Question: Please help, I cannot figure out this question and I keep getting it wrong. This is for a test grade and I would really appreciate

Please help, I cannot figure out this question and I keep getting it wrong. This is for a test grade and I would really appreciate your help!

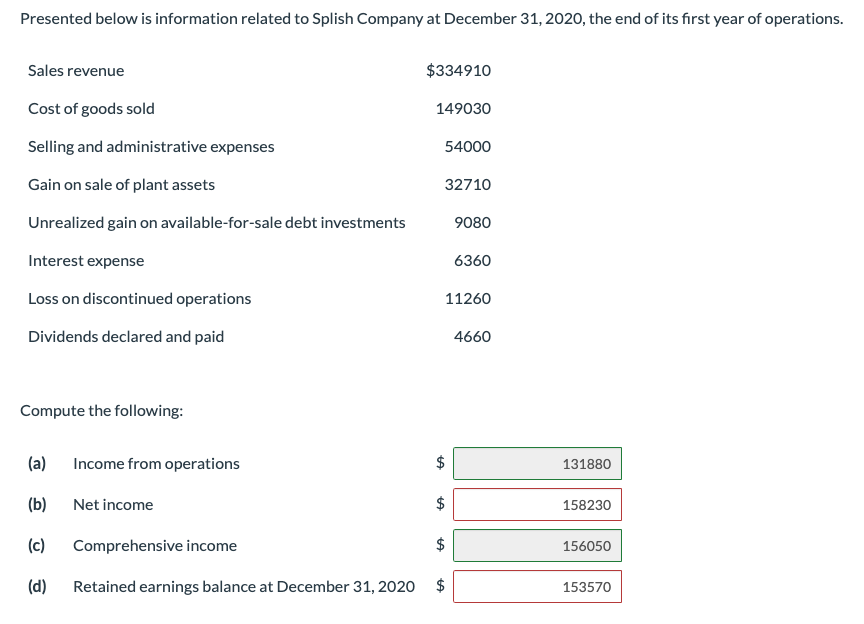

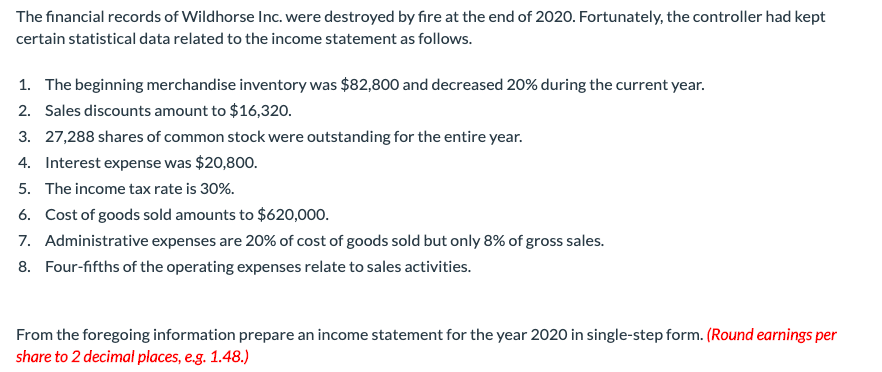

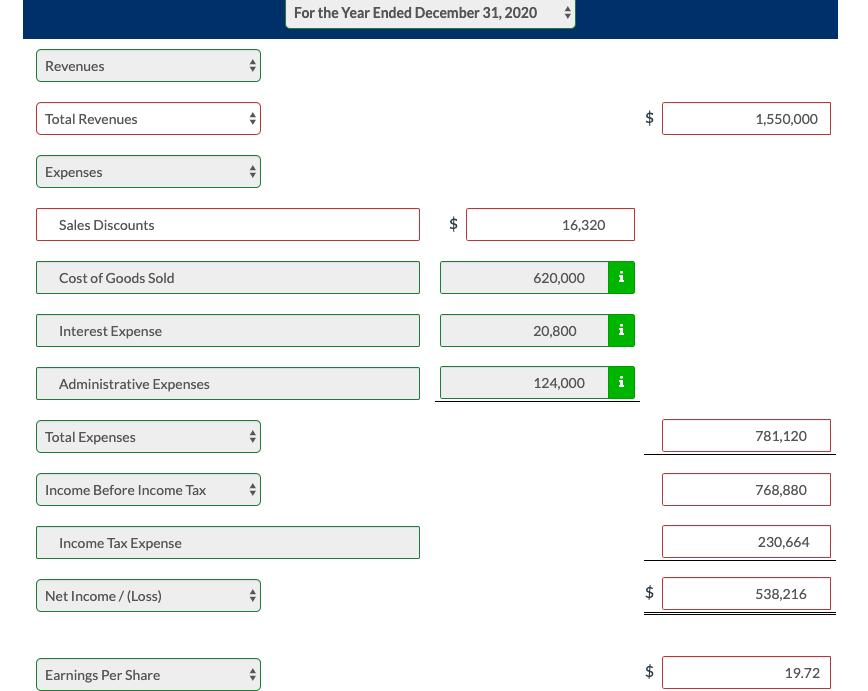

Presented below is information related to Splish Company at December 31, 2020, the end of its first year of operations. Sales revenue $334910 Cost of goods sold 149030 Selling and administrative expenses 54000 Gain on sale of plant assets 32710 Unrealized gain on available-for-sale debt investments 9080 Interest expense 6360 Loss on discontinued operations 11260 Dividends declared and paid 4660 Compute the following: (a) Income from operations 131880 (b) Net income 158230 A AA A (c) Comprehensive income 156050 (d) Retained earnings balance at December 31, 2020 $ 153570 The financial records of Wildhorse Inc. were destroyed by fire at the end of 2020. Fortunately, the controller had kept certain statistical data related to the income statement as follows. 1. The beginning merchandise inventory was $82,800 and decreased 20% during the current year. 2. Sales discounts amount to $16,320. 3. 27,288 shares of common stock were outstanding for the entire year. 4. Interest expense was $20,800. 5. The income tax rate is 30%. 6. Cost of goods sold amounts to $620,000. 7. Administrative expenses are 20% of cost of goods sold but only 8% of gross sales. 8. Four-fifths of the operating expenses relate to sales activities. From the foregoing information prepare an income statement for the year 2020 in single-step form. (Round earnings per share to 2 decimal places, eg. 1.48.) For the Year Ended December 31, 2020 Revenues Total Revenues 1,550,000 Expenses Sales Discounts 16,320 Cost of Goods Sold 620,000 i Interest Expense 20,800 i Administrative Expenses 124,000 Administrative Expenses Total Expenses Total Expenses 781,120 Income Before Income Tax 768,880 Income Tax Expense 230,664 Net Income /(Loss) 538,216 Earnings Per Share 19.72 Presented below is information related to Splish Company at December 31, 2020, the end of its first year of operations. Sales revenue $334910 Cost of goods sold 149030 Selling and administrative expenses 54000 Gain on sale of plant assets 32710 Unrealized gain on available-for-sale debt investments 9080 Interest expense 6360 Loss on discontinued operations 11260 Dividends declared and paid 4660 Compute the following: (a) Income from operations 131880 (b) Net income 158230 A AA A (c) Comprehensive income 156050 (d) Retained earnings balance at December 31, 2020 $ 153570 The financial records of Wildhorse Inc. were destroyed by fire at the end of 2020. Fortunately, the controller had kept certain statistical data related to the income statement as follows. 1. The beginning merchandise inventory was $82,800 and decreased 20% during the current year. 2. Sales discounts amount to $16,320. 3. 27,288 shares of common stock were outstanding for the entire year. 4. Interest expense was $20,800. 5. The income tax rate is 30%. 6. Cost of goods sold amounts to $620,000. 7. Administrative expenses are 20% of cost of goods sold but only 8% of gross sales. 8. Four-fifths of the operating expenses relate to sales activities. From the foregoing information prepare an income statement for the year 2020 in single-step form. (Round earnings per share to 2 decimal places, eg. 1.48.) For the Year Ended December 31, 2020 Revenues Total Revenues 1,550,000 Expenses Sales Discounts 16,320 Cost of Goods Sold 620,000 i Interest Expense 20,800 i Administrative Expenses 124,000 Administrative Expenses Total Expenses Total Expenses 781,120 Income Before Income Tax 768,880 Income Tax Expense 230,664 Net Income /(Loss) 538,216 Earnings Per Share 19.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts