Question: Please help me solve question 4, 5, 6 and 7. The tax rates for question 6 and 7 is the last image. #4 #5 Midori

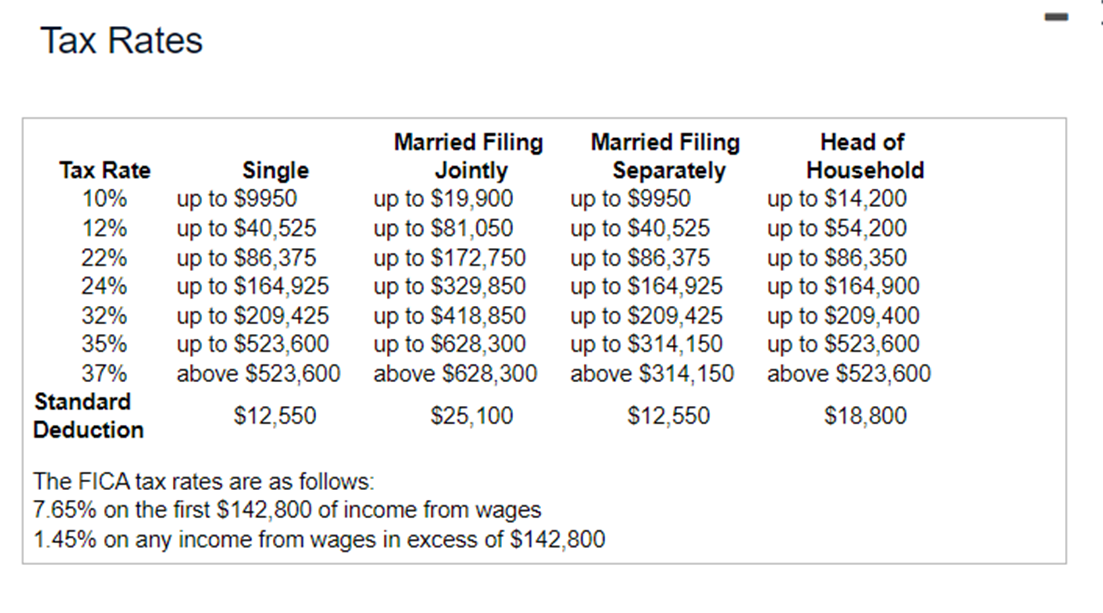

Please help me solve question 4, 5, 6 and 7. The tax rates for question 6 and 7 is the last image.

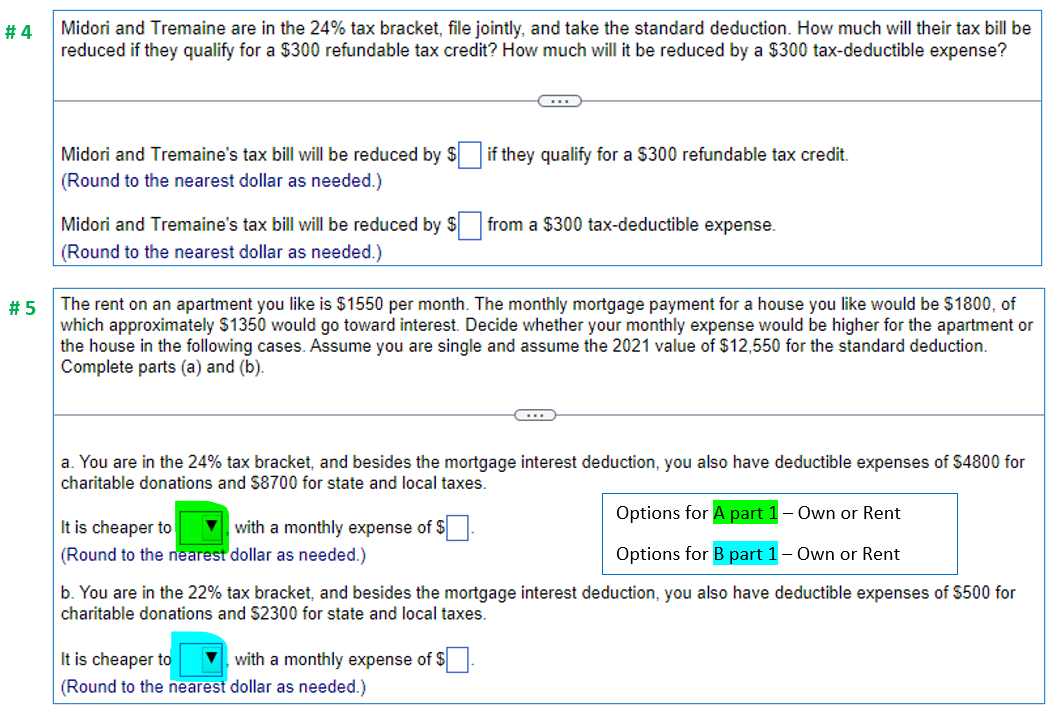

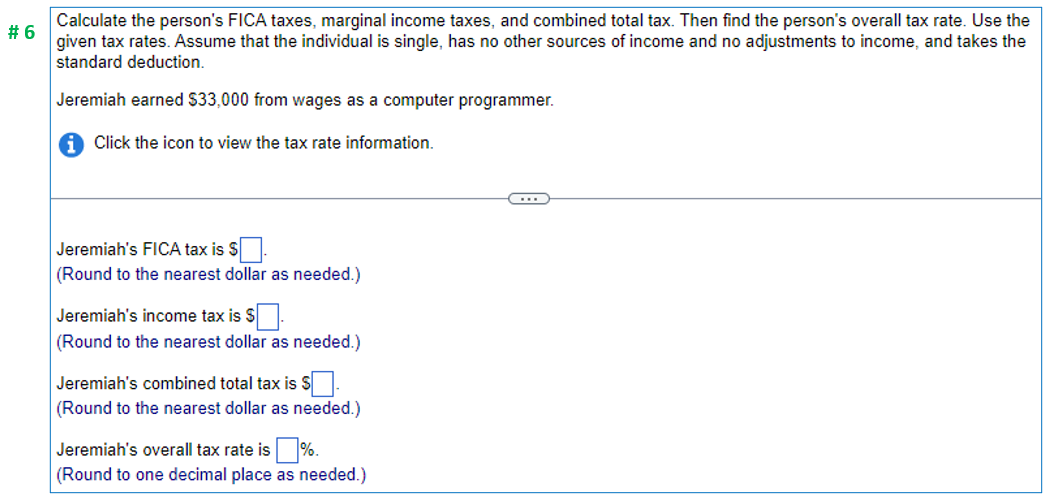

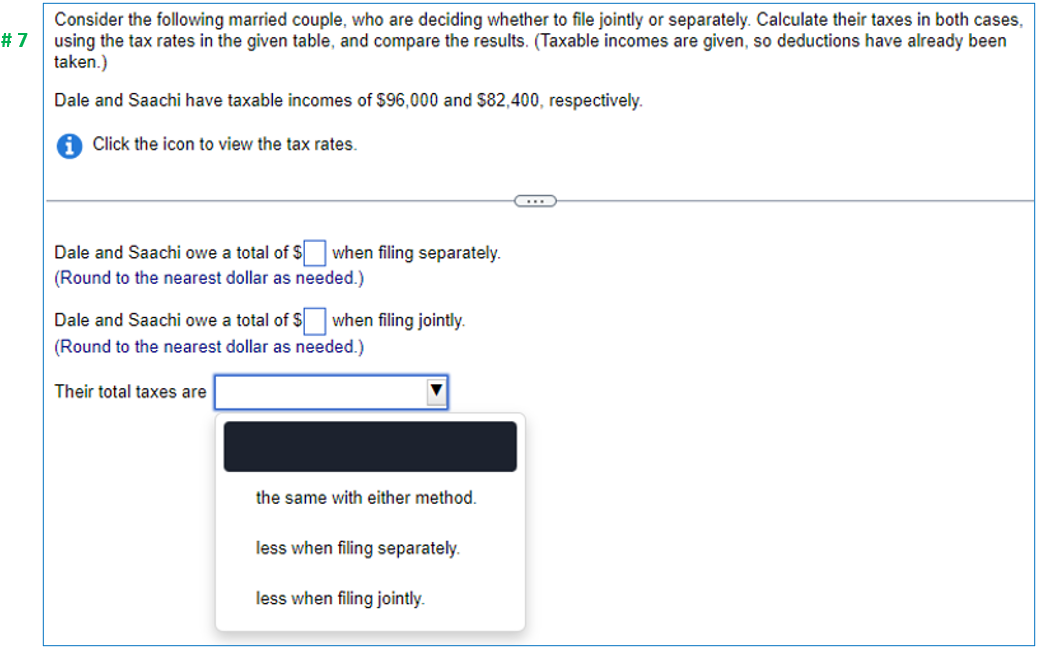

#4 #5 Midori and Tremaine are in the 24% tax bracket. le jointly. and take the standard deduction. How much will their tax bill be reduced if they qualify for a $300 refundable tax credit? How much will it be reduced by a $300 taxdeductible expense? E Midori and Tremaine's tax bill will be reduced by $I:| if they qualify for a $300 refundable tax credit. (Round to the nearest dollar as needed.) Midori and Tremaine's tax bill will be reduced by 5'] from a $3001axdeductible expense, (Round to the nearest dollar as needed.) The rent on an apartment you like is $1550 per month. The monthly mortgage payment for a house you like would be $1300, of which approximately $1350 would go toward interest. Decide whether your monthly expense would be higher for the apartment or the house in the following cases. Assume you are single and assume the 2021 value of $12550 for the standard deduction. Complete parts (a) and (b). a. You are in the 24% tax bracket. and besides the mortgage interest deduction, you also have deductible expenses of $4300 for charitable donations and $8700 for state and local taxes. Options for a\" z" ; Own or Rent It is cheaper to I with a monthly expense of 5D. (Round to the dollar as needed.) Options for B part 1 Own or Rent b. You are in the 22% tax bracket. and besides the mortgage interest deduction, you also have deductible expenses of $500 for charitable donations and 52300 for state and local taxes. It is cheaper to IE with a monthly expense of 5D. {Round to the nearest dollar as needed.) # 6 Calculate the person's FICA taxes, marginal income taxes, and combined total tax. Then find the person's overall tax rate. Use the given tax rates. Assume that the individual is single, has no other sources of income and no adjustments to income, and takes the standard deduction. Jeremiah earned $33,000 from wages as a computer programmer. Click the icon to view the tax rate information. Jeremiah's FICA tax is $ (Round to the nearest dollar as needed.) Jeremiah's income tax is $ (Round to the nearest dollar as needed.) Jeremiah's combined total tax is $ (Round to the nearest dollar as needed.) Jeremiah's overall tax rate is %. (Round to one decimal place as needed.)Consider the following married couple, who are deciding whether to file jointly or separately. Calculate their taxes in both cases, # 7 using the tax rates in the given table, and compare the results. (Taxable incomes are given, so deductions have already been taken.) Dale and Saachi have taxable incomes of $96,000 and $82,400, respectively. i Click the icon to view the tax rates. Dale and Saachi owe a total of $ when filing separately. (Round to the nearest dollar as needed.) Dale and Saachi owe a total of $ when filing jointly. (Round to the nearest dollar as needed.) Their total taxes are the same with either method. less when filing separately. less when filing jointly.Tax Rates Married Filing Married Filing Head of Tax Rate Single Jointly Separately Household 10% up to $9950 up to $19,900 up to $9950 up to $14,200 12% up to $40,525 up to $81,050 up to $40,525 up to $54,200 22% up to $86,375 up to $172,750 up to $86,375 up to $86,350 24% up to $164,925 up to $329,850 up to $164,925 up to $164,900 32% up to $209,425 up to $418,850 up to $209,425 up to $209,400 35% up to $523,600 up to $628,300 up to $314,150 up to $523,600 37% above $523,600 above $628,300 above $314,150 above $523,600 Standard Deduction $12,550 $25,100 $12,550 $18,800 The FICA tax rates are as foliows: 7.65% on the rst $142,800 of income from wages 1.45% on any income from wages in excess of $142,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts