Question: Please help, need help badly begin{tabular}{|l|l|} hline Jan & JE hline 1 & Took out a loan for $100,000. To be repaid annually $20,000+7%

Please help, need help badly

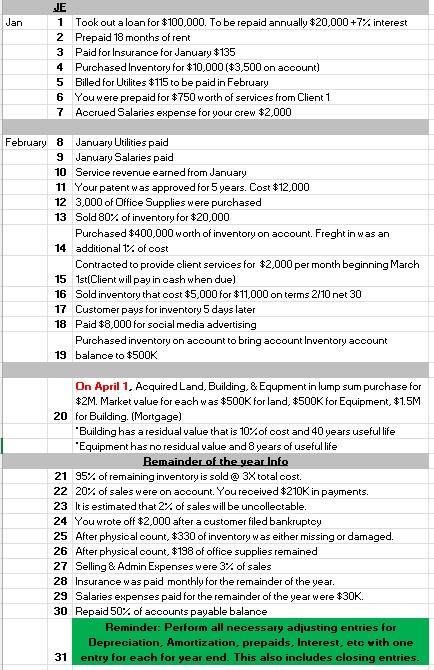

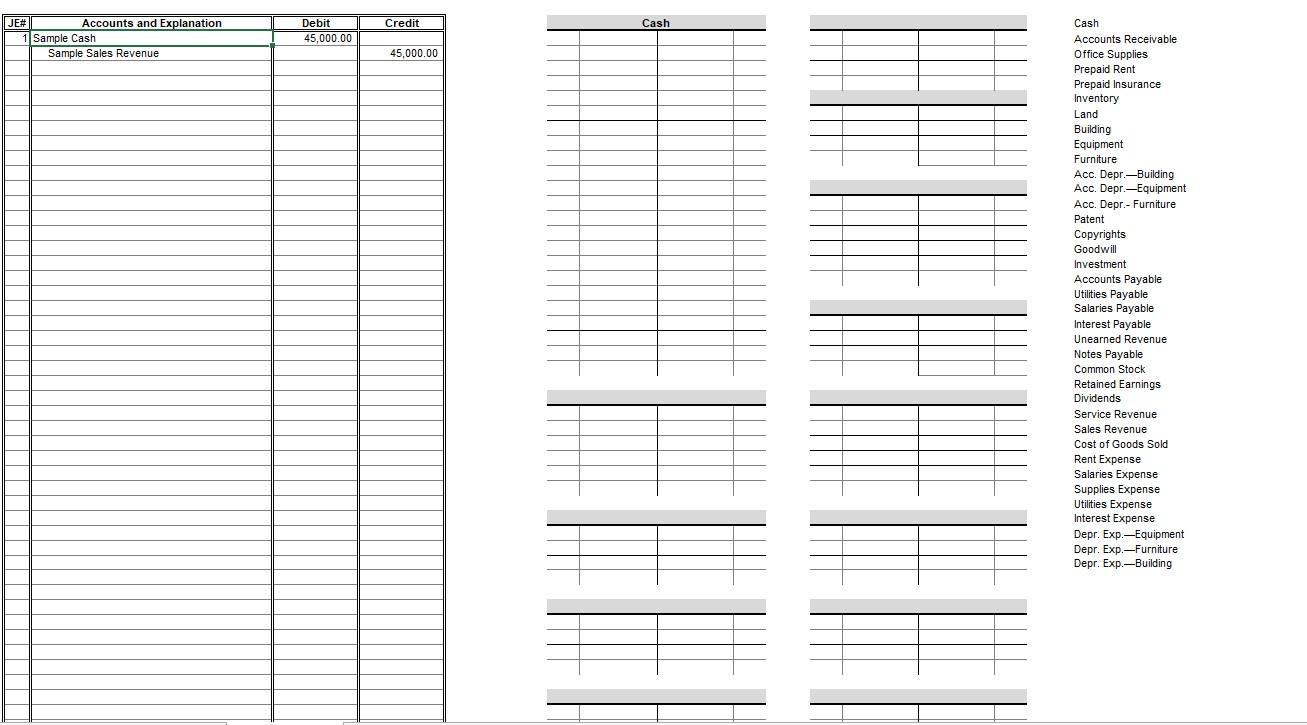

\begin{tabular}{|l|l|} \hline Jan & JE \\ \hline 1 & Took out a loan for $100,000. To be repaid annually $20,000+7% interest \\ 2 & Prepaid 18 months of rent \\ \hline 3 & Paid for Insurance for January $135 \\ \hline 4 & Purchased Inventory for $10,000 ( $3,500 on account) \\ 5 & Billed for Utilites $115 to be paid in February \\ 6 & You were prepaid for $750 worth of services from Client 1 \\ \hline 7 & Accrued Salaries expense for your crew $2,000 \end{tabular} February 8 January Utilities paid 9 January Salaries paid 10 Service revenue earned from January 11 Your patent was approved for 5 years. Cost $12,000 123,000 of Drfice Supplies were purchased 13 Sold 80% of inventory for $20,000 Purchased $400,000 worth of inventory on acoount. Freght in was an 14 additional 1% of cost Contracted to provide client services for $2,000 per month beginning March 15 1st(Client will pay in cash when due) 16 Sold inventory that cost $5,000 for $11,000 on terms 2/10 net 30 17 Customer pays for inventory 5 days later 18 Paid $8,000 for social media advertising Purchased inventory on account to bring acoount inventory account 19 balance to $500K On April 1. Aequired Land, Building, \& Equpment in lump sum purchase for $2M. Market value for each was $500K for land, $500K for Equipment, $1.5M 20 for Building. (Mortgage) "Building has a residual value that is 10% of cost and 40 years useful life "Equipment has no residual value and 8 years of useful life Bemainder of the year info 2195% of remaining inventory is sold @3 total cost. 2220% of sales were on account. You received $210K in payments. 23 It is estimated that 2% of sales will be uncollectable. 24 You wrote off $2,000 after a customer filed bankruptoy 25 After physical count, $330 of inventory was either missing or damaged. 26 After physical count, $198 of office supplies remained 27 Selling \& Admin Expenses were 3\% of sales 28 Insurance was paid monthly for the remainder of the year. 29 Salaries expenses paid for the remainder of the year were $30K. 30 Repaid 50% of acoounts payable balance Reminder: Perform all necessary adjusting entries for Depreciation, Amortization, prepaids, Interest, etc vith one 31 entry for each for year end. This also includes closing entries. Cash Accounts Receivable Office Supplies Prepaid Rent Prepaid Insurance Inventory Land Building Equipment Furniture Acc. Depr.Building Acc. Depr.-Equipment Acc. Depr.- Furniture Patent Copyrights Goodwill Investment Accounts Payable Utilties Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends Service Revenue Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Supplies Expense Utilities Expense Interest Expense Depr. Exp.-Equipment Depr. Exp. Furniture Depr. Exp.-Building \begin{tabular}{|l|l|} \hline Jan & JE \\ \hline 1 & Took out a loan for $100,000. To be repaid annually $20,000+7% interest \\ 2 & Prepaid 18 months of rent \\ \hline 3 & Paid for Insurance for January $135 \\ \hline 4 & Purchased Inventory for $10,000 ( $3,500 on account) \\ 5 & Billed for Utilites $115 to be paid in February \\ 6 & You were prepaid for $750 worth of services from Client 1 \\ \hline 7 & Accrued Salaries expense for your crew $2,000 \end{tabular} February 8 January Utilities paid 9 January Salaries paid 10 Service revenue earned from January 11 Your patent was approved for 5 years. Cost $12,000 123,000 of Drfice Supplies were purchased 13 Sold 80% of inventory for $20,000 Purchased $400,000 worth of inventory on acoount. Freght in was an 14 additional 1% of cost Contracted to provide client services for $2,000 per month beginning March 15 1st(Client will pay in cash when due) 16 Sold inventory that cost $5,000 for $11,000 on terms 2/10 net 30 17 Customer pays for inventory 5 days later 18 Paid $8,000 for social media advertising Purchased inventory on account to bring acoount inventory account 19 balance to $500K On April 1. Aequired Land, Building, \& Equpment in lump sum purchase for $2M. Market value for each was $500K for land, $500K for Equipment, $1.5M 20 for Building. (Mortgage) "Building has a residual value that is 10% of cost and 40 years useful life "Equipment has no residual value and 8 years of useful life Bemainder of the year info 2195% of remaining inventory is sold @3 total cost. 2220% of sales were on account. You received $210K in payments. 23 It is estimated that 2% of sales will be uncollectable. 24 You wrote off $2,000 after a customer filed bankruptoy 25 After physical count, $330 of inventory was either missing or damaged. 26 After physical count, $198 of office supplies remained 27 Selling \& Admin Expenses were 3\% of sales 28 Insurance was paid monthly for the remainder of the year. 29 Salaries expenses paid for the remainder of the year were $30K. 30 Repaid 50% of acoounts payable balance Reminder: Perform all necessary adjusting entries for Depreciation, Amortization, prepaids, Interest, etc vith one 31 entry for each for year end. This also includes closing entries. Cash Accounts Receivable Office Supplies Prepaid Rent Prepaid Insurance Inventory Land Building Equipment Furniture Acc. Depr.Building Acc. Depr.-Equipment Acc. Depr.- Furniture Patent Copyrights Goodwill Investment Accounts Payable Utilties Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends Service Revenue Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Supplies Expense Utilities Expense Interest Expense Depr. Exp.-Equipment Depr. Exp. Furniture Depr. Exp.-Building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts