Question: please fill int the blance. The x is wrong and check is correct. This si the second try. Thanks! stery Problem: The Adjusting Process. adjusted

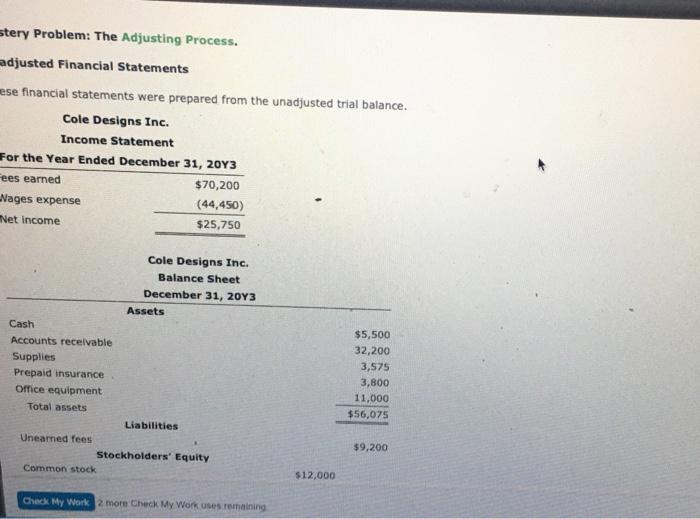

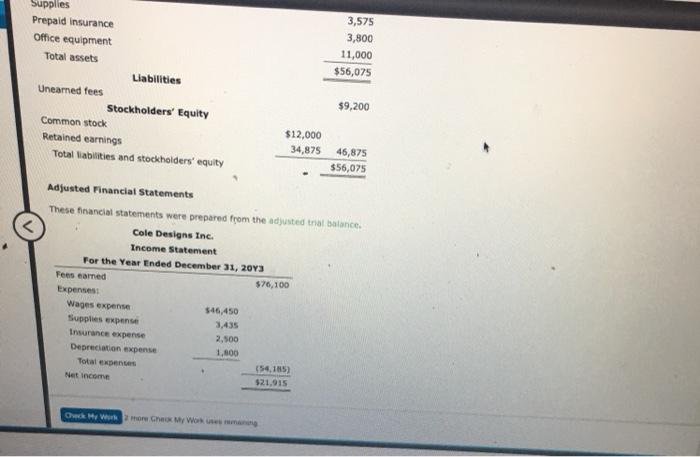

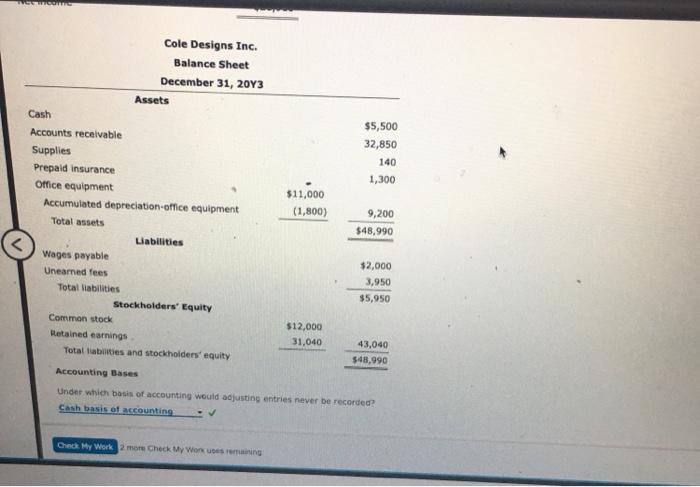

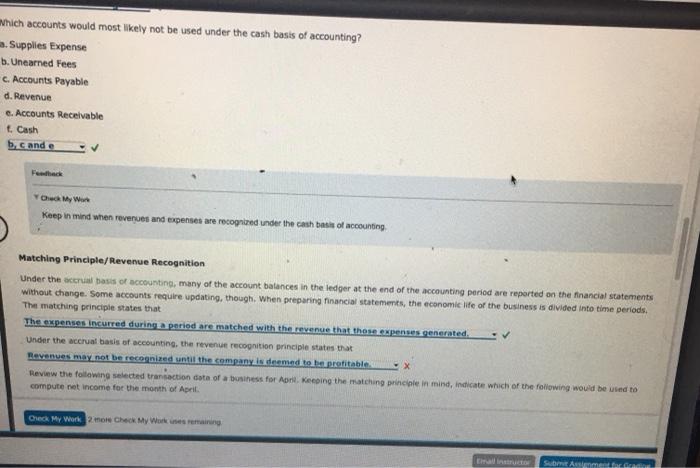

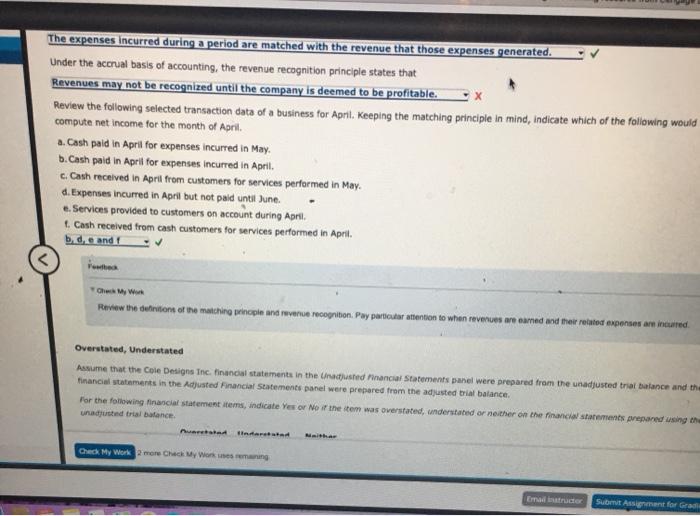

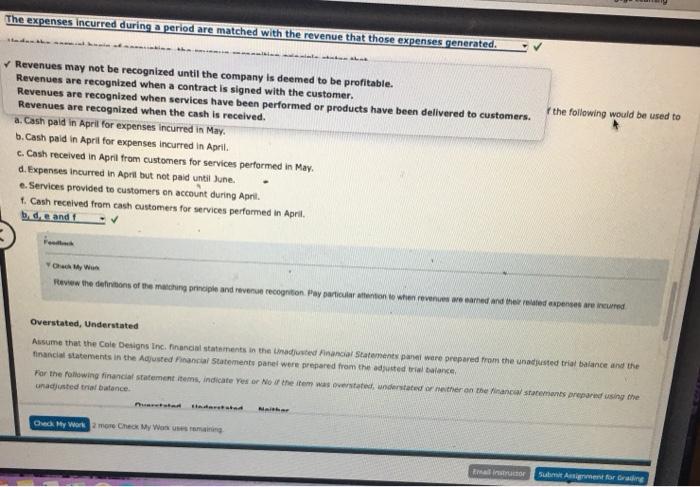

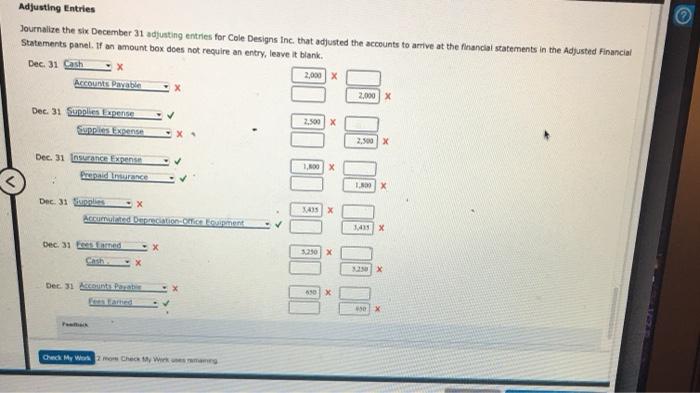

stery Problem: The Adjusting Process. adjusted Financial Statements ese financial statements were prepared from the unadjusted trial balance. Cole Designs Inc. Income Statement For the Year Ended December 31, 2013 ees earned $70,200 Nages expense (44,450) Net income $25,750 Cole Designs Inc. Balance Sheet December 31, 20Y3 Assets Cash Accounts receivable Supplies Prepaid insurance Office equipment Total assets Liabilities Unearned fees Stockholders' Equity Common stock $5,500 32,200 3,575 3,800 11,000 $56,075 $9,200 $12,000 Check My Work 2 more Check My Work uses remaining 3,575 3,800 11,000 $56,075 Supplies Prepaid insurance Office equipment Total assets Liabilities Uneared fees Stockholders' Equity Common stock Retained earnings Total liabilities and stockholders' equity $9,200 $12,000 34,875 46,875 $56,075 Adjusted Financial Statements These financial statements were prepared from the adjusted trial balance Cole Designs Inc. Income Statement For the Year Ended December 31, 2013 Fees earned $76,100 Expenses: Wages expense $46,450 Supplies expense 3,435 Insurance expense 2.500 Depreciation expense 1,500 Total expenses (54,185 Net Income $21.915 Ow My Wore Che Works wema $5,500 32,850 140 1,300 Cole Designs Inc. Balance Sheet December 31, 2013 Assets Cash Accounts receivable Supplies Prepaid insurance Office equipment Accumulated depreciation-office equipment Total assets Liabilities Wages payable Unearned fees Total liabilities Stockholders' Equity Common stock Retained earnings Total liabilities and stockholders' equity $11,000 (1,800) 9,200 $48,990 $2,000 3,950 $5,950 $12,000 31,040 43,040 $48,990 Accounting Bases Under which basis of accounting would adjusting entries never be recorded Cash basis of accounting Check My Work 2 more Check My Worker which accounts would most likely not be used under the cash basis of accounting? Supplies Expense b. Unearned Fees c. Accounts Payable d. Revenue e. Accounts Receivable Cash b, cande Oh My W Keep in mind when revenues and expenses are recognized under the cash basis of accounting Matching Principle/Revenue Recognition Under the accrual basis of accounting, many of the account balances in the ledger at the end of the accounting period are reported on the financial statements without change. Some accounts require updating, though. When preparing financial statements, the economic life of the business is divided into time periods. The matching principle states that The expenses incurred during a period are matched with the revenue that these expenses generated, Under the accrual basis of accounting the revenue recognition principle states that Revenues may not be recognized until the company is deemed to be profitable X Review the following selected transaction data of a business for Ari Kering the matching principle in mind, indicate which of the following would be used to compute net income for the month of April Check My Work 2 ore Check My Works remaining SA The expenses incurred during a period are matched with the revenue that those expenses generated. Under the accrual basis of accounting, the revenue recognition principle states that Revenues may not be recognized until the company is deemed to be profitable. Review the following selected transaction data of a business for April. Keeping the matching principle in mind, indicate which of the following would compute net income for the month of April. a. Cash paid in April for expenses incurred in May. b. Cash paid in April for expenses incurred in April. c. Cash received in April from customers for services performed in May. d. Expenses incurred in April but not paid until June e. Services provided to customers on account during April t. Cash received from cash customers for services performed in April. b.de and Check My W Review the definitions of the matching principle and revenue recognition. Pay particular attention to when revenues are eamed and their related expenses are incurred Overstated, Understated Assume that the Cole Designs Inc, financial statements in the Unausted Financial Statement panel were prepared from the unadjusted trial balance and the financial statements in the Adjusted Financial Statements panel were prepared from the adjusted trial balance For the following financial statement terms, indicate Yes or near the tem was overstated, understated or nother on the financial statements prepared using the unadjusted trial balance Duartala sha Check My Work 2 more Check My Wong Emance Submit Assignment for Grade The expenses incurred during a period are matched with the revenue that those expenses generated. the following would be used to Revenues may not be recognized until the company is deemed to be profitable. Revenues are recognized when a contract is signed with the customer. Revenues are recognized when services have been performed or products have been delivered to customers. Revenues are recognized when the cash is received. a. Cash paid in April for expenses incurred in May. b. Cash paid in April for expenses incurred in April. c. Cash received in April from customers for services performed in May. d. Expenses incurred in April but not paid until June e Services provided to customers on account during April 1. Cash received from cash customers for services performed in April, bd Rand 1 Check My Wine Review the definitions of matching principle and even recognition Pay particulation to wherever we canned and the related expenses are curred Overstated, Understated Assume that the Cole Designs Inc. Financial statements in the adjusted Financial Statements panel were prepared from the unausted trial balance and the financial statements in the Adjusted Financial Statements panel were prepared from the adjusted trial balance For the following financial statement items, indicate Yes or Notheim was overstated, understated or other on the financial statements prepared using the unadjusted trial batance Od My Work more Check My Wonen Emaior Submit Antigent for Grading Adjusting Entries Journalize the six December 31 adjusting entries for Cole Designs Inc. that adjusted the accounts to arrive at the financial statements in the Adjusted Financial Statements panel. If an amount box does not require an entry, leave it blank Dec 31 Cash 2,000 Accounts Payable X 2,000 X Dec. 31 Supplies upense Supplies Expense 2.500 x 2.500 X Dec. 31 Insurance lipes Panduan X 1.800 X Dec 31 Suns Acumulated Depreciation Comment XX X Dec 31 es farned Cash EU 18 18 18 18 250 x 250x Dec 31 Accounts Para X 0 x Ched My Wormor Checkmann

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts