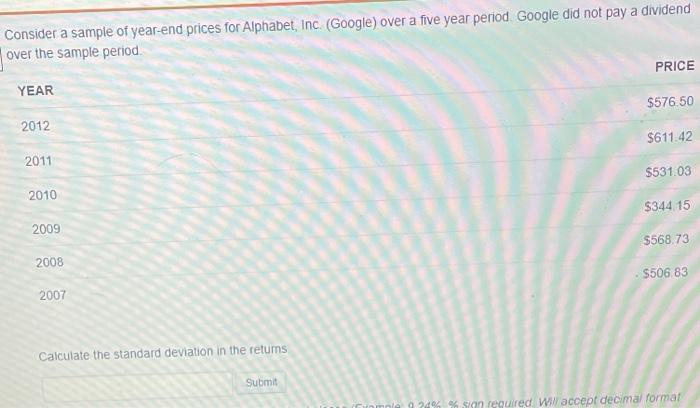

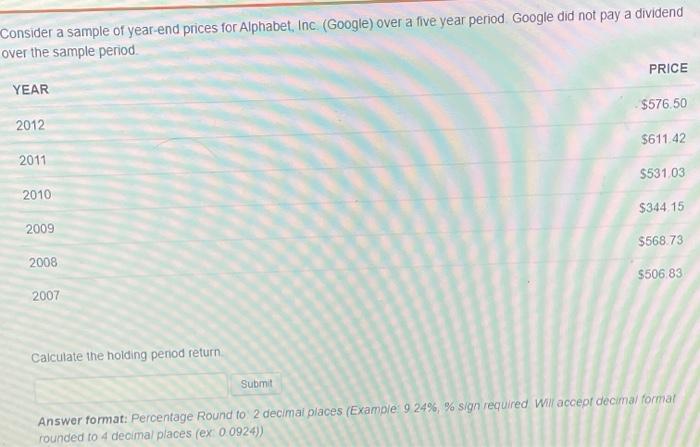

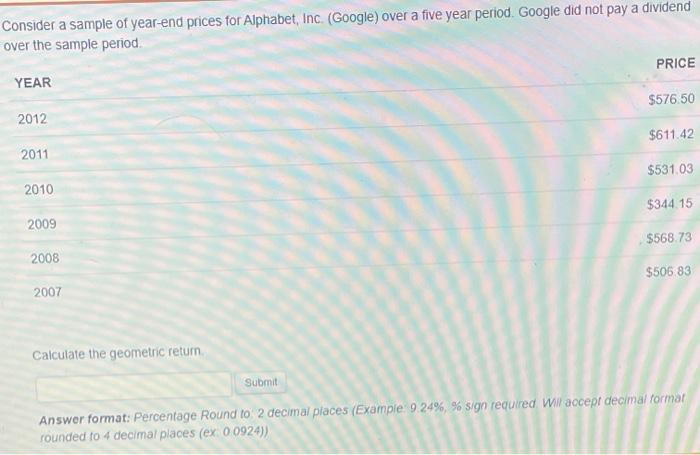

Question: please find all three (standard deviation in the returns, holding period return, and geometric return) Consider a sample of year-end prices for Alphabet, Inc. (Google)

Consider a sample of year-end prices for Alphabet, Inc. (Google) over a five year period Google did not pay a dividend over the sample period PRICE YEAR $576.50 2012 $611.42 2011 $531.03 2010 $344 15 2009 $568.73 2008 $506.83 2007 Calculate the standard deviation in the retums Submit sion required wiw accept decimal format Consider a sample of year-end prices for Alphabet, Inc. (Google) over a five year period Google did not pay a dividend over the sample period PRICE YEAR $576.50 2012 $611.42 2011 $531.03 2010 $344 15 2009 $568.73 2008 $506 83 2007 Calculate the holding penod return Submit Answer format: Percentage Round to 2 decimal places (Example 9 24%, % sign required Will accept decimal formal rounded to 4 decimal places (ex 0 0924)) Consider a sample of year-end prices for Alphabet, Inc. (Google) over a five year period. Google did not pay a dividend over the sample period PRICE YEAR $576.50 2012 $611.42 2011 $531.03 2010 $344.15 2009 $568.73 2008 $506 83 2007 Calculate the geometric return Submit Answer format: Percentage Round to 2 decimal places (Example 9.24%, % sign required Will accept decimal formar rounded to 4 decimal places (ex 00924))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts