Question: please help for this question Suppose a 100% equity financed firm is worth $ 2.2 billion and the firm wants to get to a 8

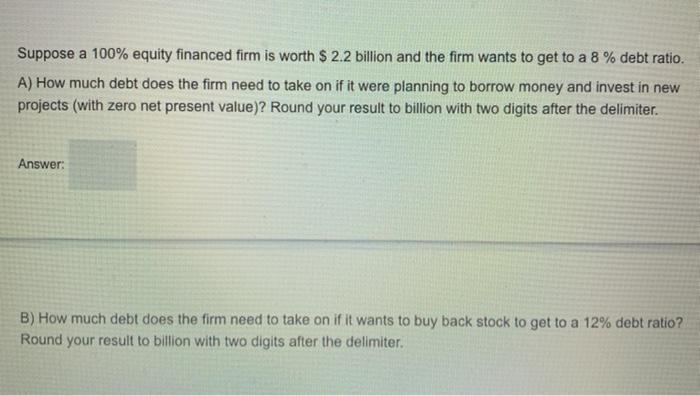

Suppose a 100% equity financed firm is worth $ 2.2 billion and the firm wants to get to a 8 % debt ratio. A) How much debt does the firm need to take on if it were planning to borrow money and invest in new projects (with zero net present value)? Round your result to billion with two digits after the delimiter. Answer: B) How much debt does the firm need to take on if it wants to buy back stock to get to a 12% debt ratio? Round your result to billion with two digits after the delimiter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts