Question: please help me solve for a,b, and c. thanks, I'll make sure leave thumbs A 10-year, $1,000 par value zero-coupon rate bond is to be

please help me solve for a,b, and c. thanks, I'll make sure leave thumbs

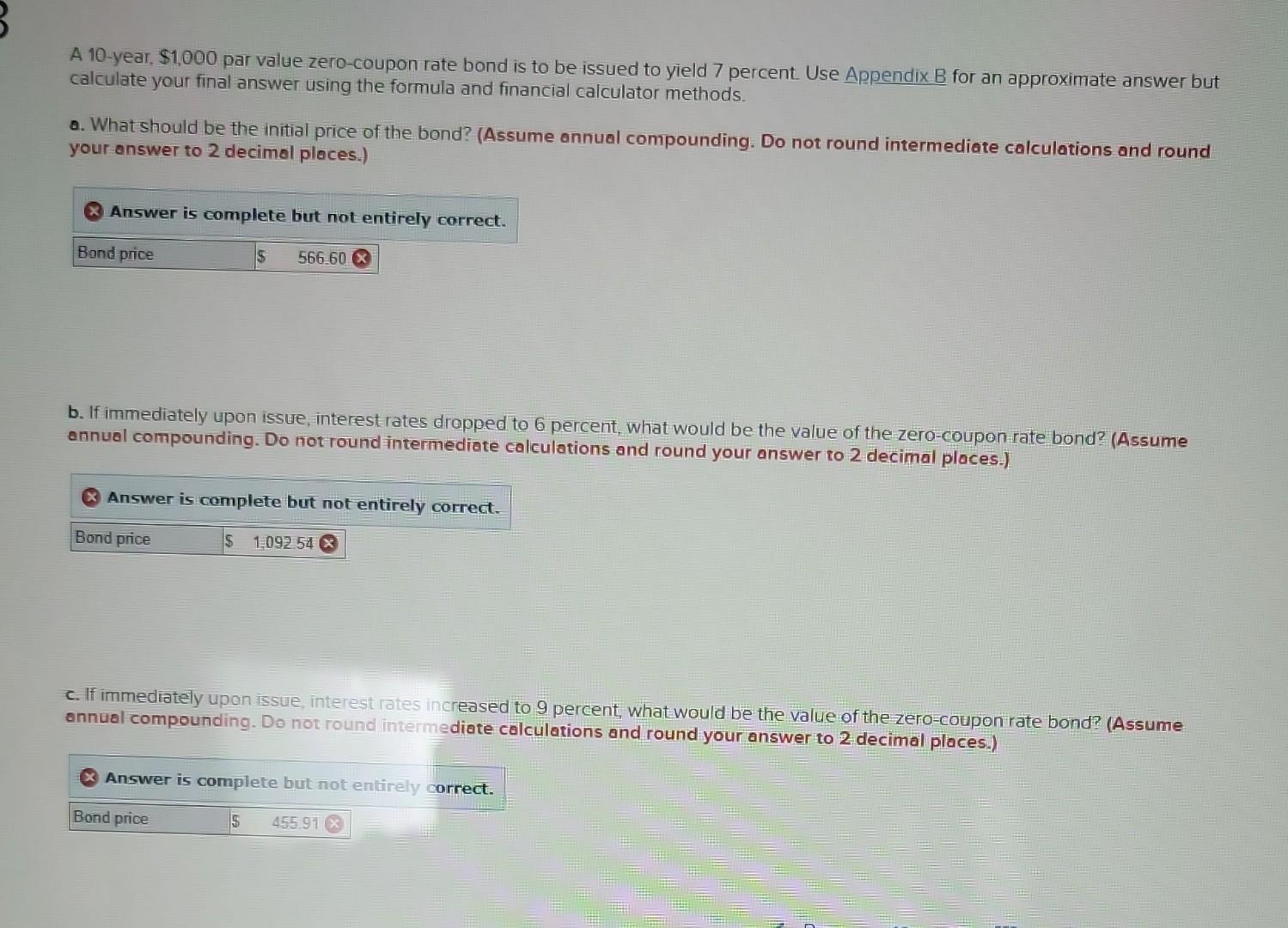

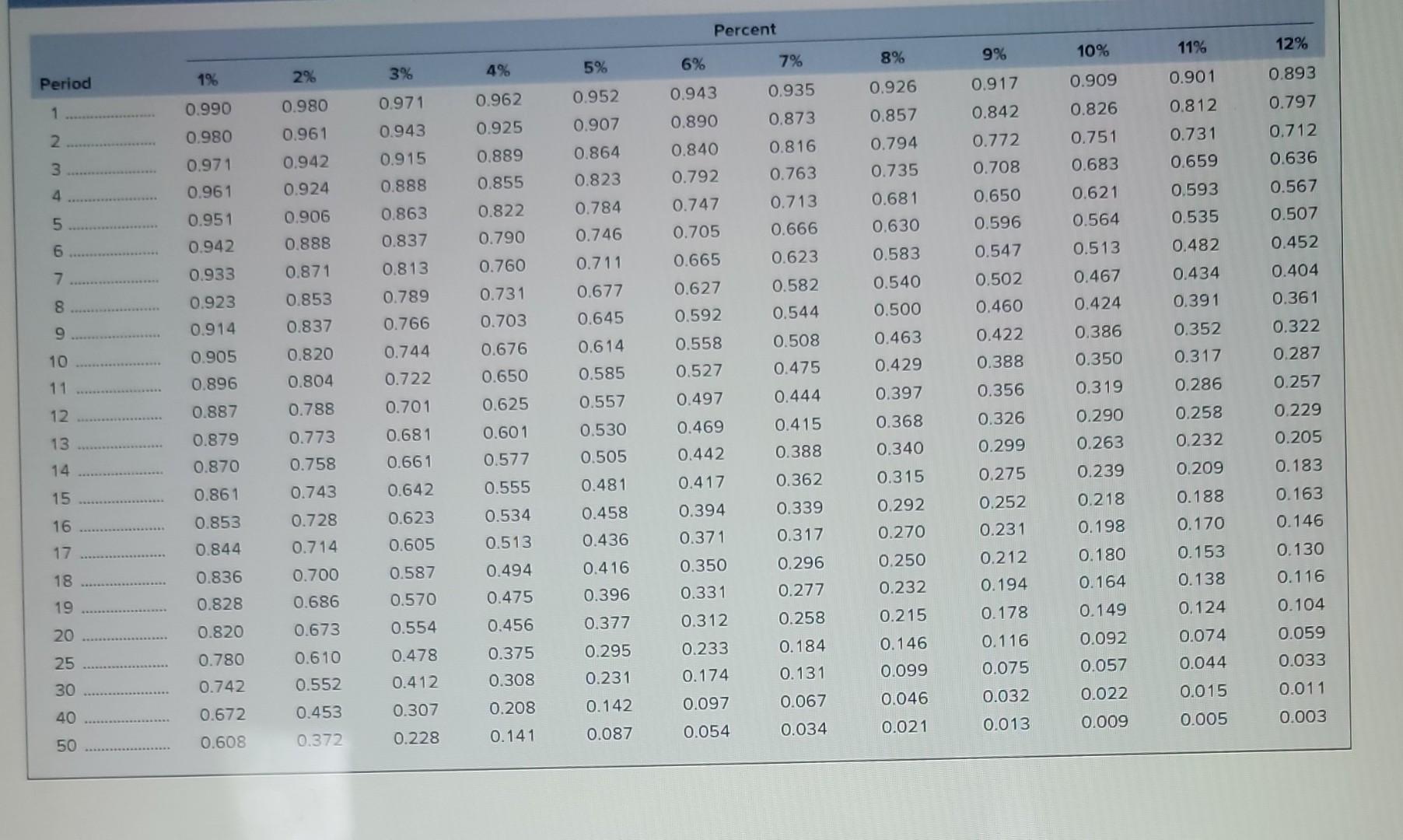

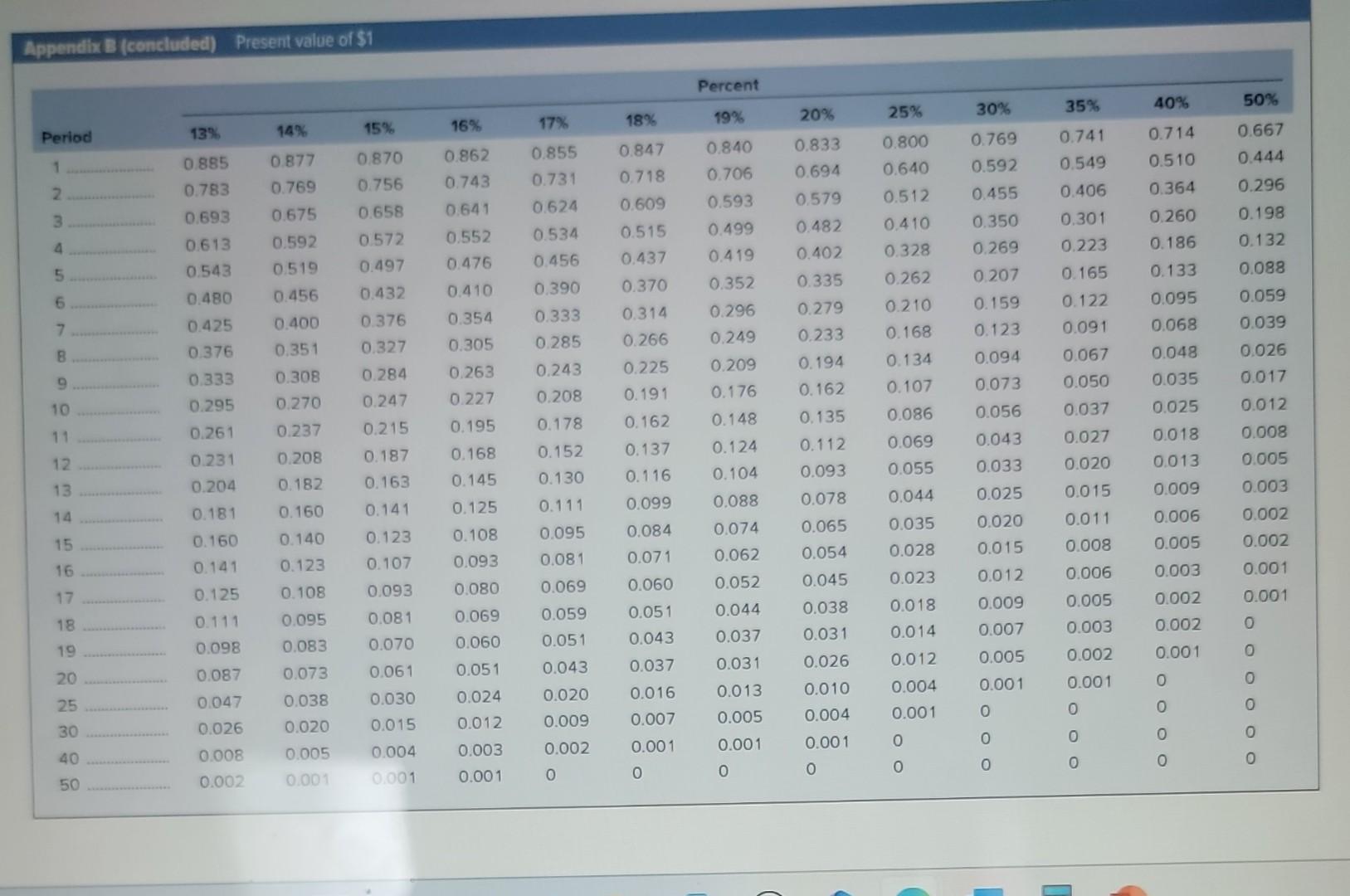

A 10-year, $1,000 par value zero-coupon rate bond is to be issued to yield 7 percent. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. What should be the initial price of the bond? (Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal ploces.) Q Answer is complete but not entirely correct. b. If immediately upon issue, interest rates dropped to 6 percent, what would be the value of the zero-coupon rate bond? (Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places.) Answer is complete but not entirely correct. c. If immediately upon issue, interest rates increased to 9 percent, what would be the value of the zero-coupon rate bond? (Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

To solve for the price of the zerocoupon bond under different conditions you can use ... View full answer

Get step-by-step solutions from verified subject matter experts