Question: please help how explaining thouroughly how to solve to get the IRR after figuring out the NPV. I understand all the formulas up until trying

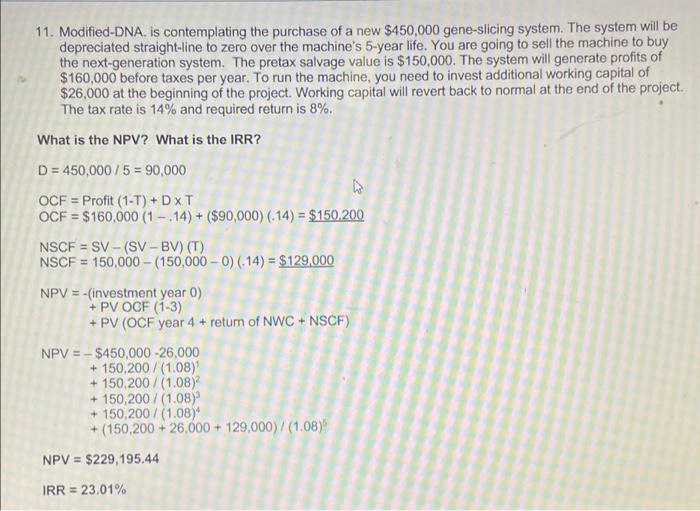

11. Modified-DNA. is contemplating the purchase of a new $450,000 gene-slicing system. The system will be depreciated straight-line to zero over the machine's 5-year life. You are going to sell the machine to buy the next-generation system. The pretax salvage value is $150,000. The system will generate profits of $160,000 before taxes per year. To run the machine, you need to invest additional working capital of $26,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. The tax rate is 14% and required return is 8%. What is the NPV? What is the IRR? D = 450,000/5 = 90,000 OCF = Profit (1-T) + DXT OCF = $160,000 (1 - 14) + ($90,000) (14) = $150.200 NSCF = SV - (SV-BV) (T) NSCF = 150,000 - (150,000 - 0) (-14) = $129.000 NPV = -(investment year 0) + PV OCF (1-3) + PV (OCF year 4 + return of NWC + NSCF) NPV = - $450,000 -26,000 + 150,200/(1.08) + 150,200 / (1.08) + 150,200 / (1.08) + 150,200/(1.08) + (150,200 + 26,000 + 129,000)/(1.08) NPV = $229,195.44 IRR = 23.01%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts