Question: please help 222 Let's begin with the easier one, Net Capital Spending. New spending on capital assets (property, plant, and equipment, or Fixed Assets) does

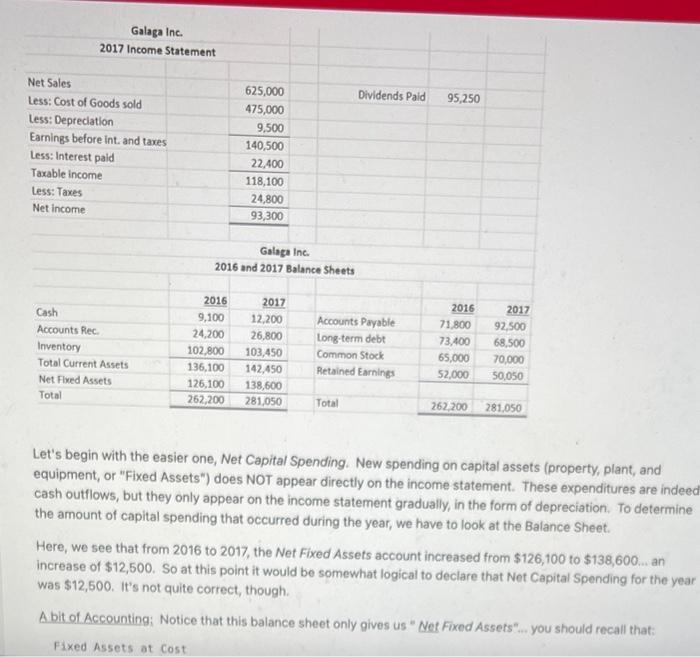

Let's begin with the easier one, Net Capital Spending. New spending on capital assets (property, plant, and equipment, or "Fixed Assets") does NOT appear directly on the income statement. These expenditures are indeec cash outflows, but they only appear on the income statement gradually, in the form of depreciation. To determine the amount of capital spending that occurred during the year, we have to look at the Balance Sheet. Here, we see that from 2016 to 2017 , the Net Fixed Assets account increased from $126,100 to $138,600 an increase of $12,500. So at this point it would be somewhat logical to declare that Net Capital Spending for the year was $12,500. It's not quite correct, though. A bit of Accounting: Notice that this balance sheet only gives us "Nef Fixed Assers"... you should recall that: Fixed Assets at Cost cash outflows, but they only appear on the income statement gradually, in the form of depreciation. To determine the amount of capital spending that occurred during the year, we have to look at the Balance Sheet. Here, we see that from 2016 to 2017 , the Net Fixed Assets account increased from $126,100 to $138,600 an increase of $12,500. So at this point it would be somewhat logical to declare that Net Capital Spending for the year was $12,500. It's not quite correct, though. A bit of Accounting: Notice that this balance sheet only gives us " Net Fixed Assets"... you should recall that: Fixed Assets at Cost - Accumulated Depreciation = Net Fixed Assets So TWO things happened in getting from NFA =126100 to NFA =138600 : Some amount of capital spending occurred, ADDING to the "Fixed Assets at Cost" portion, AND the annual depreciation charge ($9500, from the income statement) was added to "Accumulated Depreciation"...reducing Net Fixed Assets. It's that "some amount of capital spending" that we are interested in. To back it out, we would calculate NCS =( Change in NFA) + (Depreciation Charge for the current year) Try calculating NCS yourself. I've already given the amount of change in Net Fixed Assets (12500). Plug in the value for Depreciation, and give your answer below (no tricks, it really is an easy question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts