Question: Please go in order, and solve for these values using the information given below: Determine the firms maximum sales growth percentage for 2021 that would

Please go in order, and solve for these values using the information given below:

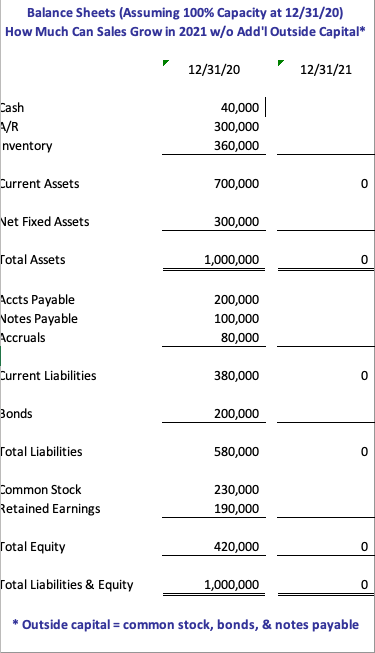

Determine the firms maximum sales growth percentage for 2021 that would not require additional capital (capital being common stock, bonds payable and/or notes payable).

I have answers to the totals, such as total assets for 2021 being 1,061,946, but I want to understand how it is done. Thank u!

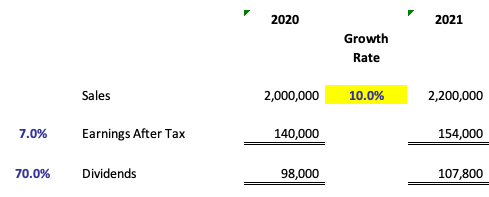

2020 2021 Growth Rate Sales 2,000,000 10.0% 2,200,000 7.0% Earnings After Tax 140,000 154,000 70.0% Dividends 98,000 107,800 Balance Sheets (Assuming 100% Capacity at 12/31/20) How Much Can Sales Grow in 2021 w/o Add'l Outside Capital* 12/31/20 12/31/21 Cash VR nventory 40,000 300,000 360,000 Current Assets 700,000 0 Net Fixed Assets 300,000 Total Assets 1,000,000 0 Accts Payable Notes Payable Accruals 200,000 100,000 80,000 Current Liabilities 380,000 0 Bonds 200,000 Total Liabilities 580,000 0 Common Stock Retained Earnings 230,000 190,000 Total Equity 420,000 0 Total Liabilities & Equity 1,000,000 0 Outside capital = common stock, bonds, & notes payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts