Question: Please help me solve a, b, c, d, and e. 3. (Single index model; beta; correlation) Assume the single-index model holds Asset Beta Correlation with

Please help me solve a, b, c, d, and e.

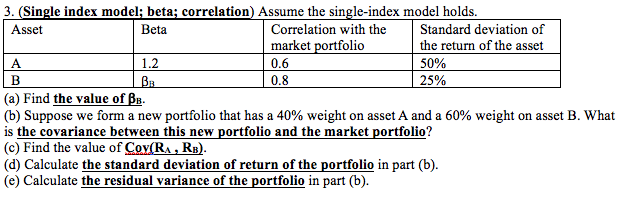

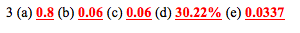

3. (Single index model; beta; correlation) Assume the single-index model holds Asset Beta Correlation with theStandard deviation of market portfolio the return of the asset 50% 25% 1.2 0.8 (a) Find the value of BB. (b) Suppose we form a new portfolio that has a 40% weight on asset A and a 60% weight on asset B. What is the covariance between this new portfolio and the market portfolio? (c) Find the value of Cov(RA RB (d) Calculate the standard deviation of return of the portfolio in part (b). (e) Calculate the residual variance of the portfolio in part (b) 3 (a) 0.8 (b) 0.06 (c) 0.06 (d) 30.22% (e) 0.0337

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts