Question: Please Help and answer all questions! Background Information Performance Task 5 requires you to complete the accounting cycle for Sonic Electronix, a merchandising company. The

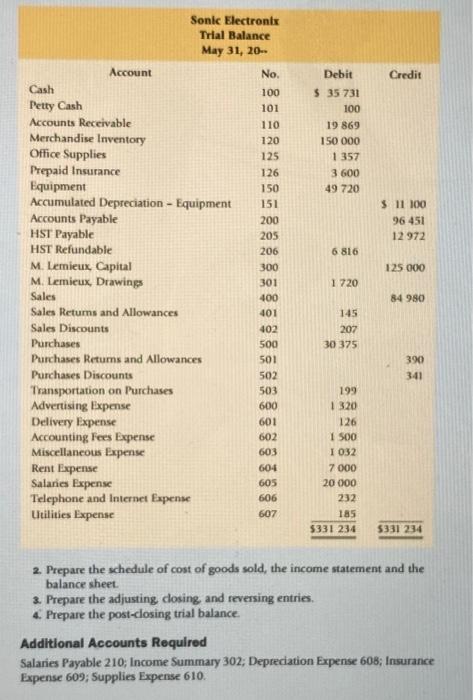

Background Information Performance Task 5 requires you to complete the accounting cycle for Sonic Electronix, a merchandising company. The company sells electronic equipment such as DVD players, MP4 players, digital cameras, eReaders, TVs, and computer hardware. The company uses a periodic inventory system. The Task You have been retained by M. Lemieux, the manager of Sonic Electronix, to com- plete the end-of-month accounting tasks for the month of May. There are four parts to this task: 1. The May 31 trial balance is shown below. Prepare the adjustments and complete the work sheet for May using the following information: Equipment depreciates 20 percent per year. One month of the 12-month insurance policy has expired. The 12-month cost is $3600. . At the end of the month, there is $585 worth of supplies on hand. Salaries of $4000 are owed to employees. I The ending merchandise inventory is $145 000. Account Sonic Electronix Trial Balance May 31, 20- No. Debit 100 $ 35 731 Cash Petty Cash 101 100 Accounts Receivable 110 19 869 Merchandise Inventory 120 150 000 Office Supplies 125 1357 Prepaid Insurance 126 3 600 Equipment 150 49 720 Accumulated Depreciation - Equipment 151 Accounts Payable 200 HST Payable 205 HST Refundable 206 6 816 M. Lemieux, Capital 300 301 1720 M. Lemieux, Drawings Sales 400 Sales Returns and Allowances 401 145 Sales Discounts 402 207 Purchases 500 30 375 Purchases Returns and Allowances 501 Purchases Discounts 502 Transportation on Purchases 503 199 Advertising Expense 600 1320 Delivery Expense 601 126 Accounting Fees Expense 602 1 500 Miscellaneous Expense 603 I 032 Rent Expense 604 7 000 Salaries Expense 605 20 000 Telephone and Internet Expense 606 232 Utilities Expense 607 185 $331 234 $331 234 2. Prepare the schedule of cost of goods sold, the income statement and the balance sheet. 3. Prepare the adjusting, closing, and reversing entries. 4. Prepare the post-closing trial balance. Additional Accounts Required Salaries Payable 210; Income Summary 302; Depreciation Expense 608; Insurance Expense 609; Supplies Expense 610. Credit $ 11 100 96 451 12 972 125.000 84 980 390 341

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts