Question: Please help me find a few discussion points for the memo, a bullet point list of helpful information would be great. John won a lottery

Please help me find a few discussion points for the memo, a bullet point list of helpful information would be great.

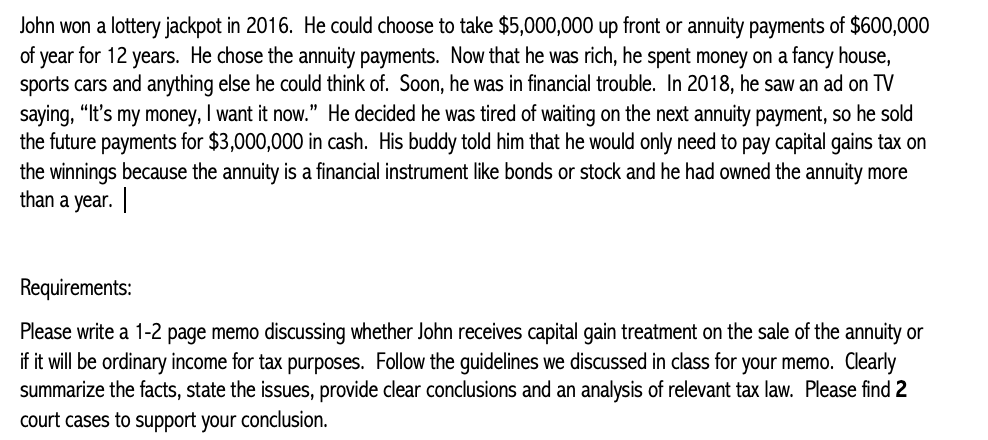

John won a lottery jackpot in 2016. He could choose to take $5,000,000 up front or annuity payments of $600,000 of year for 12 years. He chose the annuity payments. Now that he was rich, he spent money on a fancy house, sports cars and anything else he could think of. Soon, he was in financial trouble. In 2018, he saw an ad on TV saying, It's my money, I want it now. He decided he was tired of waiting on the next annuity payment, so he sold the future payments for $3,000,000 in cash. His buddy told him that he would only need to pay capital gains tax on the winnings because the annuity is a financial instrument like bonds or stock and he had owned the annuity more than a year. | Requirements: Please write a 1-2 page memo discussing whether John receives capital gain treatment on the sale of the annuity or if it will be ordinary income for tax purposes. Follow the guidelines we discussed in class for your memo. Clearly summarize the facts, state the issues, provide clear conclusions and an analysis of relevant tax law. Please find 2 court cases to support your conclusion. John won a lottery jackpot in 2016. He could choose to take $5,000,000 up front or annuity payments of $600,000 of year for 12 years. He chose the annuity payments. Now that he was rich, he spent money on a fancy house, sports cars and anything else he could think of. Soon, he was in financial trouble. In 2018, he saw an ad on TV saying, It's my money, I want it now. He decided he was tired of waiting on the next annuity payment, so he sold the future payments for $3,000,000 in cash. His buddy told him that he would only need to pay capital gains tax on the winnings because the annuity is a financial instrument like bonds or stock and he had owned the annuity more than a year. | Requirements: Please write a 1-2 page memo discussing whether John receives capital gain treatment on the sale of the annuity or if it will be ordinary income for tax purposes. Follow the guidelines we discussed in class for your memo. Clearly summarize the facts, state the issues, provide clear conclusions and an analysis of relevant tax law. Please find 2 court cases to support your conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts