Question: PLEASE HELP!!! 1 2 3 4 5 Assume that Division Blue has achieved a yearly income from operations of $158,000 using $1,004,000 of invested assets.

PLEASE HELP!!!

1

2

3

4

5

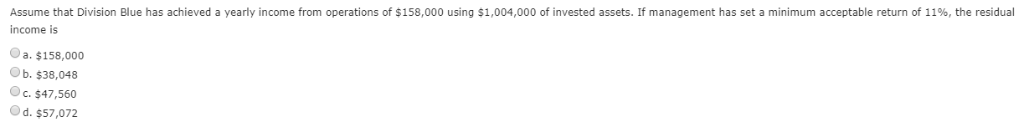

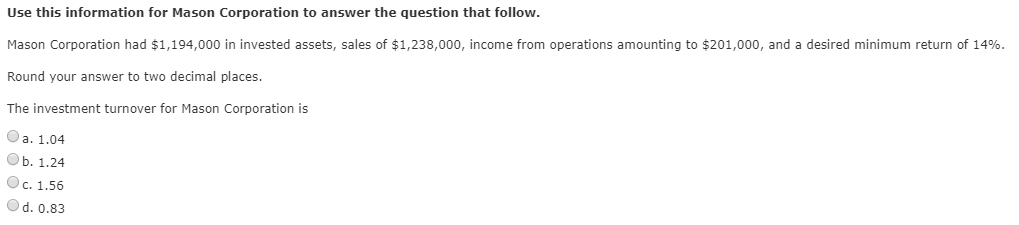

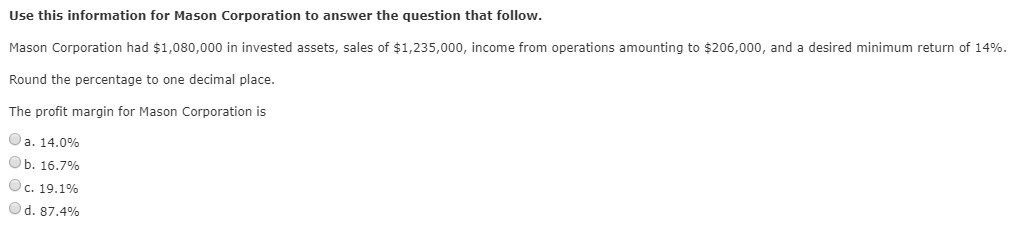

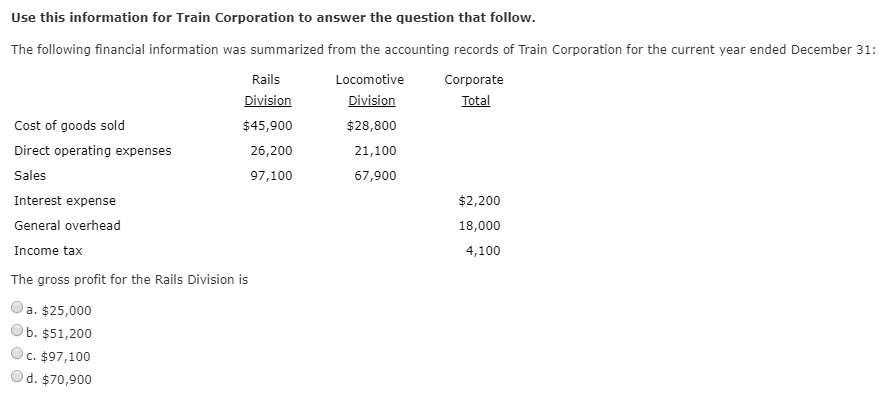

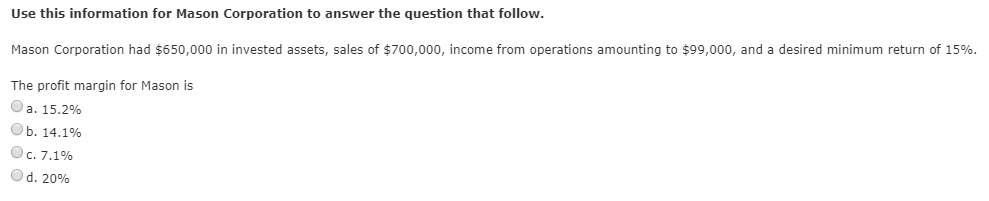

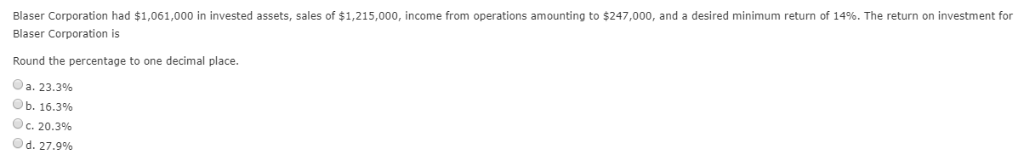

Assume that Division Blue has achieved a yearly income from operations of $158,000 using $1,004,000 of invested assets. If management has set a minimum acceptable return of 11%, the residual income is a. $158,000 b. $38,048 c. $ 47,560 d. $57,072 Use this information for Mason Corporation to answer the question that follow. Mason Corporation had $1,194,000 in invested assets, sales of $1,238,000, income from operations amounting to $201,000, and a desired minimum return of 14%. Round your answer to two decimal places. The investment turnover for Mason Corporation is a. 1.04 Ob. 1.24 c. 1.56 d. 0.83 Use this information for Mason Corporation to answer the question that follow. Mason Corporation had $1,080,000 in invested assets, sales of $1,235,000, income from operations amounting to $206,000, and a desired minimum return of 14%. Round the percentage to one decimal place. The profit margin for Mason Corporation is O a. 14.0% b. 16.7% c. 19.1% Od. 87.4% Use this information for Mason Corporation to answer the question that follow. Mason Corporation had $650,000 in invested assets, sales of $700,000, income from operations amounting to $99,000, and a desired minimum return of 15%. The profit margin for Mason is a. 15.2% Ob. 14.1% c. 7.1% d. 20% Blaser Corporation had $1,061,000 in invested assets, sales of $1,215,000, income from operations amounting to $247,000, and a desired minimum return of 14%. The return on investment for Blaser Corporation is Round the percentage to one decimal place. a. 23.3% b. 16.3% c. 20.3% d. 27.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts