Question: Please help answer the question below. Also, have attached a draft template for use to answer the question. I need the answers in these templates.

Please help answer the question below. Also, have attached a draft template for use to answer the question. I need the answers in these templates.

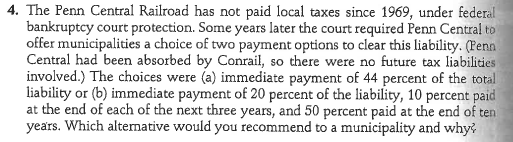

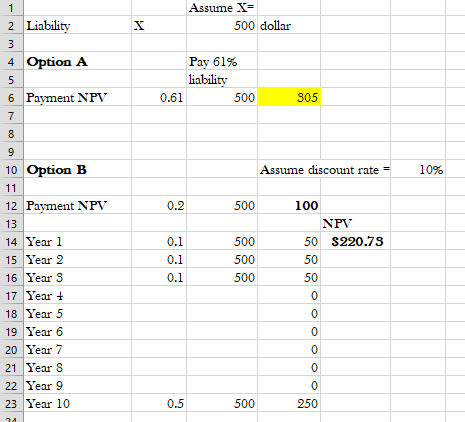

4. The Penn Central Railroad has not paid local taxes since 1969, under federal bankruptcy court protection. Some years later the court required Penn Central to offer municipalities a choice of two payment options to clear this liability. (Penn Central had been absorbed by Conrail, so there were no future tax liabilities involved.) The choices were (a) immediate payment of 44 percent of the total liability or (b) immediate payment of 20 percent of the liability, 10 percent paid at the end of each of the next three years, and 50 percent paid at the end of ten years. Which alternative would you recommend to a municipality and why Assume X- 500 dollar 1 2 Liability 3 3 4 Option A 5 6 Payment NPV 7 Pay 61% liability 0.61 500 S05 8 Assume discount rate = 10% 0.2 500 9 10 Option B 11 12 Payment NPV 13 14 Year 1 15 Year 2 16 Years 17 Year + 18 Year 5 19 Year 6 20 Year 7 21 Year 8 22 Year 9 23 Year 10 0.1 0.1 0.1 500 500 500 100 NPV 50 $220.73 50 50 0 0 0 0 0 0 0.5 500 250 24 E H 500 305 1+r r Assume: discount rate 0.05 1.05 100 47.619 45.351 43.192 153.48 389.6 1+1 A 1 Calculating Present Values 2 3 Assume liability (X) 4 5 Option now 6 Option B 7 Assume: 8 now 9 end of 1st year 10 end of 2nd year 11 end of 3rd year 12 end of 10th year 13 Total 14 15 Assume: 16 now 17 end of 1st year 18 end of 2nd year 19 end of 3rd year 20 end of 10th year 21 Total 22 23 Assume: 24 w 25 end of 1st year 26 end of 2nd year 27 end of 3rd year 28 end of 10th year 29 Total 30 discount rate 0.1 1.1 100 45.455 41.322 37.566 96.386 320.7 r 1+1 discount rate 0.15 1.15 100 43.478 37.807 32.876 61.796 276 4. The Penn Central Railroad has not paid local taxes since 1969, under federal bankruptcy court protection. Some years later the court required Penn Central to offer municipalities a choice of two payment options to clear this liability. (Penn Central had been absorbed by Conrail, so there were no future tax liabilities involved.) The choices were (a) immediate payment of 44 percent of the total liability or (b) immediate payment of 20 percent of the liability, 10 percent paid at the end of each of the next three years, and 50 percent paid at the end of ten years. Which alternative would you recommend to a municipality and why Assume X- 500 dollar 1 2 Liability 3 3 4 Option A 5 6 Payment NPV 7 Pay 61% liability 0.61 500 S05 8 Assume discount rate = 10% 0.2 500 9 10 Option B 11 12 Payment NPV 13 14 Year 1 15 Year 2 16 Years 17 Year + 18 Year 5 19 Year 6 20 Year 7 21 Year 8 22 Year 9 23 Year 10 0.1 0.1 0.1 500 500 500 100 NPV 50 $220.73 50 50 0 0 0 0 0 0 0.5 500 250 24 E H 500 305 1+r r Assume: discount rate 0.05 1.05 100 47.619 45.351 43.192 153.48 389.6 1+1 A 1 Calculating Present Values 2 3 Assume liability (X) 4 5 Option now 6 Option B 7 Assume: 8 now 9 end of 1st year 10 end of 2nd year 11 end of 3rd year 12 end of 10th year 13 Total 14 15 Assume: 16 now 17 end of 1st year 18 end of 2nd year 19 end of 3rd year 20 end of 10th year 21 Total 22 23 Assume: 24 w 25 end of 1st year 26 end of 2nd year 27 end of 3rd year 28 end of 10th year 29 Total 30 discount rate 0.1 1.1 100 45.455 41.322 37.566 96.386 320.7 r 1+1 discount rate 0.15 1.15 100 43.478 37.807 32.876 61.796 276

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts