Question: Please fill the following for operating margin % The reference is below Industry: 18 Y10 Actual Y11 Actual Y12 Actual Company: President: Total Company North

Please fill the following for operating margin %

The reference is below

| Industry: 18 | Y10 Actual | Y11 Actual | Y12 Actual |

| Company: | |||

| President: | |||

| Total Company | |||

| North America | |||

| Europe-Africa | |||

| Asia-Pacific | |||

| Latin America |

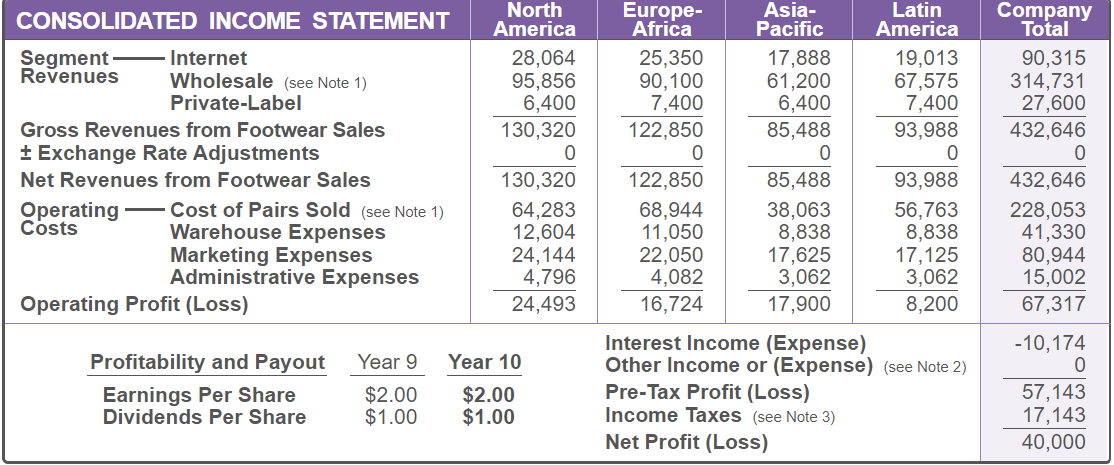

Y10

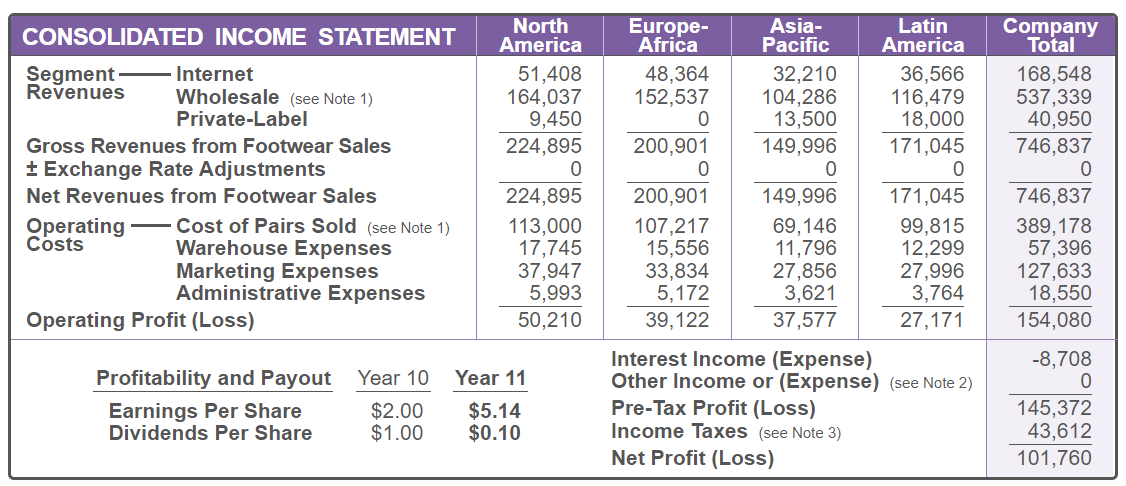

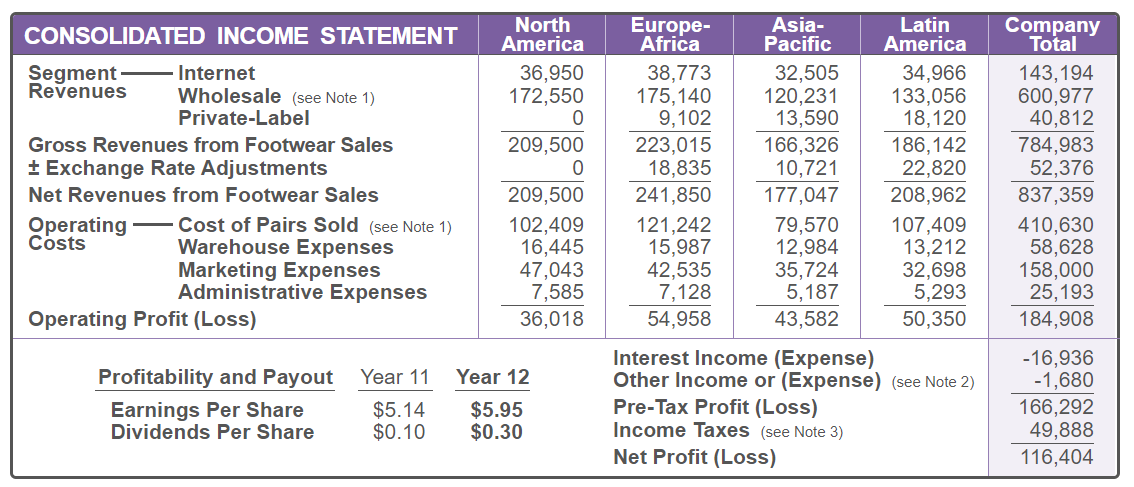

CONSOLIDATED INCOME STATEMENT Segment Revenues Internet Wholesale (see Note 1) Private-Label Gross Revenues from Footwear Sales i Exchange Rate Adjustments Net Revenues from Footwear Sales Operating Cost of Pairs Sold (see Note 1) Costs Warehouse Expenses Marketing Expenses Administrative Expenses Operating Profit (Loss) North Euro pe- America Africa 28,064 95,856 6,400 25,350 90,100 7,400 17,888 61 ,200 6,400 Company Total 90,315 314,731 27,600 130,320 0 122,850 0 85,488 0 432,646 0 130,320 64,283 12,604 24,144 4,796 122,850 68,944 11,050 22,050 4,082 85,488 38,063 8,838 17,625 3,062 432,646 228,053 41,330 80,944 15,002 24,493 16,724 17,900 67,317 Profitability and Payout Year 9 Year 10 Earnings Per Share $2.00 Dividends Per Share $1.00 $2.00 $1 .00 Interest Income (Expense) Other Income or (Expense) (see Note 2) Pre-Tax Profit (Loss) Income Taxes (see Note 3) Net Profit (Loss) -10,174 0 57,143 17,143 40,000 CONSOLIDATED INCOME STATEMENT Segment Revenues Internet Wholesale (see Note 1) Private-Label Gross Revenues from Footwear Sales i Exchange Rate Adjustments Net Revenues from Footwear Sales Operating Cost of Pairs Sold (see Note 1) C055 Warehouse Expenses Marketing Expenses Administrative Expenses Operating Profit (Loss) Nort_h Amerlca 51 ,408 164,037 9,450 48,364 152,537 0 32,210 104,286 13,500 36,566 116,479 18,000 Company Total 168,548 537,339 40,950 224,895 0 200,901 0 149,996 0 171,045 0 746,837 0 224,895 113,000 17,745 37,947 5,993 200,901 107,217 15,556 33,834 5,172 149,996 69,146 11,796 27,856 3,621 171,045 99,815 12,299 27,996 3,764 746,837 389,178 57,396 127,633 18,550 50,210 39,122 37,577 27,171 154,080 Profitability and Payout Year 10 Year 11 $2.00 $1.00 Earnings Per Share Dividends Per Share $5.14 $0.10 Interest Income (Expense) Other Income or (Expense) [see Note 2) Pre-Tax Profit (Loss) Income Taxes [see Note 3} Net Profit {Loss} -8,708 0 145,372 43,612 101,760 CONSOLIDATED INCOME STATEMENT $2,822,, Agata, \"+11%"? Segment Internet 36,950 38,773 32,505 34,966 143,194 Revenues Wholesale (see Note 1) 172,550 175,140 120,231 133,056 600,977 Private-Label 0 9,102 13,590 18,120 40,812 Gross Revenues from Footwear Sales 209,500 223,015 166,326 186,142 784,983 2 Exchange Rate Adjustments 0 18,835 10,721 22,820 52,376 Net Revenues from Footwear Sales 209,500 241,850 177,047 208,962 837,359 Operating Cost Of Pairs Sold (see Note 1) 102,409 121,242 79,570 107,409 410,630 C055 Warehouse Expenses 16,445 15,987 12,984 13,212 58,628 Marketing Expenses 47,043 42,535 35,724 32,698 158,000 Administrative Expenses 7,585 7,128 5,187 5,293 25,193 Operating Profit (Loss) 36,018 54,958 43,582 50,350 184,908 _ _ _ Interest Income (Expense) 46,936 PTOfltabllltY and PYOUt Year 11 Year 12 Other Income or (Expense) [see Note 2) -1,680 Earnings Per Share $5.14 $5.95 Pre-Tax Profit (L055) 156,292 Dividends Per Share $0.10 $0.30 Income Taxes [see Note 3) 49,888 Net Profit (Loss) 116,404

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts