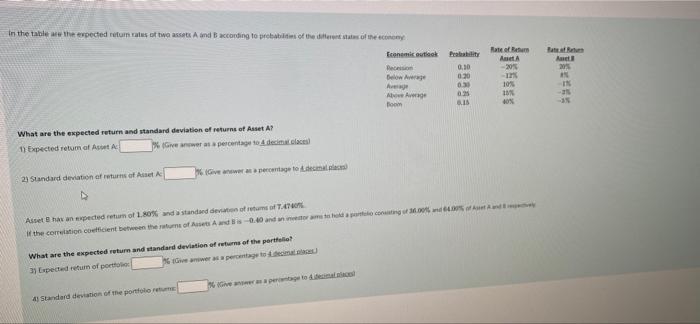

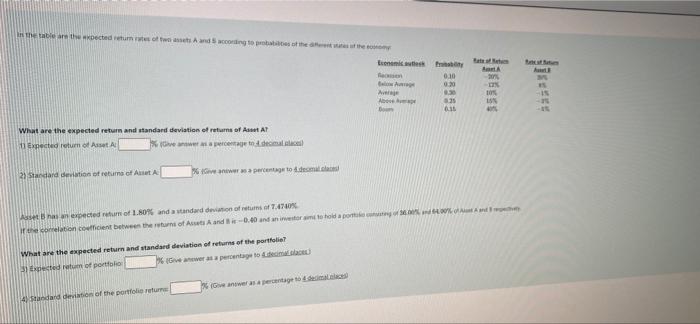

Question: please help!!!! In the table with expected return values of two sets And Baccording to probabilities of the rest of the con Economic outlook Dec

In the table with expected return values of two sets And Baccording to probabilities of the rest of the con Economic outlook Dec Below we Ave Ae Average Boom Rate of them AA -20% Karel 0.10 0.30 0.30 0.25 16 10% IN 3 00% What are the expected return and standard deviation of returns of Asset A? 1) Expected retum of A A General percentage to decimales Gewer percentage to 2) Standard deviation of return of it Asset an expected return of 1.80% and standard deviation of items of 470 w the correlation coeficient between the sum of Art Audi -0.40 andra What are the expected return and standard deviation of return of the portfolio 3) Expected return of porto was percentage to 4 Standard deviation of the portfolorum metable are the rected retumsoftwand go the Erity 00 0:20 RA 2014 10% Above 335 What are the expected return and standard deviation of returns of AA 11 Expected return of Asset a percentagende 21 Standard de ton ot return of AA www percentage to de A has an expected return of 1.8096 and standard deviation of return of 7.4700% the correlation coefficient between them of Arts and -0.40 and an investor mi to hold on What are the expected return and standard deviation of return of the portfolio Expected return of portfolio ver a pecentage to as a percentage to 4 de 4) Standard de tion of the portfolio return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts