Question: Please help me answer the following, Only the odd numbered problems 1,3,5,7,9. I really need help right now, Shortcut answers is okay as long as

Please help me answer the following, Only the odd numbered problems 1,3,5,7,9. I really need help right now, Shortcut answers is okay as long as the process are still clear, and accurate answers please...thank you!

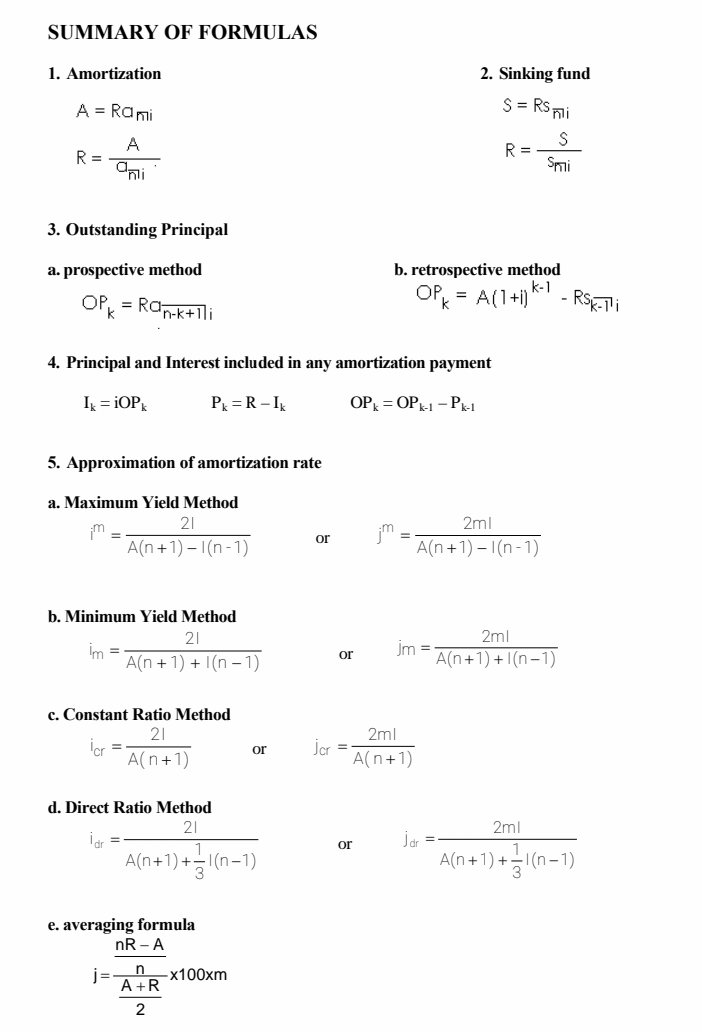

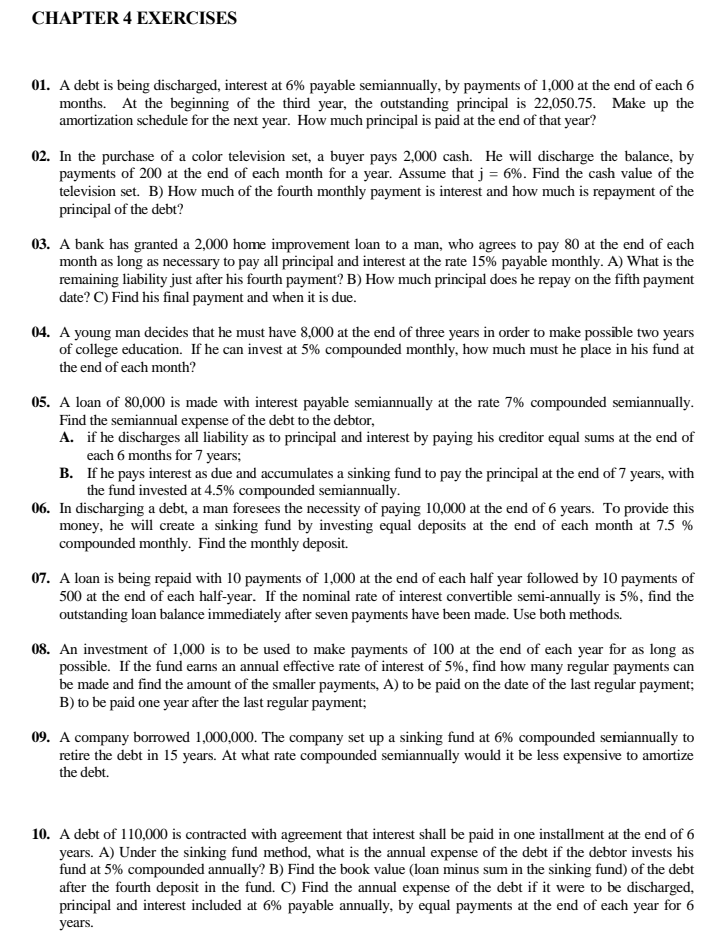

SUMMARY OF FORMULAS 1. Amortization 2. Sinking fund A = Ra mi S = RS mi A S R = R = Smi 3. Outstanding Principal a. prospective method b. retrospective method OPK = Ron-k+lli OPK = A(1+1) K - RSK-Thi 4. Principal and Interest included in any amortization payment IK = 1OP k PK = R- Ik OPK = OPK-1 - Pk-1 5. Approximation of amortization rate a. Maximum Yield Method i'm 21 2ml A(n + 1) - I(n-1) or i'm = A(n + 1) - 1(n-1) b. Minimum Yield Method 21 2ml I'm = A(n + 1) + 1(n-1) or Jm = - A(n+1) + 1(n-1) c. Constant Ratio Method 2 2ml Icr A( n + 1 ) or Jer A( n+ 1 ) d. Direct Ratio Method 21 2ml lar or Jor = - A(n+1) +=1(n-1) A(n + 1) + -1(n-1) e. averaging formula nR - A j= n A +R -x100xm 2CHAPTER 4 EXERCISES 01. A debt is being discharged, interest at 6% payable semiannually, by payments of 1,000 at the end of each 6 months. At the beginning of the third year, the outstanding principal is 22,050.75. Make up the amortization schedule for the next year. How much principal is paid at the end of that year? 02. In the purchase of a color television set, a buyer pays 2,000 cash. He will discharge the balance, by payments of 200 at the end of each month for a year. Assume that j = 6%. Find the cash value of the television set. B) How much of the fourth monthly payment is interest and how much is repayment of the principal of the debt? 03. A bank has granted a 2,000 home improvement loan to a man, who agrees to pay 80 at the end of each month as long as necessary to pay all principal and interest at the rate 15% payable monthly. A) What is the remaining liability just after his fourth payment? B) How much principal does he repay on the fifth payment date? C) Find his final payment and when it is due. 04. A young man decides that he must have 8,000 at the end of three years in order to make possible two years of college education. If he can invest at 5% compounded monthly, how much must he place in his fund at the end of each month? 05. A loan of 80,000 is made with interest payable semiannually at the rate 7% compounded semiannually. Find the semiannual expense of the debt to the debtor, A. if he discharges all liability as to principal and interest by paying his creditor equal sums at the end of each 6 months for 7 years; B. If he pays interest as due and accumulates a sinking fund to pay the principal at the end of 7 years, with the fund invested at 4.5% compounded semiannually. 06. In discharging a debt, a man foresees the necessity of paying 10,000 at the end of 6 years. To provide this money, he will create a sinking fund by investing equal deposits at the end of each month at 7.5 % compounded monthly. Find the monthly deposit. 07. A loan is being repaid with 10 payments of 1,000 at the end of each half year followed by 10 payments of 500 at the end of each half-year. If the nominal rate of interest convertible semi-annually is 5%, find the outstanding loan balance immediately after seven payments have been made. Use both methods. 08. An investment of 1,000 is to be used to make payments of 100 at the end of each year for as long as possible. If the fund earns an annual effective rate of interest of 5%, find how many regular payments can be made and find the amount of the smaller payments, A) to be paid on the date of the last regular payment; B) to be paid one year after the last regular payment; 09. A company borrowed 1,000,000. The company set up a sinking fund at 6% compounded semiannually to retire the debt in 15 years. At what rate compounded semiannually would it be less expensive to amortize the debt. 10. A debt of 110,000 is contracted with agreement that interest shall be paid in one installment at the end of 6 years. A) Under the sinking fund method, what is the annual expense of the debt if the debtor invests his fund at 5% compounded annually? B) Find the book value (loan minus sum in the sinking fund) of the debt after the fourth deposit in the fund. C) Find the annual expense of the debt if it were to be discharged, principal and interest included at 6% payable annually, by equal payments at the end of each year for 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts