Question: Please finish A firm is analyzing two mutually exclusive projects, A and B, whose cash flows are shown below: Years 0 1 2 3 4

Please finish

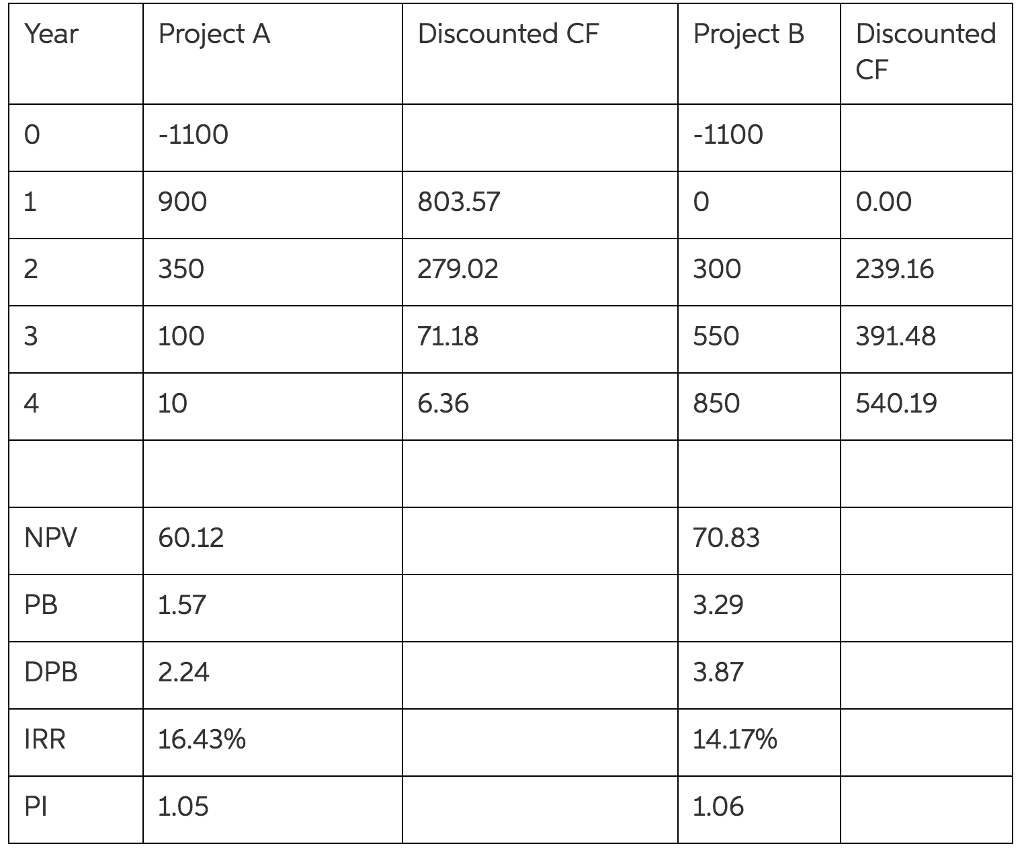

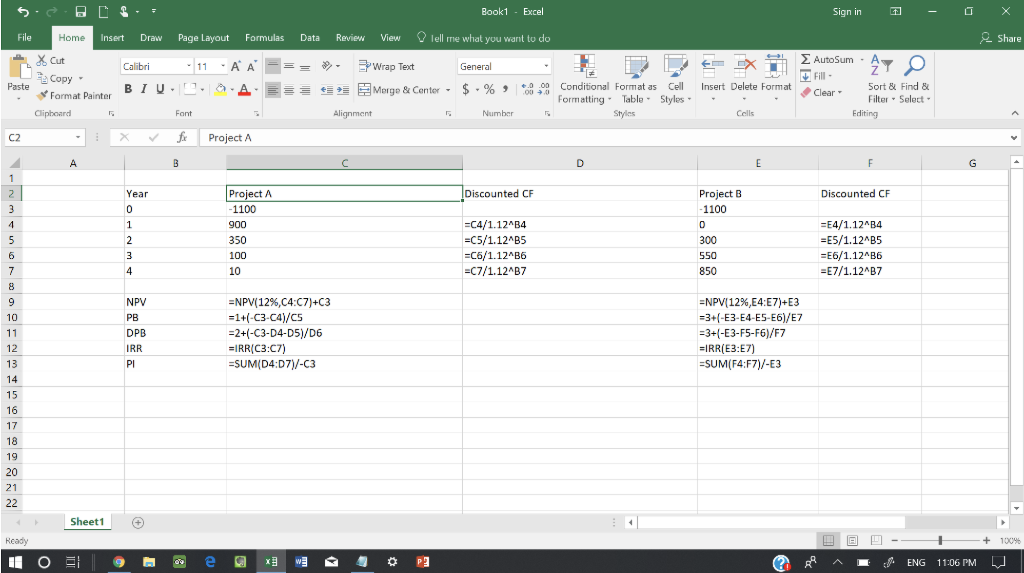

A firm is analyzing two mutually exclusive projects, A and B, whose cash flows are shown below:

Years 0 1 2 3 4

A -1,100 900 350 100 10

B -1,100 0 300 550 850

CC=12% , with no capital restrictions at that cost. The CPP=2years

CC= Cost of Capital, CPP= cutoff payback period, PB= Payback, DPB=discounted payback, PI= profitability index, CR = Crossover rate

Show the NPV profile (table and graph) of the two projects and find CR. Which method gives you the correct answer? Is there a conflict between NPV and IRR methods? Explain.

Calculate each projects MIRR. Which project would you choose? Explain why MIRR is better than IRR.

Use a data table to do a sensitivity analysis to see how cost of capital affects the IRR and MIRR of the two projects. Explain

Given these findings

Year Project A Discounted CF Project B Discounted CF 1100 900 350 100 10 1100 0 300 550 850 0 2 3 4 803.57 279.02 71.18 6.36 0.00 239.16 391.48 540.19 NPV PB DPB IRR Pl 60.12 1.57 2.24 16.43% 1.05 70.83 3.29 3.87 14.17% 1.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts