Question: please help me resolve this case study URG !!!! URG !!!!! there is the case study then there're 7 questions below the case. URG PLEAASE

please help me resolve this case study URG !!!! URG !!!!!

there is the case study then there're 7 questions below the case. URG PLEAASE !!!

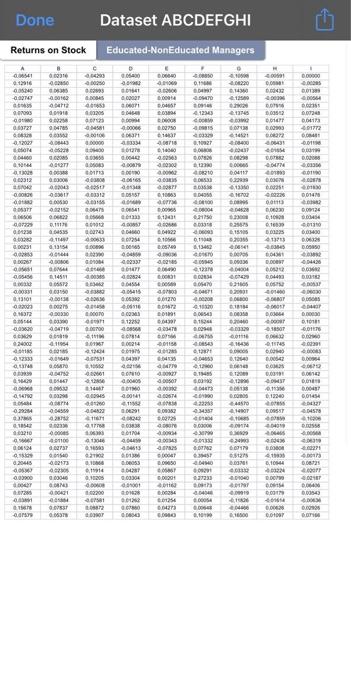

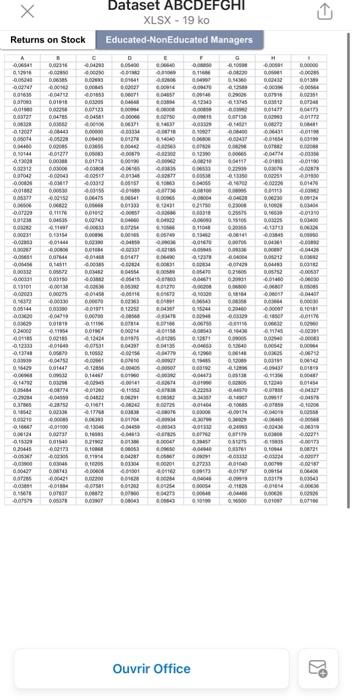

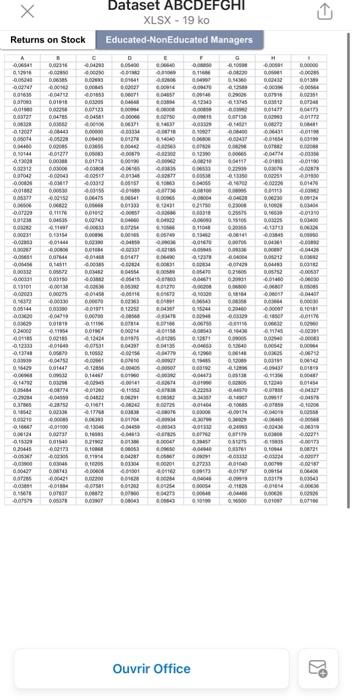

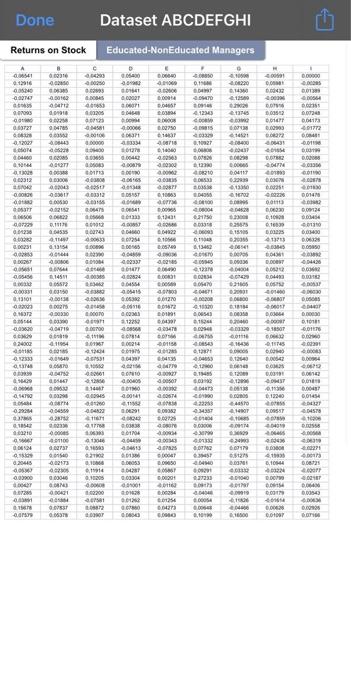

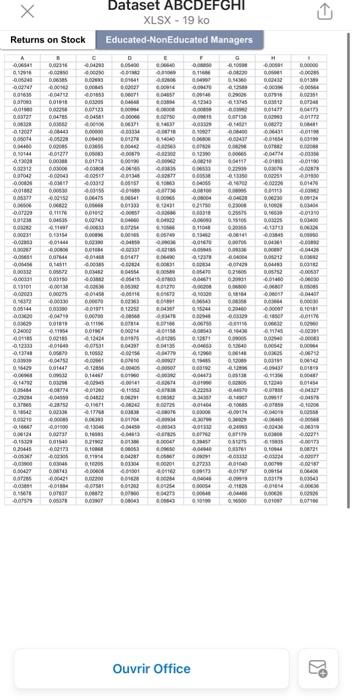

here is the dataa

URG !!!!!

here is the data more clear

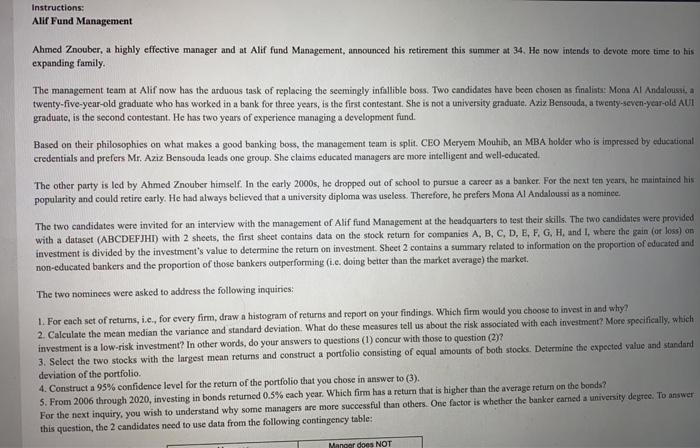

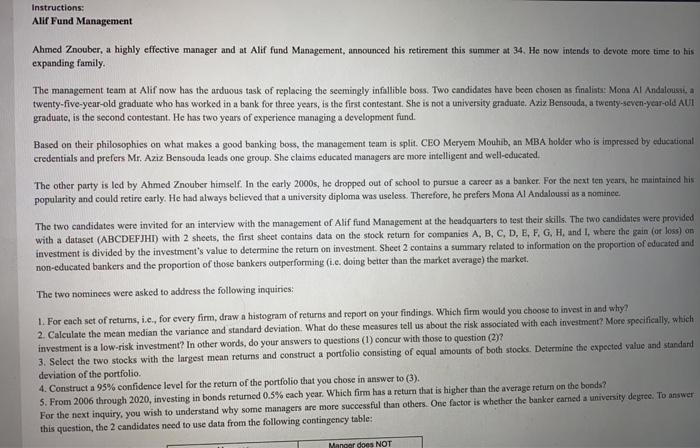

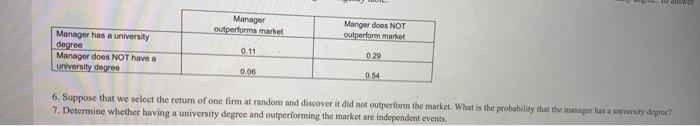

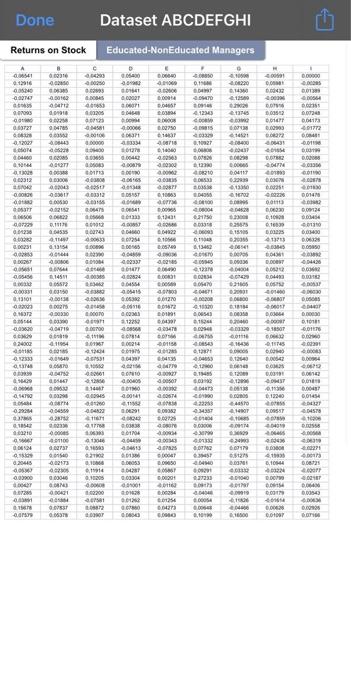

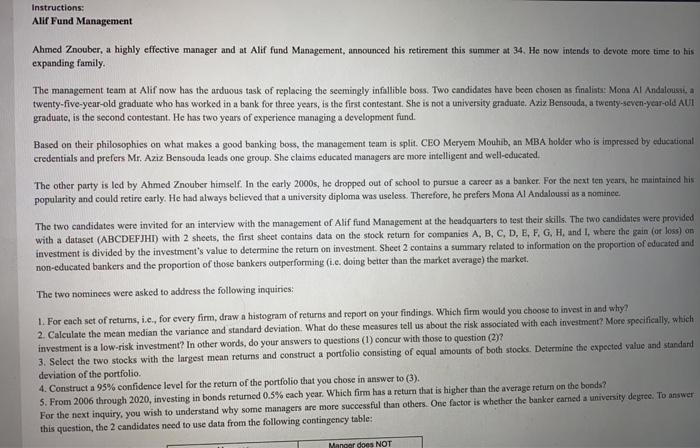

Instructions: Alif Fund Management Ahmed Znouber, a highly effective manager and at Alif fund Management, announced his retirement this summer at 34. He now intends to devote more time to his expanding family. The management team at Alif now has the arduous task of replacing the seemingly infallible boss. Two candidates have been chosen as finalists: Mona Al Andaloussi, a twenty-five-year-old graduate who has worked in a bank for three years, is the first contestant. She is not a university graduate. Aziz Bensouda, a twenty-seven-year-old ALL graduate, is the second contestant. He has two years of experience managing a development fund. Based on their philosophies on what makes a good banking boss, the management team is split. CEO Meryem Mouhib, an MBA bolder who is impressed by educational credentials and prefers Mr. Aziz Bensouda leads one group. She claims educated managers are more intelligent and well-educated. The other party is led by Ahmed Znouber himself. In the early 2000s, he dropped out of school to pursue a career as a banker. For the next ten years, he maintained his popularity and could retire early. He had always believed that a university diploma was useless. Therefore, ho prefers Mona Al Andaloussi as a nominee. The two candidates were invited for an interview with the management of Alif fund Management at the headquarters to test their skills. The two candidates were provided with a dataset (ABCDEFJHI) with 2 sheets, the first sheet contains data on the stock return for companies A, B, C, D, E, F, G, H, and I, where the pain (or loss) on investment is divided by the investment's value to determine the return on investment. Sheet 2 contains a summary related to information on the proportion of educated and non-educated bankers and the proportion of those bankers outperforming (i.e. doing better than the market average) the market. The two nominees were asked to address the following inquiries: 1. For each set of returns, i.c., for every firm, draw a histogram of returns and report on your findings. Which firm would you choose to invest in and why? 2. Calculate the mean median the variance and standard deviation. What do these measures tell us about the risk associated with each investment? More specifically, which investment is a low-risk investment? In other words, do your answers to questions (1) concur with those to question (2) 3. Select the two stocks with the largest mean returns and construct a portfolio consisting of qual amounts of both stocks. Determine the expected value and standard deviation of the portfolio 4. Construct a 95% confidence level for the return of the portfolio that you chose in answer to (3). 5. From 2006 through 2020, investing in bonds returned 0.5% each year. Which firm has a return that is higher than the average return on the bonds? For the next inquiry, you wish to understand why some managers are more successful than others. One factor is whether the banker cared a university degree. To answer this question, the 2 candidates need to use data from the following contingency table: Manger does NOT Manager outperforms market Manger does NOT outperform market Manager has a university degree Manager does NOT have a university degree 0.11 0.29 0.06 0.64 6. Suppose that we select the return of one firm at random and discover it did not outperform the market. What is the probability that the manager hat university degree 7. Determine whether having a university degree and outperforming the market are independent events. Done Dataset ABCDEFGHI Returns on Stock Educated-NonEducated Managers . 01023 0.06 6.00 0250 1.2004 NO NOOD WW . 013 4.01220 . 13 GAT TO 0.000 1.000 D. D. 40 DO CORT 1488 6.620 2012 -14581 D. 0.003 0041 2012 0.00TZT HD 4.00006 11 8.00 D HEN 40S 403 0.10927 1 3.00000 070 13 4710 1000 4.0093 48 so 0.06 0.000 - 020 0.000 03 DOOD ON 0400 4 00012 360 0.000 G. 0.001 NUN GOOD OD WOT 400 DOM CORIS 1981 10055 DON 002 DO 13 2012 DON LED OVOG D IZDO 078 HD re VERIS 0.00124 . DES 2.100 10 B.IN 4. 00 0.00004 ON 2.00 DGOS 110 142 Ost DOO ESP 0.72 . 0.0022 0.0021 DO 024 1515 2008 TO 1 1354 ED DEP D0320 D. GVW IN ww 0026 402337 3. 0.000 . BON 1454 - 4009 DO B. D 00854 0.0470 40 4924 0654 4. 6.032 NES 00D LOS CD LIN 40 DID GOD IDCO w a. . bo 0803 0.01270 B.IT 1 18 2001 DO 11 0.000 4000 LOTO COM 212212 DONT - DS TIS be 411954 1994 1.00 D O DOOR MT 164 12000 WE 11 W WD D. . 6. D. 2.000 000 B. 2007 . 30471 128 4. 0.12540 dre 105 4.2001 D. 48472 CONTO WD AD 14 DTM 0.0011 41 a . DETS 2. 3273 0.00295 AN 1200 0.01454 co so ODO 0.24 100 00 . 4. 154 WE 2.00000 0.00858 1704 4401 DOS 00000 4010 GOS STOID 0.00143 REND a. . IND SED NID w OTS 62173 100 . DMD WD VOD GOOD G.OSS 0.00304 20 B. . 100 13205 . 27333 0.00040 2.00 GOAT 01040 . 41 105 0.00 0224 D. DOM 0.00 0.00343 0.02.com 0.01097 BAT 1.200 WNLOD 401 0.0034 04 5000 WWW WA GOST 0.03 05 DORT GES 3.000 0.000 0.00 1600 Dataset ABCDEFGHI XLSX - 19 ko Educated-NonEducated Managers Returns on Stock c D . E . G -0.000 2002 . AT -0.00040 Q 3.000 DE 6 coute DOS 0.013 1 PI WEDD COCO 001 4.95 0.00 0125 WO D CHO D DU 0,01 45 23 D. DOT 0172 co DOS con 0.009 WO D DOR 0.00 0843 -0.022 4.03 . POVO G. BMIT 44 GO . DO 40057 000 UD ON -0.01277 0.000 - 110 GO 097042 0.000 427 080 2001 2003 -0.0004 BOMAT SOD 002 NOO 100 -0.00152 0.065 0006 COD 000124 S.SI 01333 0.00030 . w 07220 2010 NUD COD 0. . . B02 0.000 - 1104 6.14 COD MED 2005 0.06 NO 0.1314 be 05 | 0.00 - OCD ST 601 4 . BLOG -2.1 0. Bath - O 6.00 DO MOOD DES ROM 4.0440 B. . 0.00 DO 0.00150 DOS BOSTS . 0200 6.1605 CD TO 0.00 13101 0.000 BOSS 2011 SOON 0.000 0.00030 .DAT w W 0.001144 DOO 122 0.000 IND SITE D D 0.00007 1011 B DONDE SCRUB DANCO 603 2018 O 401454 6. DI 0.000 - DOIMI 18 4.00531 10552 . 4.12056 15 00301 4 -612333 - 4. | A) 2011 4. 16 0:00 WE GO -0.0104 0.000 IND SOM 20 DUN HI 40005 B01 a 3 VO 6,147 GO 2014 B.1454 4. . GON . WWW NI . . GO D 0.003 INTE 17 1464 0.00 . 2004 NO 4.19000 G.OS 91019 0.00 0.04 -0.01900 . MES 443 BIO 020 0001 NO .6021 DO D143 - DI 000 3.500 TO 012 to CO SHOTO DO DOSED COCO 10 0.1994 GO OP O TODOS 0.00T . 000 01100 DOS 00012 O 2017 BE w 0.00) 000 600 500D 11823 WO OG SEO 0079 DOON De SOUND 0010 Ouvrir Office Instructions: Alif Fund Management Ahmed Znouber, a highly effective manager and at Alif fund Management, announced his retirement this summer at 34. He now intends to devote more time to his expanding family. The management team at Alif now has the arduous task of replacing the seemingly infallible boss. Two candidates have been chosen as finalists: Mona Al Andaloussi, a twenty-five-year-old graduate who has worked in a bank for three years, is the first contestant. She is not a university graduate. Aziz Bensouda, a twenty-seven-year-old ALL graduate, is the second contestant. He has two years of experience managing a development fund. Based on their philosophies on what makes a good banking boss, the management team is split. CEO Meryem Mouhib, an MBA bolder who is impressed by educational credentials and prefers Mr. Aziz Bensouda leads one group. She claims educated managers are more intelligent and well-educated. The other party is led by Ahmed Znouber himself. In the early 2000s, he dropped out of school to pursue a career as a banker. For the next ten years, he maintained his popularity and could retire early. He had always believed that a university diploma was useless. Therefore, ho prefers Mona Al Andaloussi as a nominee. The two candidates were invited for an interview with the management of Alif fund Management at the headquarters to test their skills. The two candidates were provided with a dataset (ABCDEFJHI) with 2 sheets, the first sheet contains data on the stock return for companies A, B, C, D, E, F, G, H, and I, where the pain (or loss) on investment is divided by the investment's value to determine the return on investment. Sheet 2 contains a summary related to information on the proportion of educated and non-educated bankers and the proportion of those bankers outperforming (i.e. doing better than the market average) the market. The two nominees were asked to address the following inquiries: 1. For each set of returns, i.c., for every firm, draw a histogram of returns and report on your findings. Which firm would you choose to invest in and why? 2. Calculate the mean median the variance and standard deviation. What do these measures tell us about the risk associated with each investment? More specifically, which investment is a low-risk investment? In other words, do your answers to questions (1) concur with those to question (2) 3. Select the two stocks with the largest mean returns and construct a portfolio consisting of qual amounts of both stocks. Determine the expected value and standard deviation of the portfolio 4. Construct a 95% confidence level for the return of the portfolio that you chose in answer to (3). 5. From 2006 through 2020, investing in bonds returned 0.5% each year. Which firm has a return that is higher than the average return on the bonds? For the next inquiry, you wish to understand why some managers are more successful than others. One factor is whether the banker cared a university degree. To answer this question, the 2 candidates need to use data from the following contingency table: Manger does NOT Manager outperforms market Manger does NOT outperform market Manager has a university degree Manager does NOT have a university degree 0.11 0.29 0.06 0.64 6. Suppose that we select the return of one firm at random and discover it did not outperform the market. What is the probability that the manager hat university degree 7. Determine whether having a university degree and outperforming the market are independent events. Done Dataset ABCDEFGHI Returns on Stock Educated-NonEducated Managers . 01023 0.06 6.00 0250 1.2004 NO NOOD WW . 013 4.01220 . 13 GAT TO 0.000 1.000 D. D. 40 DO CORT 1488 6.620 2012 -14581 D. 0.003 0041 2012 0.00TZT HD 4.00006 11 8.00 D HEN 40S 403 0.10927 1 3.00000 070 13 4710 1000 4.0093 48 so 0.06 0.000 - 020 0.000 03 DOOD ON 0400 4 00012 360 0.000 G. 0.001 NUN GOOD OD WOT 400 DOM CORIS 1981 10055 DON 002 DO 13 2012 DON LED OVOG D IZDO 078 HD re VERIS 0.00124 . DES 2.100 10 B.IN 4. 00 0.00004 ON 2.00 DGOS 110 142 Ost DOO ESP 0.72 . 0.0022 0.0021 DO 024 1515 2008 TO 1 1354 ED DEP D0320 D. GVW IN ww 0026 402337 3. 0.000 . BON 1454 - 4009 DO B. D 00854 0.0470 40 4924 0654 4. 6.032 NES 00D LOS CD LIN 40 DID GOD IDCO w a. . bo 0803 0.01270 B.IT 1 18 2001 DO 11 0.000 4000 LOTO COM 212212 DONT - DS TIS be 411954 1994 1.00 D O DOOR MT 164 12000 WE 11 W WD D. . 6. D. 2.000 000 B. 2007 . 30471 128 4. 0.12540 dre 105 4.2001 D. 48472 CONTO WD AD 14 DTM 0.0011 41 a . DETS 2. 3273 0.00295 AN 1200 0.01454 co so ODO 0.24 100 00 . 4. 154 WE 2.00000 0.00858 1704 4401 DOS 00000 4010 GOS STOID 0.00143 REND a. . IND SED NID w OTS 62173 100 . DMD WD VOD GOOD G.OSS 0.00304 20 B. . 100 13205 . 27333 0.00040 2.00 GOAT 01040 . 41 105 0.00 0224 D. DOM 0.00 0.00343 0.02.com 0.01097 BAT 1.200 WNLOD 401 0.0034 04 5000 WWW WA GOST 0.03 05 DORT GES 3.000 0.000 0.00 1600 Dataset ABCDEFGHI XLSX - 19 ko Educated-NonEducated Managers Returns on Stock c D . E . G -0.000 2002 . AT -0.00040 Q 3.000 DE 6 coute DOS 0.013 1 PI WEDD COCO 001 4.95 0.00 0125 WO D CHO D DU 0,01 45 23 D. DOT 0172 co DOS con 0.009 WO D DOR 0.00 0843 -0.022 4.03 . POVO G. BMIT 44 GO . DO 40057 000 UD ON -0.01277 0.000 - 110 GO 097042 0.000 427 080 2001 2003 -0.0004 BOMAT SOD 002 NOO 100 -0.00152 0.065 0006 COD 000124 S.SI 01333 0.00030 . w 07220 2010 NUD COD 0. . . B02 0.000 - 1104 6.14 COD MED 2005 0.06 NO 0.1314 be 05 | 0.00 - OCD ST 601 4 . BLOG -2.1 0. Bath - O 6.00 DO MOOD DES ROM 4.0440 B. . 0.00 DO 0.00150 DOS BOSTS . 0200 6.1605 CD TO 0.00 13101 0.000 BOSS 2011 SOON 0.000 0.00030 .DAT w W 0.001144 DOO 122 0.000 IND SITE D D 0.00007 1011 B DONDE SCRUB DANCO 603 2018 O 401454 6. DI 0.000 - DOIMI 18 4.00531 10552 . 4.12056 15 00301 4 -612333 - 4. | A) 2011 4. 16 0:00 WE GO -0.0104 0.000 IND SOM 20 DUN HI 40005 B01 a 3 VO 6,147 GO 2014 B.1454 4. . GON . WWW NI . . GO D 0.003 INTE 17 1464 0.00 . 2004 NO 4.19000 G.OS 91019 0.00 0.04 -0.01900 . MES 443 BIO 020 0001 NO .6021 DO D143 - DI 000 3.500 TO 012 to CO SHOTO DO DOSED COCO 10 0.1994 GO OP O TODOS 0.00T . 000 01100 DOS 00012 O 2017 BE w 0.00) 000 600 500D 11823 WO OG SEO 0079 DOON De SOUND 0010 Ouvrir Office