Question: Please help ????? 1. Show your work with the data below. (S0 points) Calculate thallqtion value(Vc) ofa all qin with BbdeShks OponPiingMokl Data Vc Current

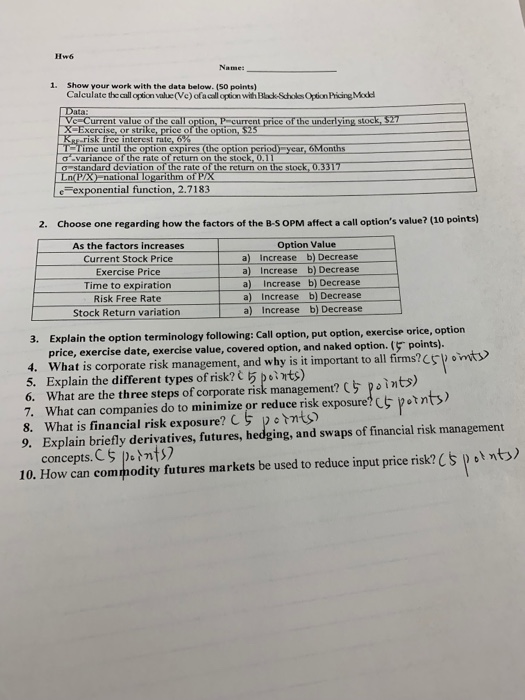

1. Show your work with the data below. (S0 points) Calculate thallqtion value(Vc) ofa all qin with BbdeShks OponPiingMokl Data Vc Current valuc of the call option, P-current price of the underlying stock, $27 X-Exercise,or strike, priceo -run- TTime until the option expires (the option period) year, 6Months a-variance of the rate of return on the stock, 0. o standard deviation of the rate of the return on the stock, 0.3317 Ln PX-national logarithm of P/X eFexponential function, 2.7183 2. Choose one regarding how the factors of the B-S OPM affect a call option's value? (10 points) Option Value As the factors increases Current Stock Price Exercise Price Time to expiration Risk Free Rate Stock Return variation a) Increase b) Decrease a) Increase b) Decrease a) Increase b) Decrease a)Increase b) Decrease a) Increase b) Decrease 3. Explain the option terminology following: Call option, put option, exercise orice, option price, exercise date, exercise value, covered option, and naked option. (5 points). 4. What is corporate risk management, and why is it important to all firms?comty 5. Explain the different types of risk?5 pets) 6 What are the three steps of corporate risk management? ( 5 p oints) 7. What can companies do to minimize or reduce risk exposure? potnty) 8. What is financial risk exposure? C petnts) 9. Explain briefly derivatives, futures, hedging, and swaps of financial risk management concepts.C$ Peints 10. How can commodity 10. How can comodity futures markets be used to reduce input price risk?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts