Question: Please genuine answer , don't copy from anywhere please and do specify formulas. Question 1 (7 marks) You are a graduate student from Holmes institute

Please genuine answer , don't copy from anywhere please and do specify formulas.

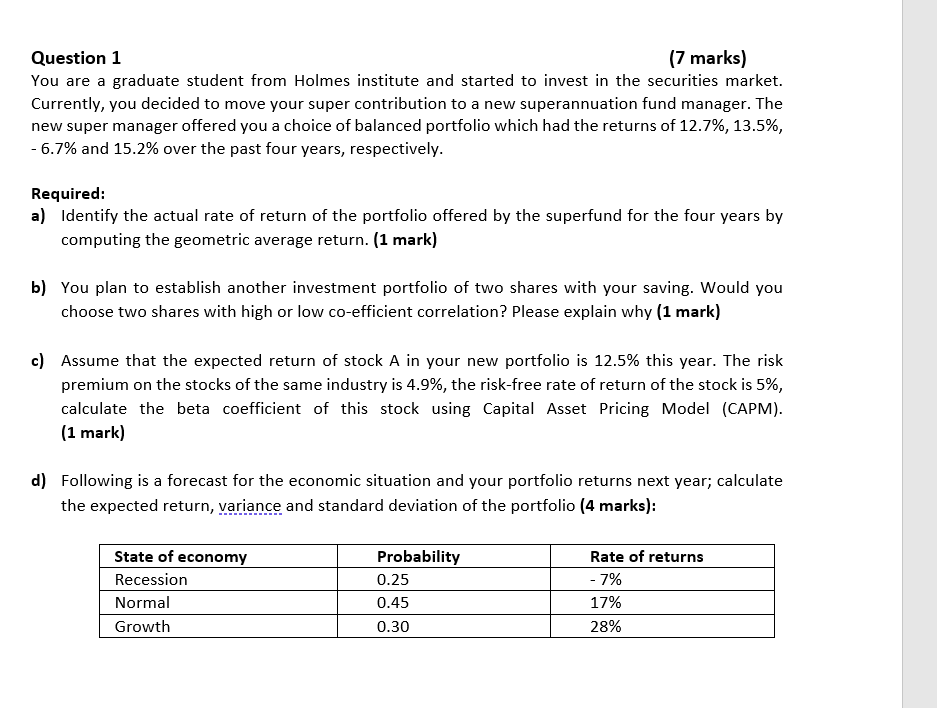

Question 1 (7 marks) You are a graduate student from Holmes institute and started to invest in the securities market. Currently, you decided to move your super contribution to a new superannuation fund manager. The new super manager offered you a choice of balanced portfolio which had the returns of 12.7%, 13.5%, -6.7% and 15.2% over the past four years, respectively. Required: a) Identify the actual rate of return of the portfolio offered by the superfund for the four years by computing the geometric average return. (1 mark) b) You plan to establish another investment portfolio of two shares with your saving. Would you choose two shares with high or low co-efficient correlation? Please explain why (1 mark) c) Assume that the expected return of stock A in your new portfolio is 12.5% this year. The risk premium on the stocks of the same industry is 4.9%, the risk-free rate of return of the stock is 5%, calculate the beta coefficient of this stock using Capital Asset Pricing Model (CAPM). (1 mark) d) Following is a forecast for the economic situation and your portfolio returns next year; calculate the expected return, variance and standard deviation of the portfolio (4 marks): State of economy Recession Normal Growth Probability 0.25 0.45 0.30 Rate of returns -7% 17% 28%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts