Question: Please guide me through the questions below. There are no texts missing so please do not write so. LTU SUMMER SCHOOL 2010 X ProQuest Ebook

Please guide me through the questions below.

There are no texts missing so please do not write so.

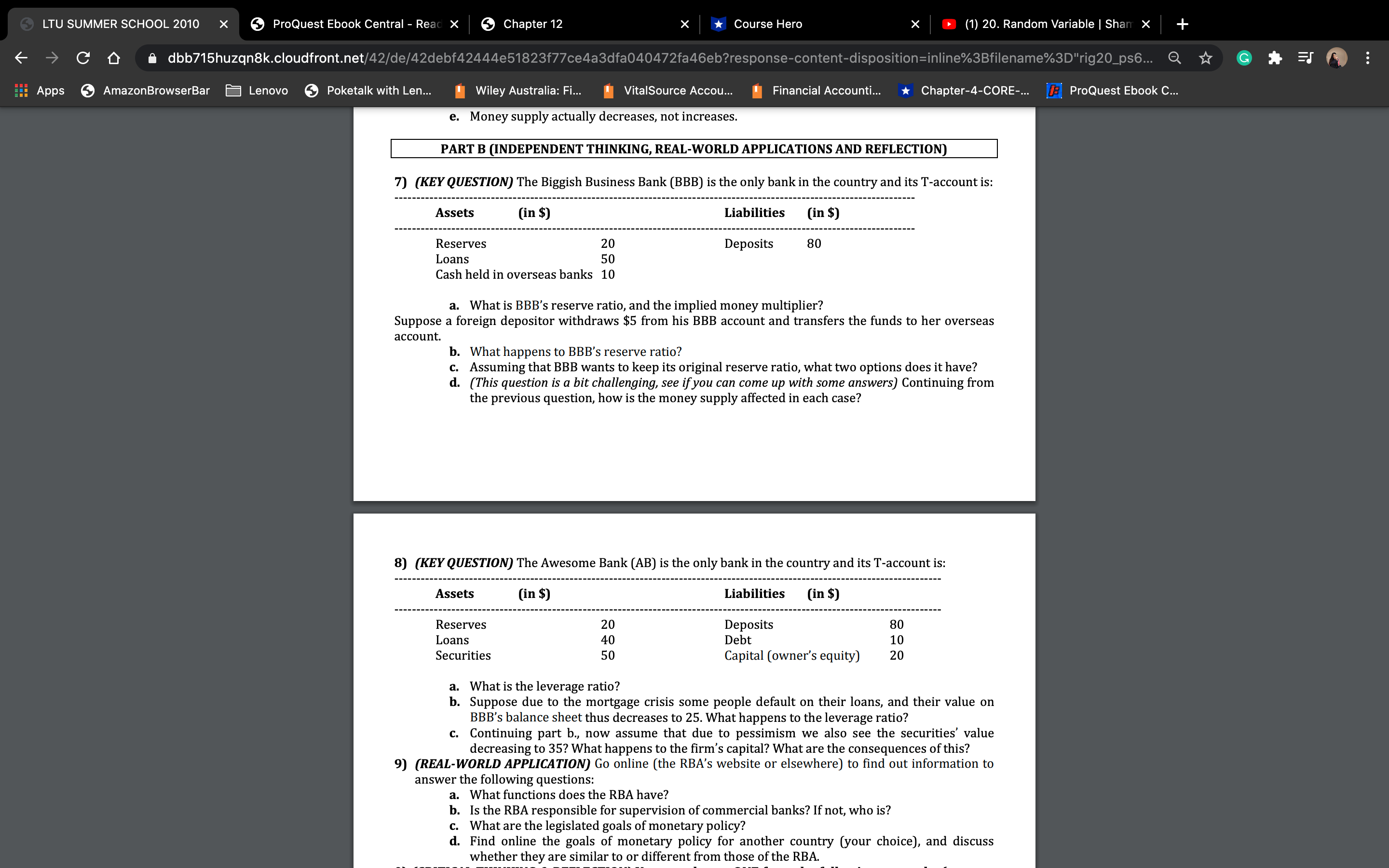

LTU SUMMER SCHOOL 2010 X ProQuest Ebook Central - Read X Chapter 12 X Course Hero X (1) 20. Random Variable | Shan x dbb715huzqn8k.cloudfront.net/42/de/42debf42444e51823f77ce4a3dfa040472fa46eb?response-content-disposition=inline%3Bfilename%3D"rig20_ps6... Q G Apps AmazonBrowserBar _ Lenovo Poketalk with Len... Wiley Australia: Fi... VitalSource Accou Financial Accounti... *Chapter-4-CORE-... [ ProQuest Ebook C. e. Money supply actually decreases, not increases. PART B (INDEPENDENT THINKING, REAL-WORLD APPLICATIONS AND REFLECTION) 7) (KEY QUESTION) The Biggish Business Bank (BBB) is the only bank in the country and its T-account is: Assets [in $ Liabilities (in $) Reserves 20 Deposits 80 Loans 50 Cash held in overseas banks 10 a. What is BBB's reserve ratio, and the implied money multiplier? Suppose a foreign depositor withdraws $5 from his BBB account and transfers the funds to her overseas account b. What happens to BBB's reserve ratio? c. Assuming that BBB wants to keep its original reserve ratio, what two options does it have? . (This question is a bit challenging, see if you can come up with some answers) Continuing from the previous question, how is the money supply affected in each case? 8) (KEY QUESTION) The Awesome Bank (AB) is the only bank in the country and its T-account is: Assets (in $ Liabilities (in $) Reserves 20 Deposits 80 Loans 40 Debt 10 Securities 50 Capital (owner's equity) 20 a. What is the leverage ratio? b. Suppose due to the mortgage crisis some people default on their loans, and their value on BBB's balance sheet thus decreases to 25. What happens to the leverage ratio? c. Continuing part b., now assume that due to pessimism we also see the securities' value decreasing to 35? What happens to the firm's capital? What are the consequences of this? 9) (REAL-WORLD APPLICATION) Go online (the RBA's website or elsewhere) to find out information to answer the following questions: a. What functions does the RBA have? b. Is the RBA responsible for supervision of commercial banks? If not, who is? c. What are the legislated goals of monetary policy? d. Find online the goals of monetary policy for another country (your choice), and discuss whether they are similar to or different from those of the RBA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts