Question: Please help me i will give good rating Question 1 Lodge Industries considers 2 investment projects over a period of 5 years. The first investment

Please help me i will give good rating

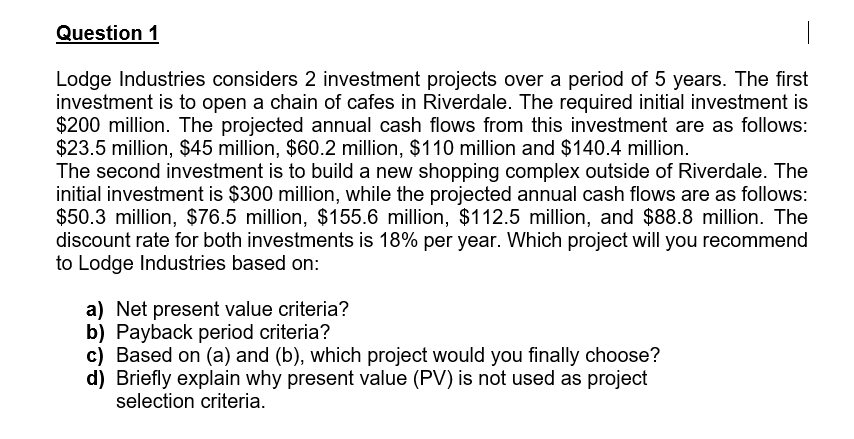

Question 1 Lodge Industries considers 2 investment projects over a period of 5 years. The first investment is to open a chain of cafes in Riverdale. The required initial investment is $200 million. The projected annual cash flows from this investment are as follows: $23.5 million, $45 million, $60.2 million, $110 million and $140.4 million. The second investment is to build a new shopping complex outside of Riverdale. The initial investment is $300 million, while the projected annual cash flows are as follows: $50.3 million, $76.5 million, $155.6 million, $112.5 million, and $88.8 million. The discount rate for both investments is 18% per year. Which project will you recommend to Lodge Industries based on: a) Net present value criteria? b) Payback period criteria? c) Based on (a) and (b), which project would you finally choose? d) Briefly explain why present value (PV) is not used as project selection criteria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts