Question: please help, i literally dont even know where to start! i will leave likes regardless!!! please help You are an investor that contemplates investing in

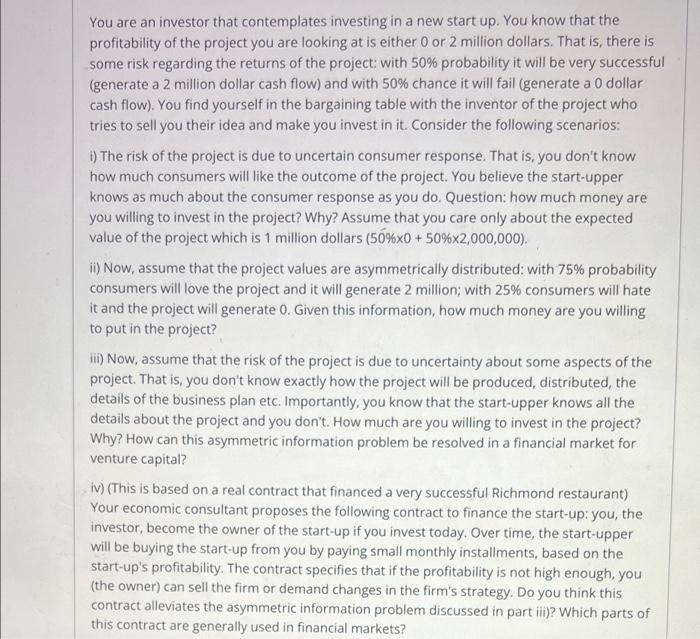

You are an investor that contemplates investing in a new start up. You know that the profitability of the project you are looking at is either 0 or 2 million dollars. That is, there is some risk regarding the returns of the project: with 50% probability it will be very successful (generate a 2 million dollar cash flow) and with 50% chance it will fail (generate a 0 dollar cash flow). You find yourself in the bargaining table with the inventor of the project who tries to sell you their idea and make you invest in it. Consider the following scenarios: 1) The risk of the project is due to uncertain consumer response. That is, you don't know how much consumers will like the outcome of the project. You believe the start-upper knows as much about the consumer response as you do. Question: how much money are you willing to invest in the project? Why? Assume that you care only about the expected value of the project which is 1 million dollars (50%x0 + 50%x2,000,000). ii) Now, assume that the project values are asymmetrically distributed: with 75% probability consumers will love the project and it will generate 2 million; with 25% consumers will hate it and the project will generate 0. Given this information, how much money are you willing to put in the project? ii) Now, assume that the risk of the project is due to uncertainty about some aspects of the project. That is, you don't know exactly how the project will be produced, distributed, the details of the business plan etc. Importantly, you know that the start-upper knows all the details about the project and you don't. How much are you willing to invest in the project? Why? How can this asymmetric information problem be resolved in a financial market for venture capital? iv) (This is based on a real contract that financed a very successful Richmond restaurant) Your economic consultant proposes the following contract to finance the start-up: you, the investor, become the owner of the start-up if you invest today, Over time, the start-upper will be buying the start-up from you by paying small monthly installments, based on the start-up's profitability. The contract specifies that if the profitability is not high enough, you (the owner) can sell the firm or demand changes in the firm's strategy. Do you think this contract alleviates the asymmetric information problem discussed in part iii)? Which parts of this contract are generally used in financial markets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts