Question: Please help calculate values with chart. The chart in the photo and in text has the same information. Assignment Table (Also in photo) At S1s

Please help calculate values with chart. The chart in the photo and in text has the same information.

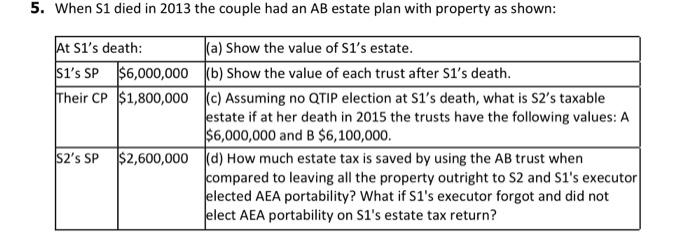

| At S1s death: | (a) Show the value of S1s estate | |

|---|---|---|

| S1s Separate Property | $6,000,000 | (b) Show the value of each trust after S1s death |

| Their Community Property | $1,800,000 | (c) Assuming no QTIP election at S1s death, what is S2s taxable estate if at her death in 2015 the trusts have the following values: A $6,000,000 and B $6,100,000 |

| S2's Separate Property | $2,600,000 | (d) How much estate tax is saved by using the AB trust when compared to leaving all the property outright to S2 and S1's executor elected AEA portability? What if S1's executor forgot and did not elect AEA portability on S1's estate tax return? |

These are the parts to the question:

(a) Show the value of S1s estate.

(b) Show the value of each trust after S1s death.

(c) Assuming no QTIP election at S1s death, what is S2s taxable estate if at her death in 2015 the trusts have the following values: A $6,000,000 and B $6,100,000

(d) How much estate tax is saved by using the AB trust when compared to leaving all the property outright to S2 and S1's executor elected AEA portability? What if S1's executor forgot and did not elect AEA portability on S1's estate tax return?

*SP means separate property

*CP means community property

The first 2 columns show the values in community property and separate property. The last column is the question: part a-d.

5. When S1 died in 2013 the couple had an AB estate plan with property as shown: At Si's death: |(a) Show the value of Si's estate. Si's SP $6,000,000 (b) Show the value of each trust after S1's death. Their CP $1,800,000 (c) Assuming no QTIP election at Si's death, what is S2's taxable estate if at her death in 2015 the trusts have the following values: A $6,000,000 and B $6,100,000. S2's SP $2,600,000 (d) How much estate tax is saved by using the AB trust when compared to leaving all the property outright to S2 and Si's executor elected AEA portability? What if Si's executor forgot and did not Jelect AEA portability on Si's estate tax return? 5. When S1 died in 2013 the couple had an AB estate plan with property as shown: At Si's death: |(a) Show the value of Si's estate. Si's SP $6,000,000 (b) Show the value of each trust after S1's death. Their CP $1,800,000 (c) Assuming no QTIP election at Si's death, what is S2's taxable estate if at her death in 2015 the trusts have the following values: A $6,000,000 and B $6,100,000. S2's SP $2,600,000 (d) How much estate tax is saved by using the AB trust when compared to leaving all the property outright to S2 and Si's executor elected AEA portability? What if Si's executor forgot and did not Jelect AEA portability on Si's estate tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts