Question: please help me answer this as soon as possible. Intermediate Finance FIN 450 -0500 Ning Marivon Ning 03/20/22 10:43 PM Homework: Homework 1 Question 9,

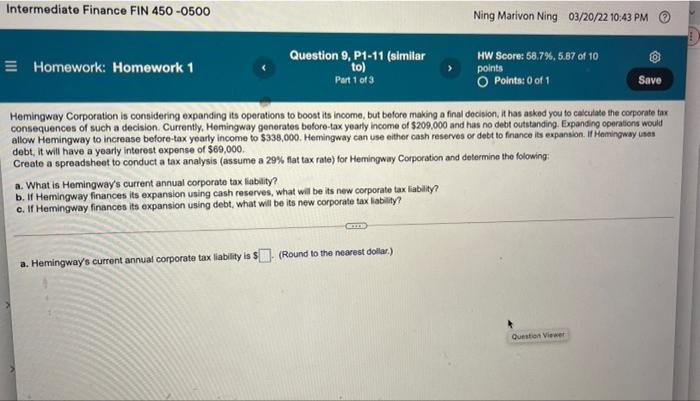

Intermediate Finance FIN 450 -0500 Ning Marivon Ning 03/20/22 10:43 PM Homework: Homework 1 Question 9, P1-11 (similar to) Part 1 of 3 HW Score: 58.7%, 5.87 of 10 points Points: 0 of 1 Save Hemingway Corporation is considering expanding its operations to boost its income, but before making a final decision, it has asked you to calculate the corporate tax consequences of such a decision. Currently, Hemingway generates before tax yearly income of $209,000 and has no debt outstanding. Expanding operations would allow Hemingway to increase before-tax yearly income to $338,000. Hemingway can use either cash reserves or debt to finance is expansion. If Hemingway uses debt, it will have a yearly interest expense of $69,000 Create a spreadsheet to conduct a tax analysis (assume a 29% flat tax rate) for Hemingway Corporation and determine the folowing a. What is Hemingway's current annual corporate tax liability? b. If Hemingway finances its expansion using cash reserves, what will be its new corporate tax liability? c. If Hemingway finances its expansion using debt, what will be its new corporate tax liability? CD (Round to the nearest dollar) a. Hemingway's current annual corporate tax liability is $ Question Viewer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts