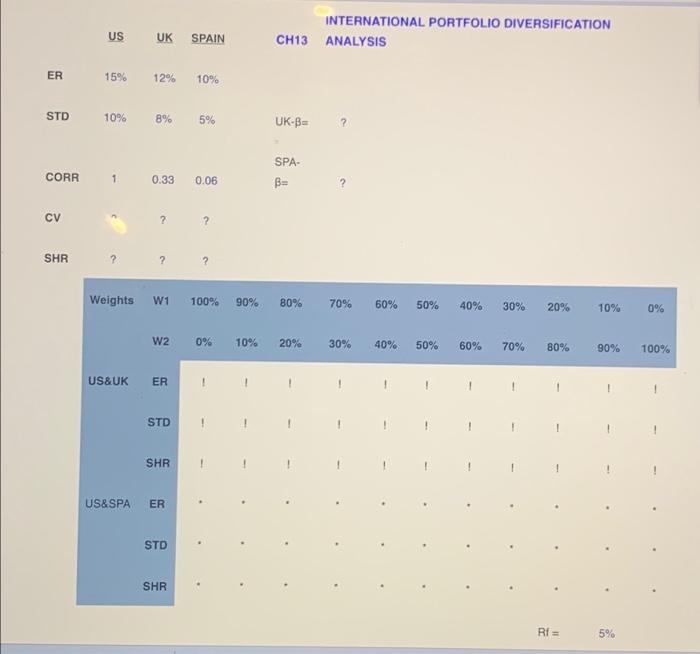

Question: please help by providing the missing numbers!! INTERNATIONAL PORTFOLIO DIVERSIFICATION CH13 ANALYSIS US UK SPAIN ER 15% 12% 10% STD 10% 8% 5% UK-B- ?

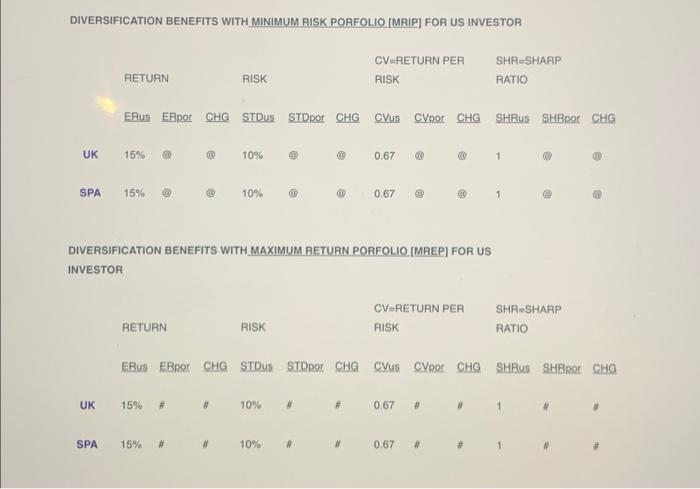

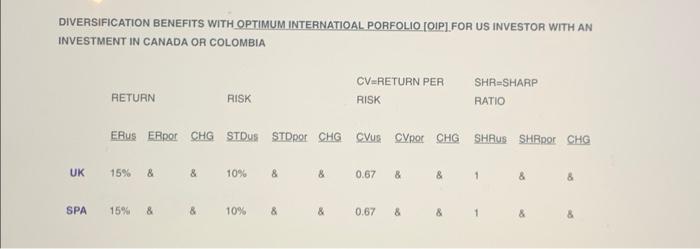

INTERNATIONAL PORTFOLIO DIVERSIFICATION CH13 ANALYSIS US UK SPAIN ER 15% 12% 10% STD 10% 8% 5% UK-B- ? CORR SPA- B- 1 0.33 0.06 ? CV ? ? SHR ? ? 2 Weights W1 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% W2 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% US&UK ER 1 ! 1 1 STD ! 1 ! SHR ! ! US&SPA ER STD SHR R1 = 5% DIVERSIFICATION BENEFITS WITH MINIMUM RISK PORFOLIO (MRIP) FOR US INVESTOR CV=RETURN PER RISK SHA-SHARP RATIO RETURN RISK ERUS ERpor CHG STDS STDpor CHG CVus CVpor CHG SHRus SHBROOCHG UK 15% @ 10% @ 0.67 1 SPA 15% 10% 0.67 1 @ DIVERSIFICATION BENEFITS WITH MAXIMUM RETURN PORFOLIO (MREP) FOR US INVESTOR CV-RETURN PER RISK RETURN SHR-SHARP RATIO RISK ERUS ERRA CHG STDS STOROCHGCVS coor CHG SHRUS SHBRO CHG UK 15% # # 10% 0.67 # 1 SPA 15% 10% 0.67 # DIVERSIFICATION BENEFITS WITH OPTIMUM INTERNATIO AL PORFOLIO COIP] FOR US INVESTOR WITH AN INVESTMENT IN CANADA OR COLOMBIA CV=RETURN PER RISK RETURN SHR-SHARP RATIO RISK ERus EBRO CHG STDus STDpor CHG Cyus Cypr CHG SHRUS SHRpor CHG UK 15% & & 10% & & 0.67 & & 1 & SPA 15% 8 & 10% & & 0.67 8 & 1 & & INTERNATIONAL PORTFOLIO DIVERSIFICATION CH13 ANALYSIS US UK SPAIN ER 15% 12% 10% STD 10% 8% 5% UK-B- ? CORR SPA- B- 1 0.33 0.06 ? CV ? ? SHR ? ? 2 Weights W1 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% W2 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% US&UK ER 1 ! 1 1 STD ! 1 ! SHR ! ! US&SPA ER STD SHR R1 = 5% DIVERSIFICATION BENEFITS WITH MINIMUM RISK PORFOLIO (MRIP) FOR US INVESTOR CV=RETURN PER RISK SHA-SHARP RATIO RETURN RISK ERUS ERpor CHG STDS STDpor CHG CVus CVpor CHG SHRus SHBROOCHG UK 15% @ 10% @ 0.67 1 SPA 15% 10% 0.67 1 @ DIVERSIFICATION BENEFITS WITH MAXIMUM RETURN PORFOLIO (MREP) FOR US INVESTOR CV-RETURN PER RISK RETURN SHR-SHARP RATIO RISK ERUS ERRA CHG STDS STOROCHGCVS coor CHG SHRUS SHBRO CHG UK 15% # # 10% 0.67 # 1 SPA 15% 10% 0.67 # DIVERSIFICATION BENEFITS WITH OPTIMUM INTERNATIO AL PORFOLIO COIP] FOR US INVESTOR WITH AN INVESTMENT IN CANADA OR COLOMBIA CV=RETURN PER RISK RETURN SHR-SHARP RATIO RISK ERus EBRO CHG STDus STDpor CHG Cyus Cypr CHG SHRUS SHRpor CHG UK 15% & & 10% & & 0.67 & & 1 & SPA 15% 8 & 10% & & 0.67 8 & 1 & &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts