Question: Please help me answer the following, I really need help right now, Shortcut answers is okay as long as the process are still clear, and

Please help me answer the following, I really need help right now, Shortcut answers is okay as long as the process are still clear, and accurate answers please...thank you!

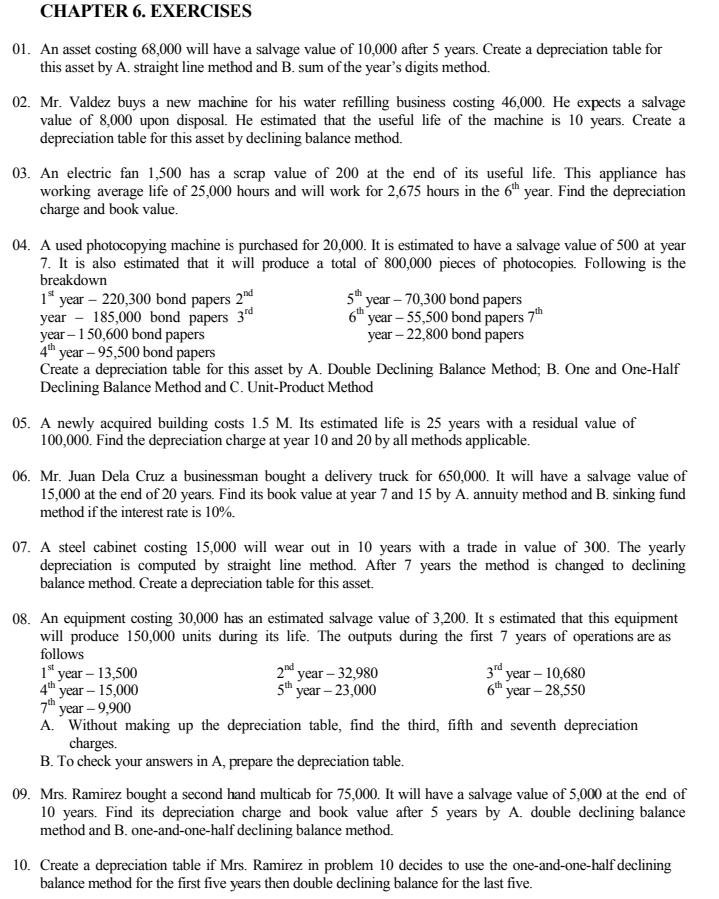

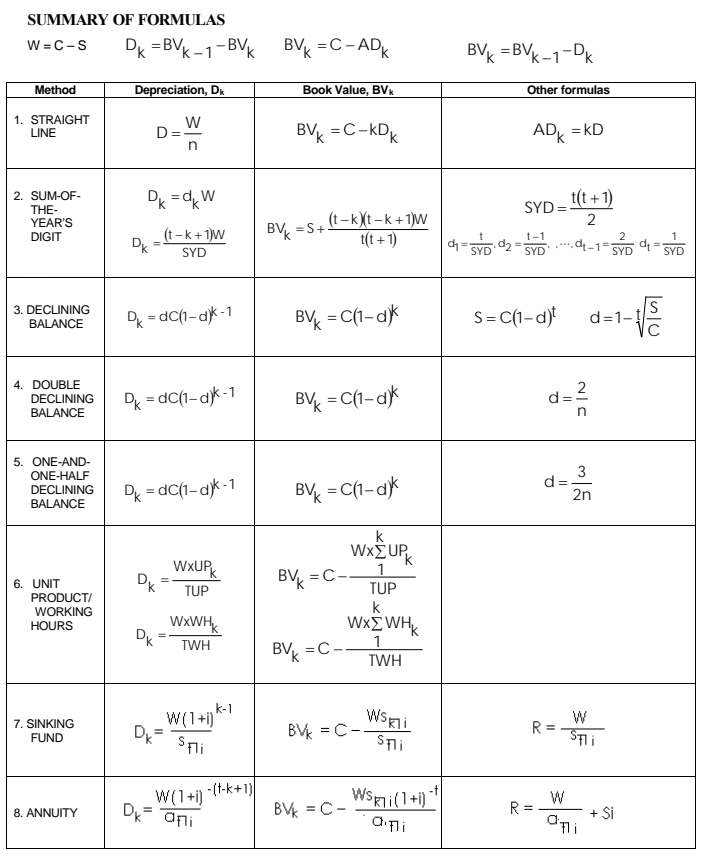

CHAPTER 6. EXERCISES 01. An asset costing 68,000 will have a salvage value of 10,000 after 5 years. Create a depreciation table for this asset by A. straight line method and B. sum of the year's digits method. 02. Mr. Valdez buys a new machine for his water refilling business costing 46,000. He expects a salvage value of 8,000 upon disposal. He estimated that the useful life of the machine is 10 years. Create a depreciation table for this asset by declining balance method. 03. An electric fan 1,500 has a scrap value of 200 at the end of its useful life. This appliance has working average life of 25,000 hours and will work for 2,675 hours in the 6" year. Find the depreciation charge and book value. 04. A used photocopying machine is purchased for 20,000. It is estimated to have a salvage value of 500 at year 7. It is also estimated that it will produce a total of 800,000 pieces of photocopies. Following is the breakdown 1 year - 220,300 bond papers 2"d 5" year - 70,300 bond papers year - 185,000 bond papers 3id 6" year - 55,500 bond papers 7th year - 1 50,600 bond papers year - 22,800 bond papers 4" year - 95,500 bond papers Create a depreciation table for this asset by A. Double Declining Balance Method; B. One and One-Half Declining Balance Method and C. Unit-Product Method 05. A newly acquired building costs 1.5 M. Its estimated life is 25 years with a residual value of 100,000. Find the depreciation charge at year 10 and 20 by all methods applicable. 06. Mr. Juan Dela Cruz a businessman bought a delivery truck for 650,000. It will have a salvage value of 15,000 at the end of 20 years. Find its book value at year 7 and 15 by A. annuity method and B. sinking fund method if the interest rate is 10%. 07. A steel cabinet costing 15,000 will wear out in 10 years with a trade in value of 300. The yearly depreciation is computed by straight line method. After 7 years the method is changed to declining balance method. Create a depreciation table for this asset. 08. An equipment costing 30,000 has an estimated salvage value of 3,200. It s estimated that this equipment will produce 150,000 units during its life. The outputs during the first 7 years of operations are as follows 1 year - 13,500 3rd year - 15,000 5 th year - 32,980 year - 10,680 year - 23,000 6 th year - 28,550 year - 9,900 Without making up the depreciation table, find the third, fifth and seventh depreciation charges. B. To check your answers in A, prepare the depreciation table. 09. Mrs. Ramirez bought a second hand multicab for 75,000. It will have a salvage value of 5,000 at the end of 10 years. Find its depreciation charge and book value after 5 years by A. double declining balance method and B. one-and-one-half declining balance method. 10. Create a depreciation table if Mrs. Ramirez in problem 10 decides to use the one-and-one-half declining balance method for the first five years then double declining balance for the last five.\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts