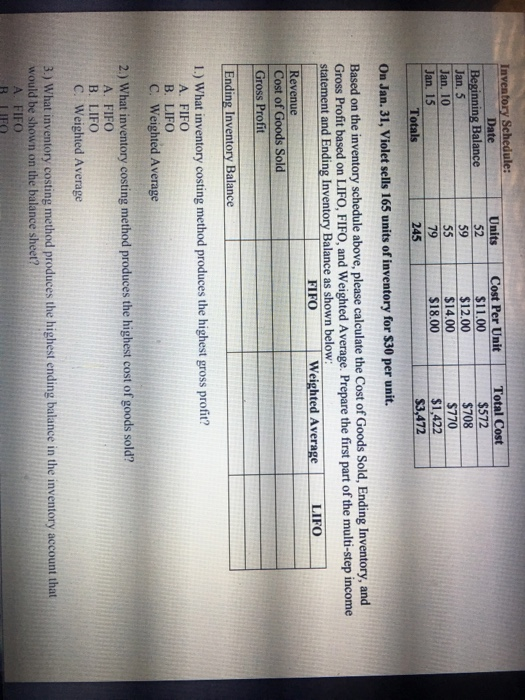

Question: Please help me, I got all wrong the first time Date Units Cost Per Unit Total Cost Beginning Balance Jan. 5 an, 10 Jan. 15

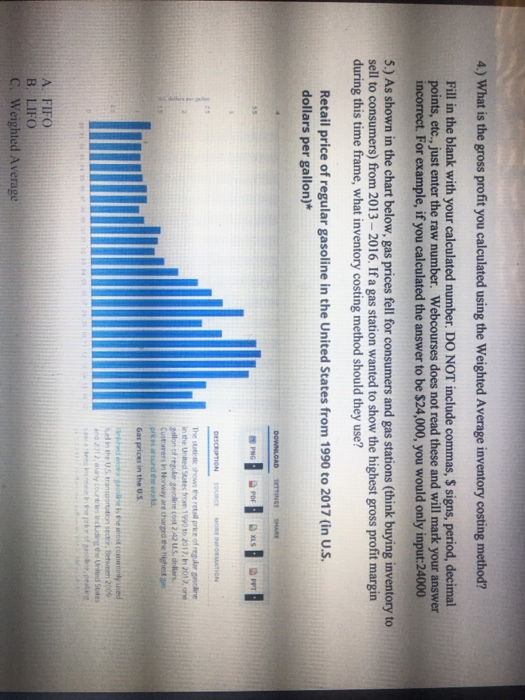

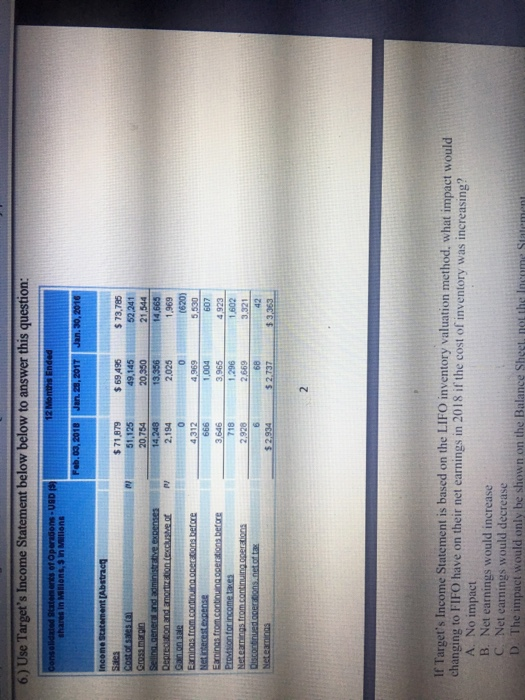

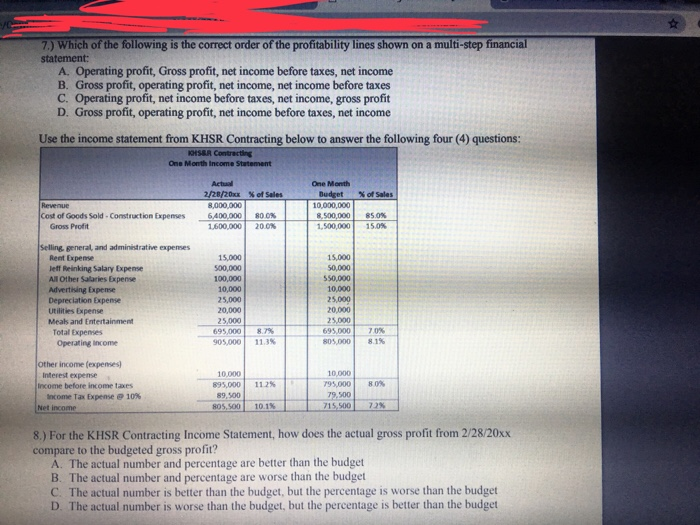

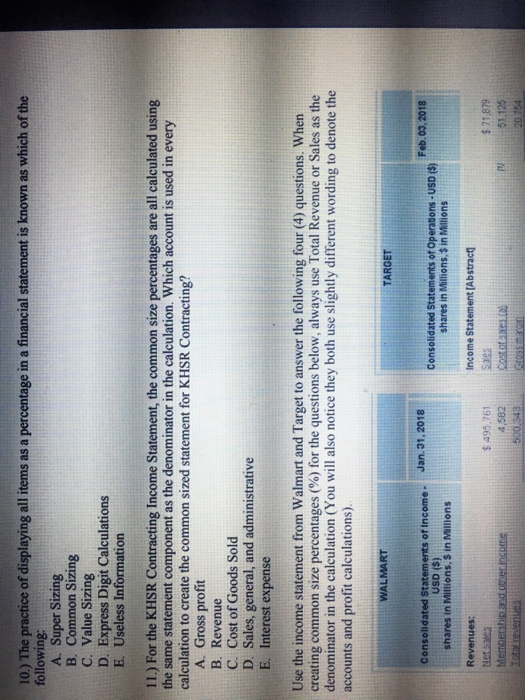

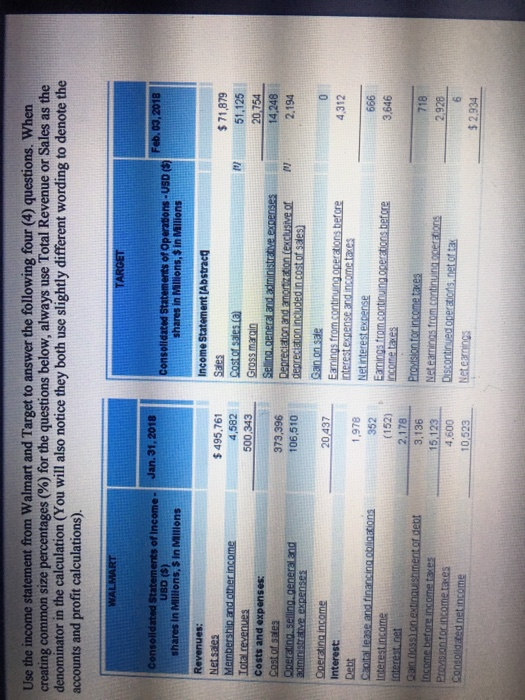

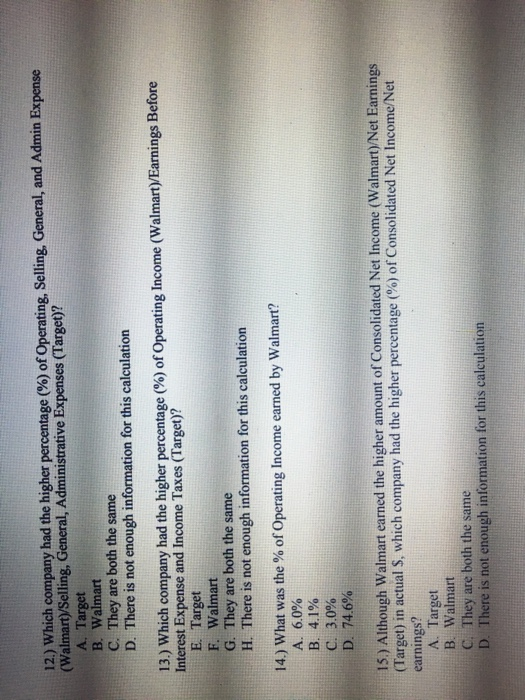

Date Units Cost Per Unit Total Cost Beginning Balance Jan. 5 an, 10 Jan. 15 52 $11.00 59 $12.00 $14.00 $18.00 $572 $708 $770 $1,422 S3,472 9 79 245 Totals On Jan. 31, Violet sells 165 units of inventory for $30 per unit. Based on the inventory schedule above, please calculate the Cost of Goods Sold, Ending Inventory, and Gross Profit based on LIFO, FIFO, and Weighted Average. Prepare the first part of the multi-step income statement and Ending Inventory Balance as shown below FIFO Weighted Average LIFO Revenue Cost of Goods Sold Gross Profit Ending Inventory Balance 1.) What inventory costing method produces the highest gross profit? A. FIFO B. LIFO C. Weighted Average 2.) What inventory costing method produces the highest cost of goods sold? A. FIFO B. LIFO C. Weighted Average 3.) What inventory costing method produces the highest ending balance in the inventory account that would be shown on the balance sheet? A. FIFO R LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts