability Long Term Debt Common Stock Retained Eamings Additional Funds Needed (AFN) Total Liability & Equity BREAKEVEN CALCULATION Fixed Costs Gross margin BREAKEVEN REVENUES Price per unit Cost per unit Contribution per unit 1600 1800 1200 4600 2200 2400 2800 0 12000 RPCAKEVINUNITS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts