Question: Please help me answer with explanations. a. I only C. Both I and II b. II only' d. Neither I nor II 4. Which of

Please help me answer with explanations.

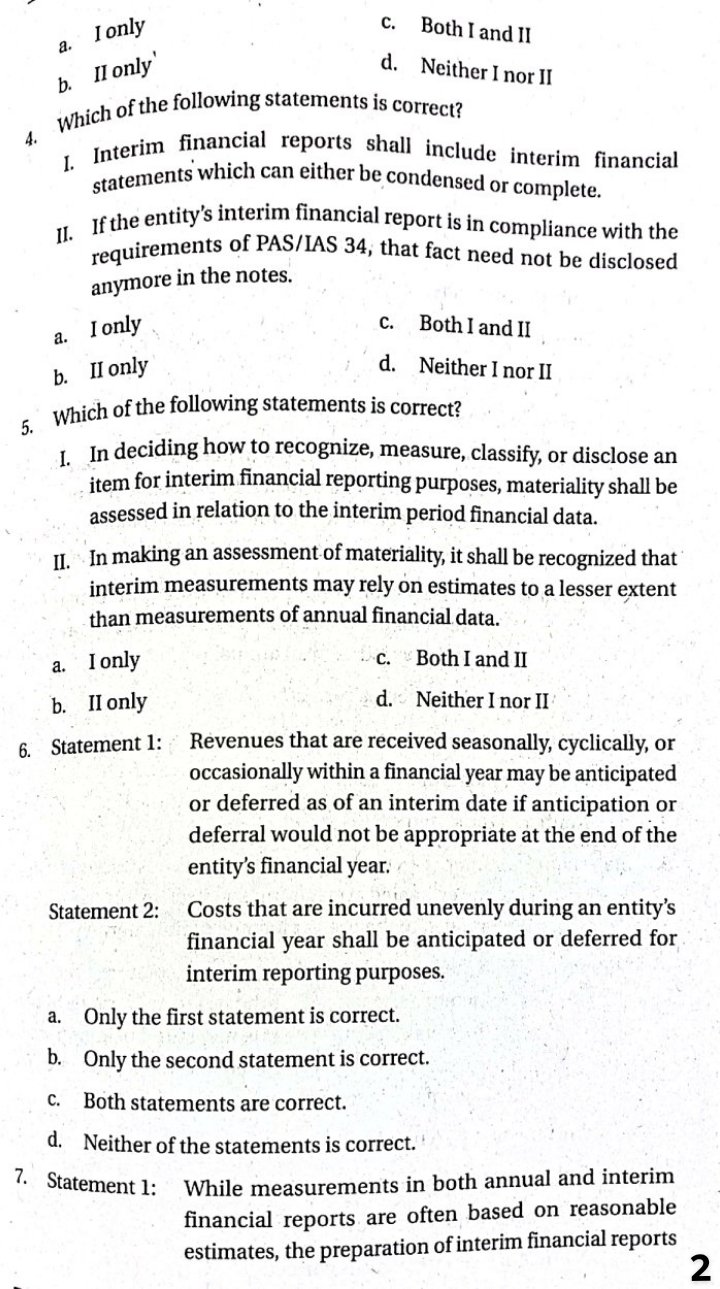

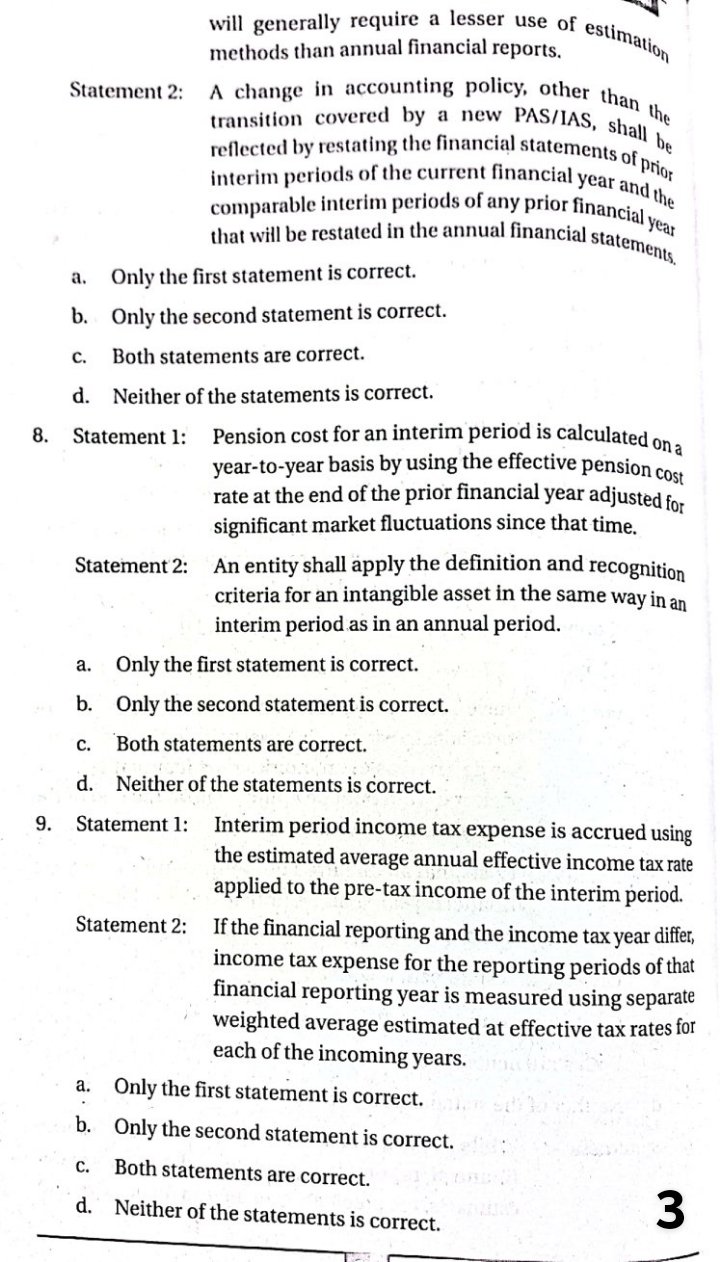

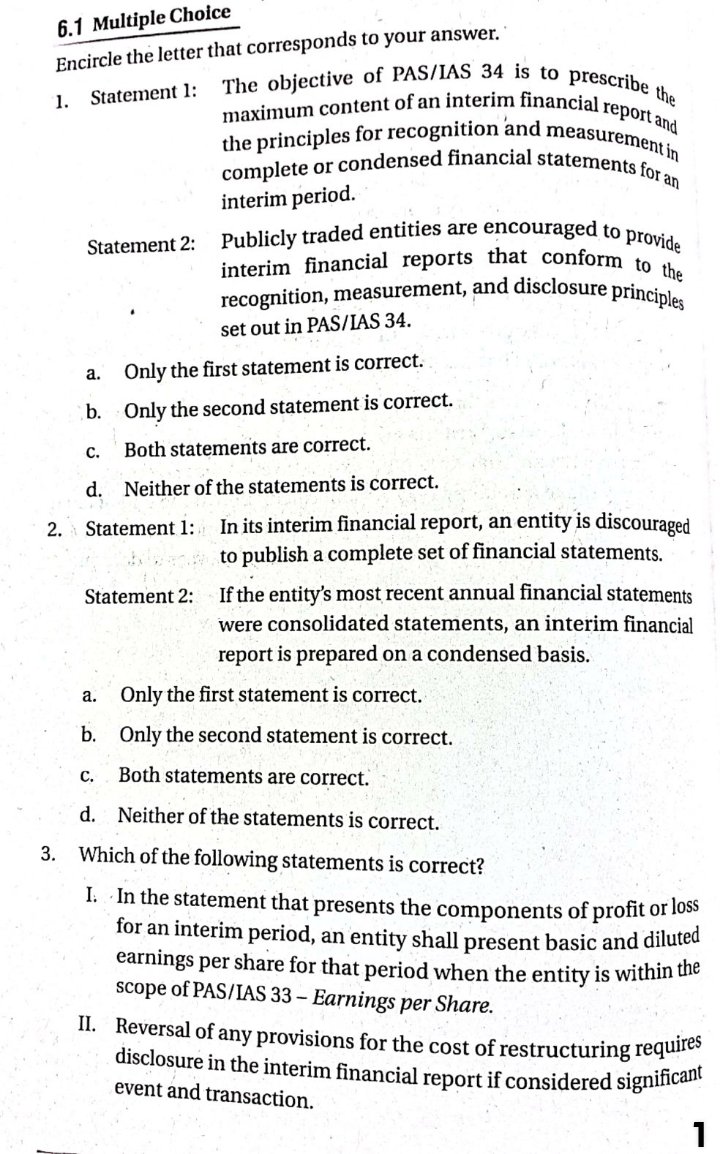

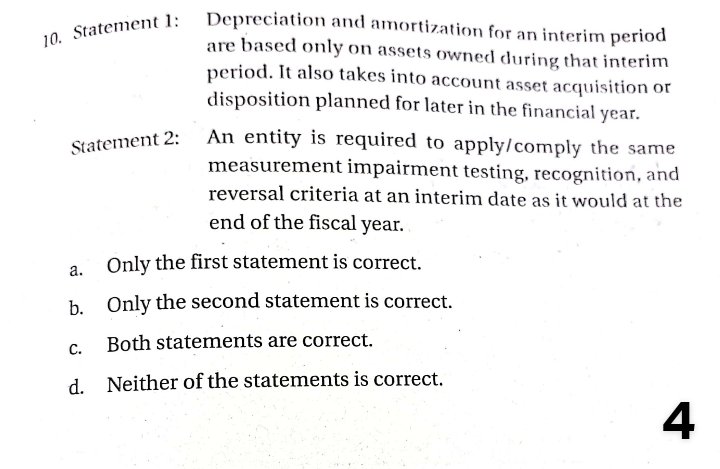

a. I only C. Both I and II b. II only' d. Neither I nor II 4. Which of the following statements is correct? 1. Interim financial reports shall include interim financial statements which can either be condensed or complete. 1. If the entity's interim financial report is in compliance with the requirements of PAS/IAS 34, that fact need not be disclosed anymore in the notes. a. Ionly C. Both I and II b. II only d. Neither I nor II 5. Which of the following statements is correct? 1. In deciding how to recognize, measure, classify, or disclose an item for interim financial reporting purposes, materiality shall be assessed in relation to the interim period financial data. II. In making an assessment of materiality, it shall be recognized that interim measurements may rely on estimates to a lesser extent than measurements of annual financial data. a. I only C. Both I and II b. II only d. Neither I nor II 6. Statement 1: Revenues that are received seasonally, cyclically, or occasionally within a financial year may be anticipated or deferred as of an interim date if anticipation or deferral would not be appropriate at the end of the entity's financial year. Statement 2: Costs that are incurred unevenly during an entity's financial year shall be anticipated or deferred for interim reporting purposes. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 7. Statement 1: While measurements in both annual and interim financial reports are often based on reasonable estimates, the preparation of interim financial reports 2will generally require a lesser use of estimation methods than annual financial reports. Statement 2: A change in accounting policy, other than the transition covered by a new PAS/IAS, shall be reflected by restating the financial statements of prior interim periods of the current financial year and the comparable interim periods of any prior financial year that will be restated in the annual financial statements a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 8. Statement 1: Pension cost for an interim period is calculated on a year-to-year basis by using the effective pension cost rate at the end of the prior financial year adjusted for significant market fluctuations since that time. Statement 2: An entity shall apply the definition and recognition criteria for an intangible asset in the same way in an interim period as in an annual period. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 9. Statement 1: Interim period income tax expense is accrued using the estimated average annual effective income tax rate applied to the pre-tax income of the interim period. Statement 2: If the financial reporting and the income tax year differ, income tax expense for the reporting periods of that financial reporting year is measured using separate weighted average estimated at effective tax rates for each of the incoming years. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 36.1 Multiple Choice Encircle the letter that corresponds to your answer. 1. Statement 1: The objective of PAS/IAS 34 is to prescribe the maximum content of an interim financial report and the principles for recognition and measurement in complete or condensed financial statements for an interim period. Statement 2: Publicly traded entities are encouraged to provide interim financial reports that conform to the recognition, measurement, and disclosure principles set out in PAS/IAS 34. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 2. Statement 1: In its interim financial report, an entity is discouraged to publish a complete set of financial statements. Statement 2: If the entity's most recent annual financial statements were consolidated statements, an interim financial report is prepared on a condensed basis. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 3. Which of the following statements is correct? I. In the statement that presents the components of profit or loss for an interim period, an entity shall present basic and diluted earnings per share for that period when the entity is within the scope of PAS/IAS 33 - Earnings per Share. II. Reversal of any provisions for the cost of restructuring requires disclosure in the interim financial report if considered significant event and transaction.in Statement I: Depreciation and amortization for an interim period are based only on assets owned during that interim period. It also takes into account asset acquisition or disposition planned for later in the financial year. Statement 2: An entity is required to apply/comply the same measurement impairment testing, recognition, and reversal criteria at an interim date as it would at the end of the fiscal year. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts