Question: Please help me .. Please b. A bond has a redemption value of $1,000 and a redemption date ten years from now. It has a

Please help me .. Please

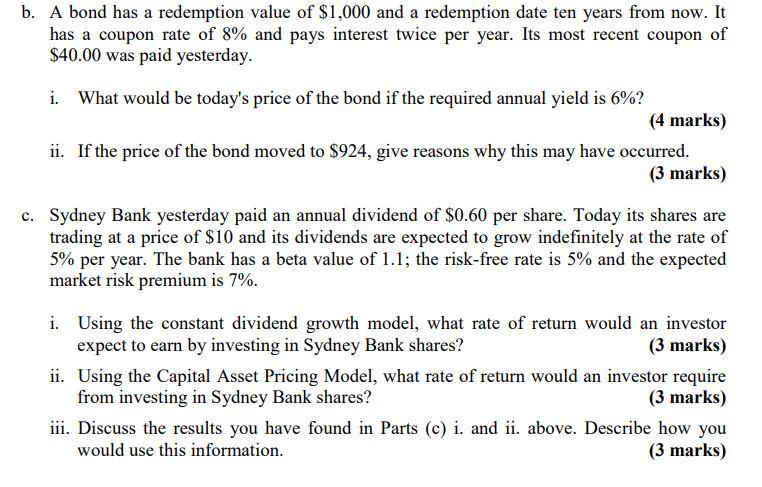

b. A bond has a redemption value of $1,000 and a redemption date ten years from now. It has a coupon rate of 8% and pays interest twice per year. Its most recent coupon of $40.00 was paid yesterday. i. What would be today's price of the bond if the required annual yield is 6%? (4 marks) ii. If the price of the bond moved to $924, give reasons why this may have occurred. (3 marks) c. Sydney Bank yesterday paid an annual dividend of $0.60 per share. Today its shares are trading at a price of $10 and its dividends are expected to grow indefinitely at the rate of 5% per year. The bank has a beta value of 1.1; the risk-free rate is 5% and the expected market risk premium is 7%. i. Using the constant dividend growth model, what rate of return would an investor expect to earn by investing in Sydney Bank shares? (3 marks) ii. Using the Capital Asset Pricing Model, what rate of return would an investor require from investing in Sydney Bank shares? (3 marks) iii. Discuss the results you have found in Parts (c) i. and ii. above. Describe how you would use this information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts