Question: Please fully answer correctly, will upvote if done right. GM is determining whether to source microchips used in production of its vehicles from one or

Please fully answer correctly, will upvote if done right.

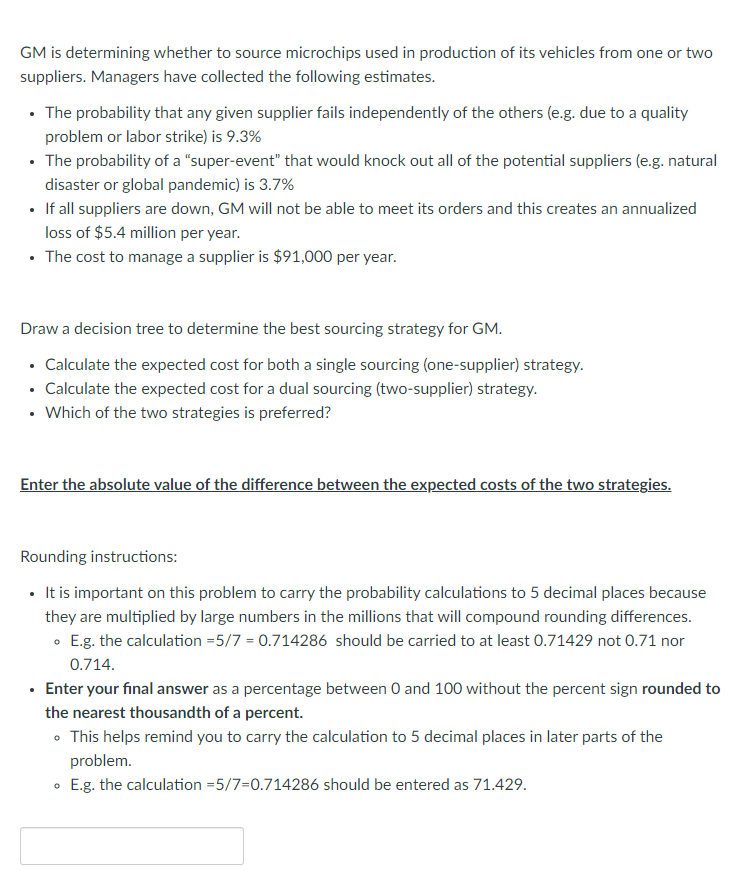

GM is determining whether to source microchips used in production of its vehicles from one or two suppliers. Managers have collected the following estimates. - The probability that any given supplier fails independently of the others (e.g. due to a quality problem or labor strike) is 9.3% - The probability of a "super-event" that would knock out all of the potential suppliers (e.g. natural disaster or global pandemic) is 3.7% - If all suppliers are down, GM will not be able to meet its orders and this creates an annualized loss of $5.4 million per year. - The cost to manage a supplier is $91,000 per year. Draw a decision tree to determine the best sourcing strategy for GM. - Calculate the expected cost for both a single sourcing (one-supplier) strategy. - Calculate the expected cost for a dual sourcing (two-supplier) strategy. - Which of the two strategies is preferred? Enter the absolute value of the difference between the expected costs of the two strategies. Rounding instructions: - It is important on this problem to carry the probability calculations to 5 decimal places because they are multiplied by large numbers in the millions that will compound rounding differences. - E.g. the calculation =5/7=0.714286 should be carried to at least 0.71429 not 0.71 nor 0.714 . - Enter your final answer as a percentage between 0 and 100 without the percent sign rounded to the nearest thousandth of a percent. - This helps remind you to carry the calculation to 5 decimal places in later parts of the problem. - E.g. the calculation =5/7=0.714286 should be entered as 71.429

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts