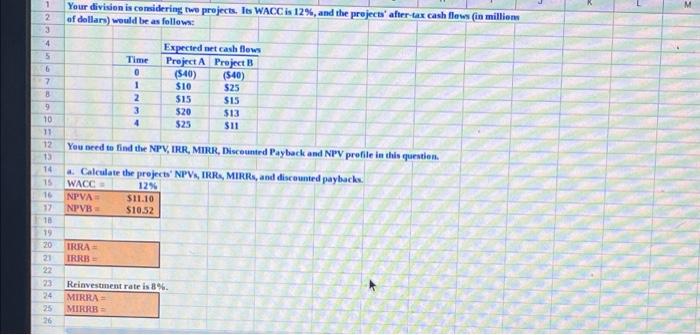

Question: please help 1 2 3 Your division is considering two projects. Is WACC is 12%, and the projects' after tax cash flows (in million of

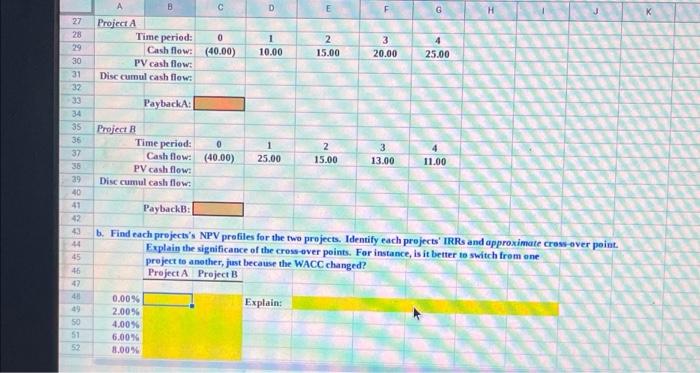

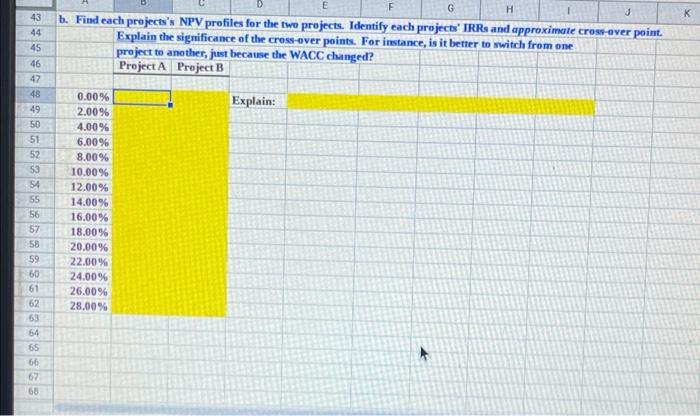

1 2 3 Your division is considering two projects. Is WACC is 12%, and the projects' after tax cash flows (in million of dollars) would be as follows: Time 4 5 6 7 8 9 10 11 12 13 0 1 2 3 4 Expected net cash flows Project A Project B (540) (540) $10 $25 $15 SIS $20 $13 $25 $11 You need to find the NPV, IRR, MIRR, Discounted Payback and NPV profile in this question. a. Calculate the projects' NPV, IRRA, MIRRs, and discounted payback WACC NPVA S11.10 NPVB- $10.52 129 15 16 17 18 19 IRRA IRRI 21 22 23 24 25 26 Reinvestment rate is 3%. MIRRA MIRRB A B D G H Project Time period: 0 Cash flow: (40.00) PV cash flow: Disc cumul cash flow 1 10.00 2 15.00 3 20.00 25.00 27 28 29 30 31 32 33 34 35 36 37 S 85 ASSES Paybacka: Project R Time period: Cashflow: (40.00) PV cash flow: Dis cumul cash flow 1 25.00 2 15.00 3 13.00 11.00 40 41 42 44 PaybackB: b. Find each projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross over point Explain the significance of the cross over points. For instance, is it better to switch from one project to another, just because the WACC changed? Project A Project B 45 46 42 Explain: 49 50 51 52 0.00% 2.00% 4.00% 6.00% 8.00% b. Find each projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross-over point. Explain the significance of the cross-over points. For instance, is it better to switch from one project to another, just because the WACC changed? Project A Project B Explain: 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00% 24.00% 26.00% 28.00% 1 2 3 Your division is considering two projects. Is WACC is 12%, and the projects' after tax cash flows (in million of dollars) would be as follows: Time 4 5 6 7 8 9 10 11 12 13 0 1 2 3 4 Expected net cash flows Project A Project B (540) (540) $10 $25 $15 SIS $20 $13 $25 $11 You need to find the NPV, IRR, MIRR, Discounted Payback and NPV profile in this question. a. Calculate the projects' NPV, IRRA, MIRRs, and discounted payback WACC NPVA S11.10 NPVB- $10.52 129 15 16 17 18 19 IRRA IRRI 21 22 23 24 25 26 Reinvestment rate is 3%. MIRRA MIRRB A B D G H Project Time period: 0 Cash flow: (40.00) PV cash flow: Disc cumul cash flow 1 10.00 2 15.00 3 20.00 25.00 27 28 29 30 31 32 33 34 35 36 37 S 85 ASSES Paybacka: Project R Time period: Cashflow: (40.00) PV cash flow: Dis cumul cash flow 1 25.00 2 15.00 3 13.00 11.00 40 41 42 44 PaybackB: b. Find each projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross over point Explain the significance of the cross over points. For instance, is it better to switch from one project to another, just because the WACC changed? Project A Project B 45 46 42 Explain: 49 50 51 52 0.00% 2.00% 4.00% 6.00% 8.00% b. Find each projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross-over point. Explain the significance of the cross-over points. For instance, is it better to switch from one project to another, just because the WACC changed? Project A Project B Explain: 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00% 24.00% 26.00% 28.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts