Question: Please help (30-32) show work if possible please. 30. Assume that the projected earnings per share over the next year for the S&P500 portfolio is

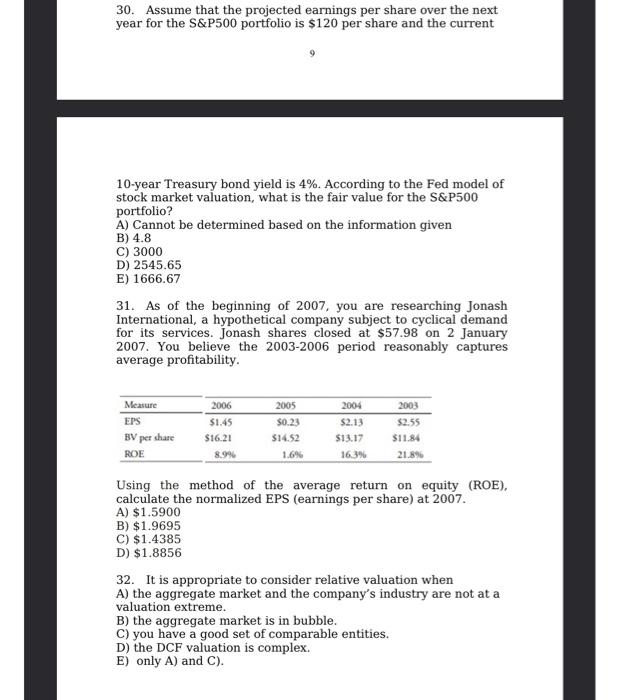

30. Assume that the projected earnings per share over the next year for the S\&P500 portfolio is $120 per share and the current 9 10 -year Treasury bond yield is 4%. According to the Fed model of stock market valuation, what is the fair value for the S\&P500 portfolio? A) Cannot be determined based on the information given B) 4.8 C) 3000 D) 2545.65 E) 1666.67 31. As of the beginning of 2007 , you are researching Jonash International, a hypothetical company subject to cyclical demand for its services. Jonash shares closed at $57.98 on 2 January 2007. You believe the 2003-2006 period reasonably captures average profitability. Using the method of the average return on equity (ROE), calculate the normalized EPS (earnings per share) at 2007. A) $1.5900 B) $1.9695 C) $1.4385 D) $1.8856 32. It is appropriate to consider relative valuation when A) the aggregate market and the company's industry are not at a valuation extreme. B) the aggregate market is in bubble. C) you have a good set of comparable entities. D) the DCF valuation is complex. E) only A) and C)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts