Question: please help ABC Corp. is trying to decide whether to buy or lease a new egg-scrambling machine. - the new machine costs $120,000 and will

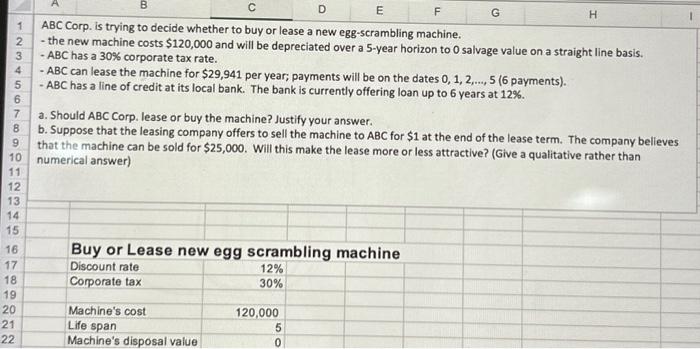

ABC Corp. is trying to decide whether to buy or lease a new egg-scrambling machine. - the new machine costs $120,000 and will be depreciated over a 5-year horizon to 0 salvage value on a straight line basis. - ABC has a 30% corporate tax rate. - ABC can lease the machine for $29,941 per year; payments will be on the dates 0,1,2,,5 (6 payments). - ABC has a line of credit at its local bank. The bank is currently offering loan up to 6 years at 12%. a. Should ABC Corp. lease or buy the machine? Justify your answer. b. Suppose that the leasing company offers to sell the machine to ABC for $1 at the end of the lease term. The company believes that the machine can be sold for $25,000. Will this make the lease more or less attractive? (Give a qualitative rather than numerical answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts