Question: Please help! Can someone please give me a clear explanation?? I know what the answers are for this assignment so dont send me the answers,

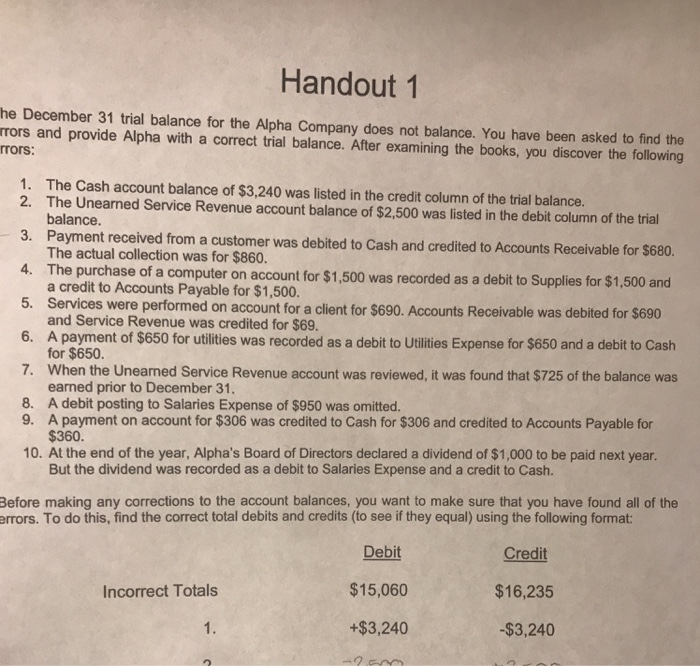

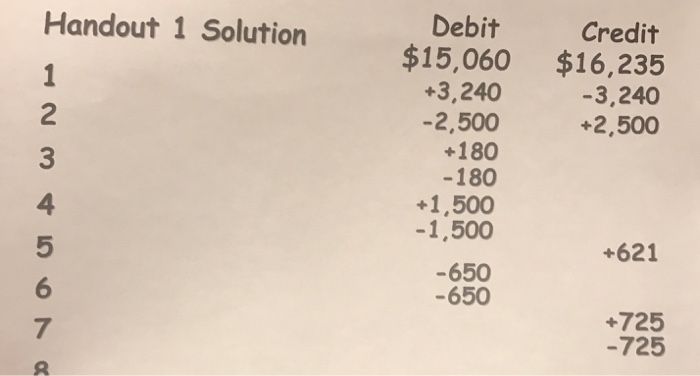

Handout 1 he December 31 trial balance for the Alpha Company does not balance. You have been asked to find the rrors and provide Alpha with a correct trial balance. After examining the books, you discover the following rors: 1. The Cash account balance of $3,240 was listed in the credit column of the trial balance. 2. The Unearned Service Revenue account balance of $2,500 was listed in the debit column of the trial balance. 3. Payment received from a customer was debited to Cash and credited to Accounts Receivable for $680. The actual collection was for $860. 4. The purchase of a computer on account for $1,500 was recorded as a debit to Supplies for $1,500 and 5. 6. 7. 8. a credit to Accounts Payable for $1,500. Services were performed on account for a client for $690. Accounts Receivable was debited for $690 and Service Revenue was credited for $69. A payment of $650 for utilities was recorded as a debit to Utilities Expense for $650 and a debit to Cash for $650. When the Unearned Service Revenue account was reviewed, it was found that $725 of the balance was earned prior to December 31. A debit posting to Salaries Expense of $950 was omitted. A payment on account for $306 was credited to Cash for $306 and credited to Accounts Payable for $360 9. 10. At the end of the year, Alpha's Board of Directors declared a dividend of $1,000 to be paid next year But the dividend was recorded as a debit to Salaries Expense and a credit to Cash. Before making any corrections to the account balances, you want to make sure that you have found all of the errors. To do this, find the correct total debits and credits (to see if they equal) using the following format: Debit $15,060 +$3,240 Credit $16,235 $3,240 Incorrect Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts