Question: Please help. I am frustrated after spending several hours trying to match the formulas with what is given on the screen. Thank you. Current Attempt

Please help. I am frustrated after spending several hours trying to match the formulas with what is given on the screen. Thank you.

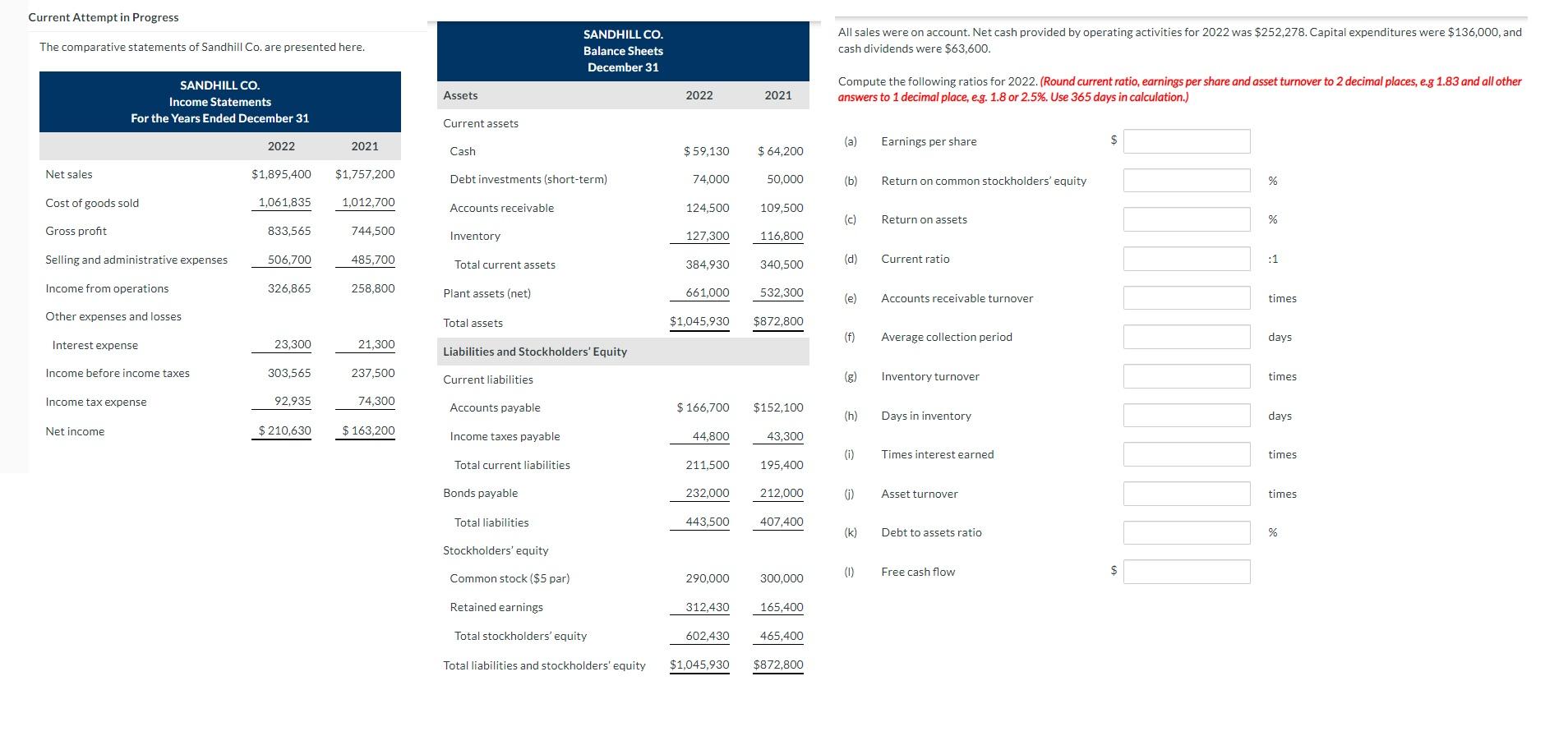

Current Attempt in Progress The comparative statements of Sandhill Co. are presented here. SANDHILL CO. Income Statements For the Years Ended December 31 2021 2022 $1,895,400 Net sales $1,757,200 Cost of goods sold 1,061,835 1,012,700 Gross profit 833,565 744,500 Selling and administrative expenses 506,700 485,700 Income from operations 326,865 258,800 Other expenses and losses Interest expense 23,300 21,300 Income before income taxes 303,565 237,500 Income tax expense 92,935 74,300 Net income $ 210,630 $ 163,200 SANDHILL CO. Balance Sheets December 31 Assets Current assets Cash Debt investments (short-term) Accounts receivable Inventory Total current assets Plant assets (net) Total assets Liabilities and Stockholders' Equity Current liabilit Accounts payable Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 2022 $59,130 74,000 124,500 127,300 384,930 661,000 $1,045,930 $ 166,700 44,800 211.500 232.000 443,500 290,000 312,430 602,430 $1,045,930 2021 $ 64,200 50,000 109,500 116,800 340,500 532,300 $872,800 $152,100 43,300 195.400 212,000 407,400 300,000 165,400 465,400 $872,800 All sales were on account. Net cash provided by operating activities for 2022 was $252,278. Capital expenditures were $136,000, and cash dividends were $63,600. Compute the following ratios for 2022. (Round current ratio, earnings per share and asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%. Use 365 days in calculation.) (a) Earnings per share $ (b) Return on common stockholders' equity % Return on assets % (d) Current ratio :1 (e) Accounts receivable turnover times (f) Average collection period days Inventory turnover times (h) Days in inventory days (i) Times interest earned times (i) Asset turnover times (k) Debt to assets ratio. % (1) Free cash flow $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts