Question: Please show work with formulas in excel A portfolio manager is considering the benefits of increasing her diversification by investing overseas. She can purchase shares

Please show work with formulas in excel

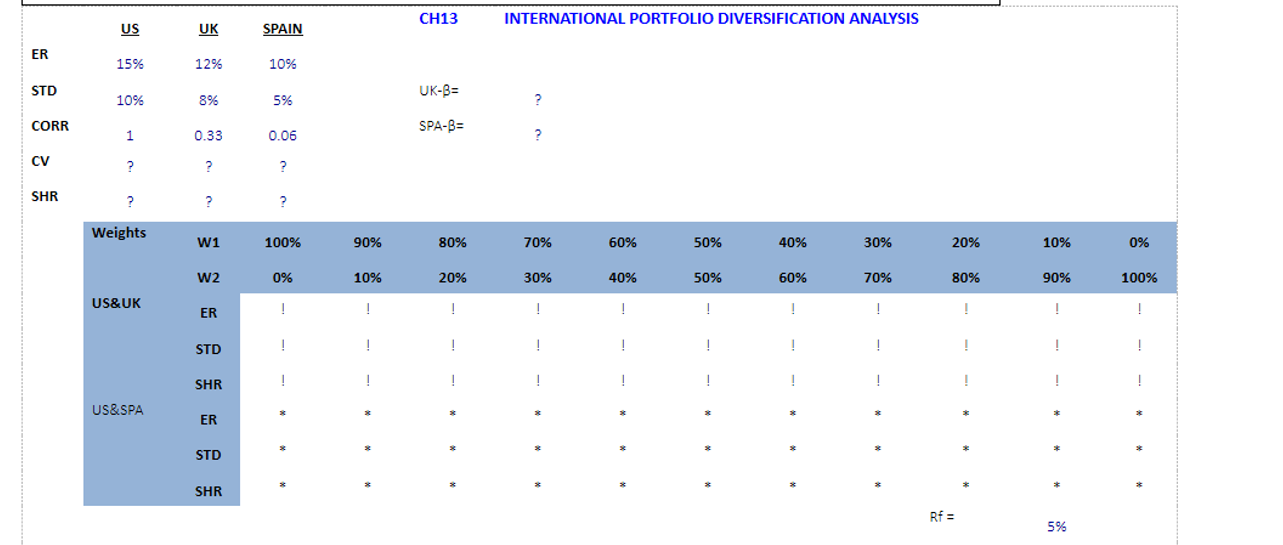

A portfolio manager is considering the benefits of increasing her diversification by investing overseas. She can purchase shares in individual country funds with the expected return (ER), standard deviation (STD) and correlations (CORR) characteristic provided above.

- Initially assume that exchange rate between $ and Pound and $ and Euro is expected to be stable (no change during the year). Assume that risk free rate is 5%.

- What are the expected returns, standard deviations of returns and sharp ratios of US&UK portfolios with different mixes such as 100% invested in US, 0% in UK; 90% invested in US, 10% in UK; 80% invested in US, 20% in UK;; 10% invested in US, 90% in UK; 0% invested in US, 100% in UK? Replace !s with the right info at the above table with the help of Excel formulas.

- What are the expected returns and standard deviations of returns of US & Spain portfolios with different mixes such as 100% invested in US, 0% in Spain; 90% invested in US, 10% in Spain; 80% invested in US, 20% in Spain;; 10% invested in US, 90% in Spain; 0% invested in US, 100% in Spain? Replace *s with the right info at the above table with the help of Excel formulas.

CH13 INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS SPAIN ER US 15% 10% 10% UK 12% 8% 0.33 STD UK-BE 5% 0.06 CORR SPA-B= CV Weights 100% 0% 90% 10% 80% 20% 70% 30% 60% 40% 50% 50% 40% 60% 30% 70% 20% 80% 10% 90% US&UK W2 ER ! SHR US&SPA * STD * SHR CH13 INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS SPAIN ER US 15% 10% 10% UK 12% 8% 0.33 STD UK-BE 5% 0.06 CORR SPA-B= CV Weights 100% 0% 90% 10% 80% 20% 70% 30% 60% 40% 50% 50% 40% 60% 30% 70% 20% 80% 10% 90% US&UK W2 ER ! SHR US&SPA * STD * SHR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts