Question: please help 9. A stock is valued at $61.50 a share. A 9-month call option has a strike price of $55 and an option premium

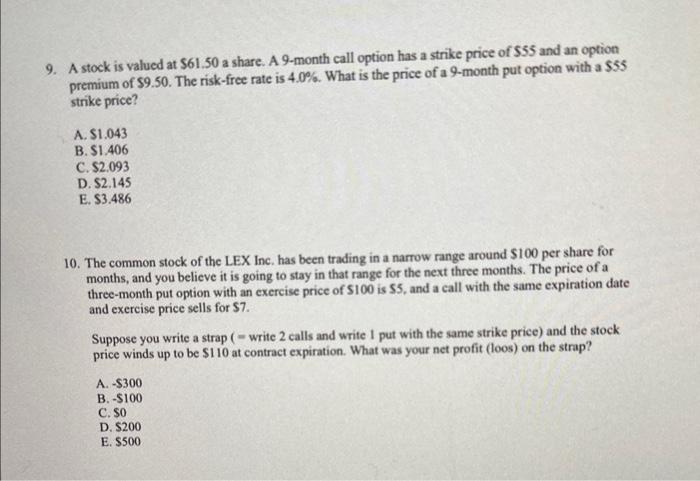

9. A stock is valued at $61.50 a share. A 9-month call option has a strike price of $55 and an option premium of $9.50. The risk-free rate is 4.0%. What is the price of a 9 -month put option with a $55 strike price? A. $1.043 B. $1.406 C. $2.093 D. $2.145 E. $3.486 10. The common stock of the LEX Inc, has been trading in a narrow range around $100 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of 5100 is 55 , and a call with the same expiration date and exercise price sells for $7. Suppose you write a strap ( = write 2 calls and write I put with the same strike price) and the stock price winds up to be $110 at contract expiration. What was your net profit (loos) on the strap? A. $300 B. 5100 C. $0 D. $200 E. $500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts