Question: Please help me answer a & d. Thank you in advance. With a typical installment loan, you are asked to sign a contract stating the

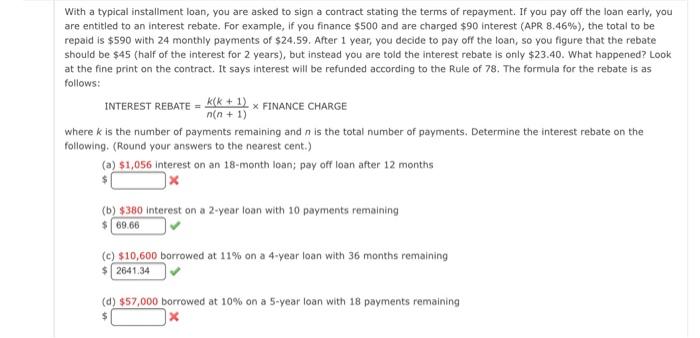

With a typical installment loan, you are asked to sign a contract stating the terms of repayment. If you pay off the loan early, you are entitled to an interest rebate. For example, if you finance $500 and are charged $90 interest (APR 8.46%), the total to be repaid is $590 with 24 monthly payments of $24.59. After 1 year, you decide to pay off the loan, so you figure that the rebate should be $45 (half of the interest for 2 years), but instead you are told the interest rebate is only $23.40. What happened? Look at the fine print on the contract. It says interest will be refunded according to the Rule of 78. The formula for the rebate is as follows: INTEREST REBATE = k k + 1) x FINANCE CHARGE n(n + 1) where k is the number of payments remaining and n is the total number of payments. Determine the interest rebate on the following. (Round your answers to the nearest cent.) (a) $1,056 Interest on an 18-month loan; pay off loan after 12 months (b) $380 interest on a 2-year loan with 10 payments remaining $69.66 (C) $10,600 borrowed at 11% on a 4-year loan with 36 months remaining 2641.34 (d) $57,000 borrowed at 10% on a 5-year loan with 18 payments remaining X $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts